On 3 March 2020, US voters go to the polls in what marks the biggest day in the presidential primary season. Known as ‘Super Tuesday’, the day marks the single occasion where the greatest number of US states hold primary elections and caucuses and where more delegates to the presidential nominating conventions can be won. While the presidency cannot be won on Super Tuesday, it almost certainly can be lost. Four years ago, Donald Trump staked his claim for the presidency by winning seven states.

The impact of the Trump presidency on economic markets, based on nothing more than a few tweets, has been one of the more defining aspects of his time in power. Yet, despite this unconventional approach, the performance of US equities over the past four years has been an undoubted success. While this success might be ‘despite’, rather than ‘because’ of Trump’s presidency, as an asset class they are certainly something that no successful fund manager should have ignored over the past four years.

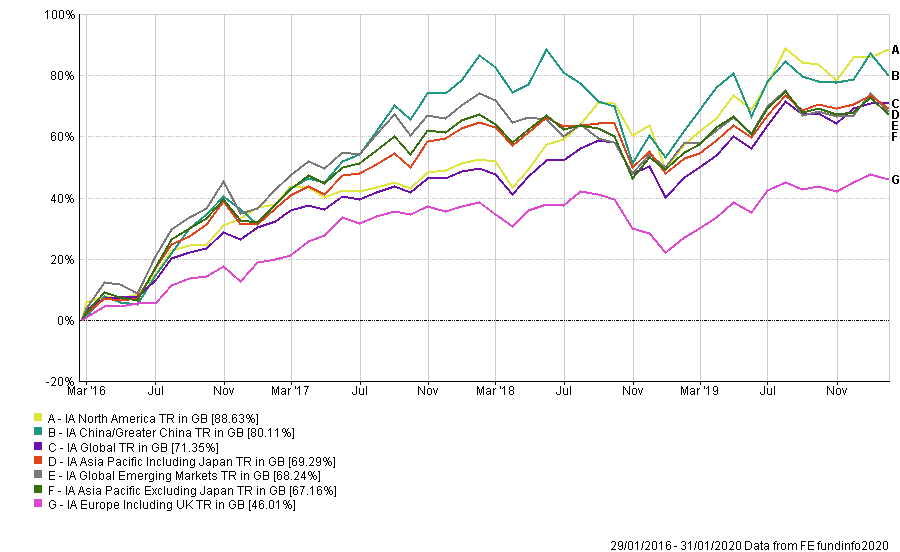

As the chart above shows, the IA North American Sector (which comprises of funds investing at least 80% of their assets in North American Equities) has, albeit narrowly, been the best performer over the last four years, returning 88.63% in that timeframe, compared with IA Greater China (80.11%), IA Global (71.35%), IA Asia Pacific Including Japan (69.29%) and IA Global Emerging Markets (68.24%).

While this impressive, performance has largely been driven by the consistently strong returns of US equities, it is worth pointing out that as an asset class they have been – and continue to be – an expensive bet. US equities retain a high valuation and as such, many fund managers have been reluctant to dive in too deeply.

Valuation alone should not be a reason to avoid US equities. The key to making the most of US equities for the successful fund manager has been balancing their allocations and exposure. Nearly two thirds (63%) of the MSCI World Index benchmark is based on US equities, so managers who have been avoiding the US markets based on valuations will have underperformed during this timeframe.

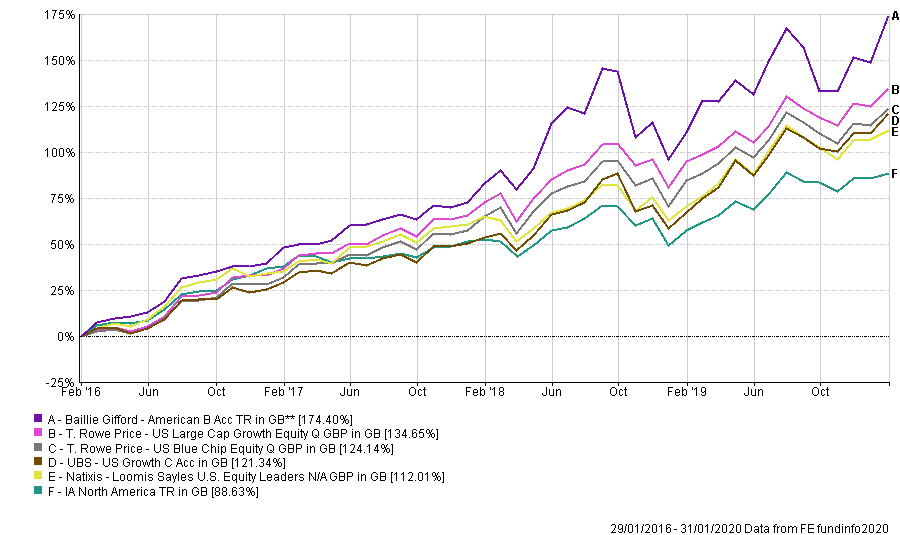

At fund level, the best performers within the sector: Baillie Gifford – American; Natixis – Loomis Sayles US Equity Leaders; T Rowe Price – US Blue Chip Equity; T Rowe Price – US Large Cap Growth Equity and UBS – US Growth have all consistently outperformed the IA North America sector over the past four years by investing heavily in US companies.

Their funds are concentrated in key sectors where the US dominates, such as Telecoms, Media & Technology; Consumer Products and Health Care, and where some of the most famous companies in the world regularly appear, such as Amazon, Facebook and Microsoft. The tech sector continues to drive the performance behind these funds, where the fund with the lowest concentration in this sector – T Rowe Price US Large Cap Growth – still maintains a level of 32.91%. The strongest performer meanwhile, Baillie Gifford – American, has returned 178.81% over the past five years, and holds well-known and interesting stocks such as Telsa, Shopify and Netflix among others.

When Donald Trump ‘won’ Super Tuesday on 1 March 2016, the IA North America sector fell by 1.3% but then promptly rose again and, as we have seen, has been a consistently strong performer ever since. While whatever happens on Super Tuesday – and indeed any tweets between now and November, when the election is held, from the present incumbent – may have a short-term impact on the performance of US equities, in the longer term, all signs point to their continued strong performance. Despite rich valuations, US companies have an impressive track record of expanding revenues and profit margins, thanks to strong productivity gains and access to innovation. They remain an expensive bargain for fund managers and investors alike.

Charles Younes is research manager at FE Investments