This article was originally published by our sister title, ESG Clarity

A fourth investment label, scrapping of the requirement firms outline a causal link between stewardship activities and asset improvements, and a new implementation timeline, are among changes UK regulator the Financial Conduct Authority (FCA) has made in its final policy statement for its long-awaited Sustainability Disclosure Requirements (SDR) released today.

The FCA published a consultation paper last year in which it set out proposals to crack down on greenwashing and provide guidance for an ever-growing sustainable investment industry in the UK. This came amid findings that 81% of consumers want their money to do good but just three in every 10 believe sustainable investments do as they claim to.

“By improving trust in the sustainable investment market, the UK will be able to maintain its position at the forefront of sustainable finance, and capture the benefits of being a leading international centre of investment,” said FCA director of ESG Sacha Sadan.

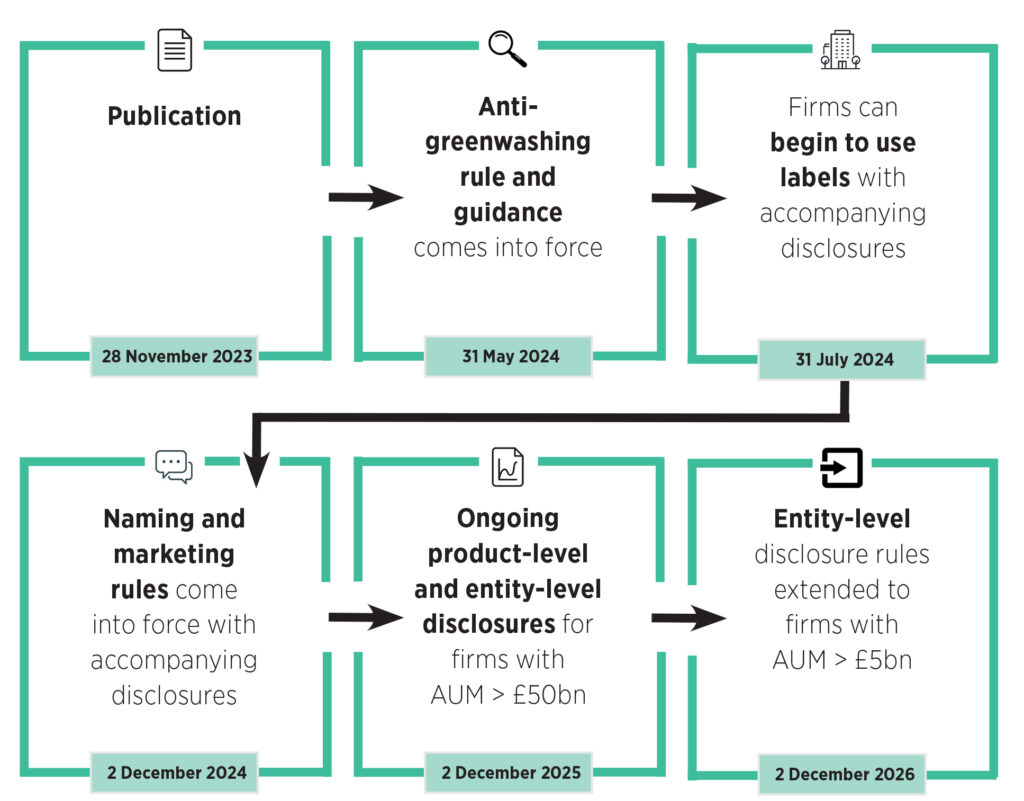

Today’s policy paper sets out the regulator’s final package of measures, the first of which will come into force on 31 May next year.

Source: FCA

ESG Clarity has outlined the main changes below:

A fourth fund label

In October’s consultation paper the FCA set out three proposed labels: “sustainable focus” funds that invest in sustainable assets, “sustainable improver” funds that invest in assets looking to improve their sustainability over time, and “sustainable impact” funds that invest in solutions.

The final requirements have changed “sustainable” to “sustainability” and include a fourth fund label: “sustainability mixed goals”.

This label is broadly for mixed asset funds, which the FCA agreed “have the potential to improve their sustainability over time”.

While the sustainability focus label has not changed much (a minimum 70% of investments are still required to have a sustainability objective), for the sustainability improvers label firms must select assets “on the basis of evidence that they have the potential to improve in time”. Firms are also required to develop short- and medium-term targets for improvements.

