As the economy has continued to recover from the impact of the Covid-19 pandemic in 2021 and adjust to the new conditions created by Brexit, investor attention has increasingly turned towards inflation and a potential hike in interest rates.

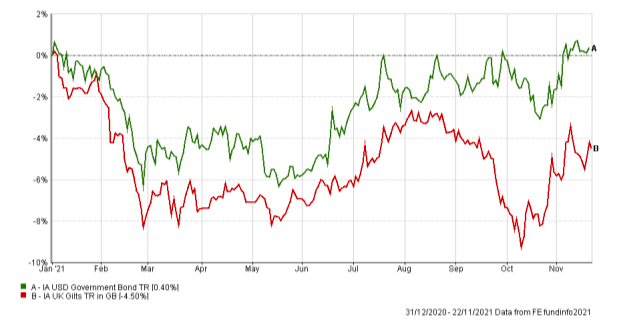

A change in sentiment towards central bank interest rate hikes can have a marked effect on government bond yields and subsequent portfolio returns. Over the summer for instance, the yield on 10-year gilts went from 0.5% to 1.2% since 23rd August, as rising inflation brought forward expectations of a first interest rate hike to this year. As yields move inversely to bond prices this means government bonds fell in value. The yield on US government bonds also increased, although not as steeply as in the UK, with the yield on 10-year Treasuries rising from 1.18% in mid-August to 1.69%. The chart below, shows the performance of the IA UK Gilts and IA US Government Bonds sectors from the beginning of the year to date in their local currencies:

Despite conjecture about interest rates, at the Bank of England’s most recent policy meeting interest rates were held at 0.1%. Markets expected a rate rise of 15 basis points as we move to a normalisation of interest rates to their position before the crisis. Along with chancellor Rishi Sunak’s autumn budget announcement of lower gilt issuance next year, this caused gilt prices to recover from their recent low point in early October, Treasuries have also risen slightly since then, but prices remain sensitive to changing expectation about central bank interest rate policy.

As the chart below shows, the value of UK gilts has outstripped the rate of inflation consistently over a three-year period:

This goes to show that even traditionally ‘stable’ investments are not immune to market volatility and investors will rightly be wondering about the effect that falling gilt values will have on their portfolios.

Despite volatility in the gilt market this year, long-term performance has been good and gilt yields are back to where they were in April 2019, after being driven to record lows during the pandemic. It seems logical for yields to have recovered to their point before the crisis. The presence of gilts in our portfolios acted as intended during the sharp sell-off in February and March last year to help protect capital in those portfolios where required by the risk profile. In short, gilts are performing as expected.

See also: Mike Riddell: ‘We don’t believe in this new higher inflation regime’

It is natural to be pulled into the short-term perspective surrounding inflation and interest rates. There are valid inflation concerns, but when we consider the abnormal events that occurred when the global economy locked down, it seems natural to expect an abnormal recovery. Many of the effects of supply side inflation should pass as we return to normal (assuming there are no negative virus mutations). Some factors will remain a problem for the economy and an inflation concern; sustainable energy sources will fail to provide enough electricity from time to time and will push up gas prices, Brexit will squeeze the economy for the foreseeable future. Overall, many of the factors seem transitory. We have still positioned portfolio with investments to mitigate the risk.

Gilts will continue to play a crucial role in many of our portfolios and at FE Investments, many of our portfolios will continue to contain a substantial allocation to them. We design our portfolios to manage risk and not to make high conviction calls on the direction of markets. We use diversification across asset classes and investment styles, so the portfolios don’t deliver any undue surprises and gilts play a central role in their construction.

Ed Margot is an investment strategist at FE Investments