Stewardship requirements have also been removed from the improvers label, but all labels must now identify what kind of stewardship strategy they are going to use.

On the impact label, references to “real-world impact” have been removed.

One major change is the removal of the requirement to have an investment strategy assessed as “credible” by an independent party. These assessments can now be done in house.

Stewardship need not show results

The FCA also clarified its stewardship expectations for funds that wish to apply for the improvers label amid concerns in the consultation feedback it would become a ‘catch-all’ category and that stewardship guidance could be “too prescriptive”. In response, the regulator acknowledged stewardship “comes in various forms” and stewardship strategies are usually developed at firm rather than product level.

As a result, the FCA said firms did not need to outline a causal link between stewardship and asset improvements.

The policy paper explained: “We have not been prescriptive as to the form in which stewardship would take place or whether the strategy is at firm or product level. So, we have removed references to terms that may imply a certain approach (eg, ‘active’ stewardship, engagement, voting).”

The FCA added disclosures may be cross referenced from UK Stewardship Code or other stewardship-related reporting.

Earlier this month the FCA published a review of ESG funds, finding “stewardship approaches generally did not meet our expectations”. It found stewardship activities were difficult to identify from fund literature and there was a lack of clear examples of progress.

“Some firms appeared to rely heavily on stewardship activities without being able to demonstrate how they set, assessed and monitored outcomes, and how these linked to the investment objectives of funds,” it said.

In answer to an ESG Clarity question concerning stewardship in the SDR, Sadan said that finding a singular definition of what stewardship is was “very, very difficult”.

“What we’ve done is reinforced it in a slightly different way. If you’re going to ask for a fund that has a label, you’re going to have to explain what it is doing and also what if something doesn’t happen. So, for example, if there’s a particular KPI on supply chains, and a fund says it will only buy companies that improve their supply chains over a 30-day period, if they don’t, then a fund will need to decide whether they exit, whether they vote against, etc. We would want that in the description, and that is still there in the SDR.

“Second, there is still a lot of work going on around stewardship, and we have set up another working group called the Vote Reporting Group, with an asset owner and an asset manager there to try and get templates set up to ensure asset owners and consumers know when someone has voted and why they’ve voted in a certain way. So, we’re trying to bring further clarity in there without being too prescriptive.

“Third, when we put the rules in for firm entity, and large firms over £5bn before December 2025, we want to know what things they’ve done on sustainability across the firm, especially including on stewardship, and that will be in the firm level disclosures. That will be coming out soon for all asset managers with over £5bn in assets, and the year after that for everybody else.”

Anti-greenwashing is still in consultation

The FCA also announced it is launching a new consultation for general guidance on what an anti-greenwashing rule means inviting feedback up until 26 January 2024.

The regulator said the anti-greenwashing rule was initially expected to come into effect immediately on the publishing of the policy statement, but the feedback from the industry was that additional guidance was needed and requested more time to implement.

The FCA is now expecting to implement the anti-greenwashing rule on 31 May 2024 once it has considered feedback. Broadly, authorised firms’ sustainability claims are required to be “fair, clear and not misleading” and the anti-greenwashing rule applies to references to environmental and/or social characteristics of financial products or services.

“We do not provide a specific list of terms for the rule,” the FCA said.

‘Unexpected’ investment disclosures removed

The FCA consultation proposed disclosures for consumers for all funds, including non-sustainable ones, but has scrapped this in its final requirements, saying only sustainability-related products should disclose.

In February this year, the UK Sustainable Investment and Finance Association (UKSIF) said the ‘unexpected’ disclosures rule, in which details of holdings clients may not expect is given, “is among those areas in the consultation that requires the most further detailed consideration by the regulator and the DLAG [Disclosures and Labels Advisory Group]”.

In the SDR, the FCA has said there is no longer a separate category of unexpected investments, but that firms using a sustainability approach must still detail any assets held that are not pursuing sustainability objectives, as well as disclosing negative environmental or social impacts.

“Where a ‘sustainability mixed goal’ label is used, the disclosure must include details of the proportion of assets invested in accordance with each relevant label,” it added.

Firms must review and update the consumer-facing disclosure at least every 12 months.

The FCA appeared to acknowledge requests that the SDR be compatible with other sustainable investment disclosure frameworks and regulation and so has made reference to the use of GRI Standards, for example, in its guidance on entity-level disclosures.