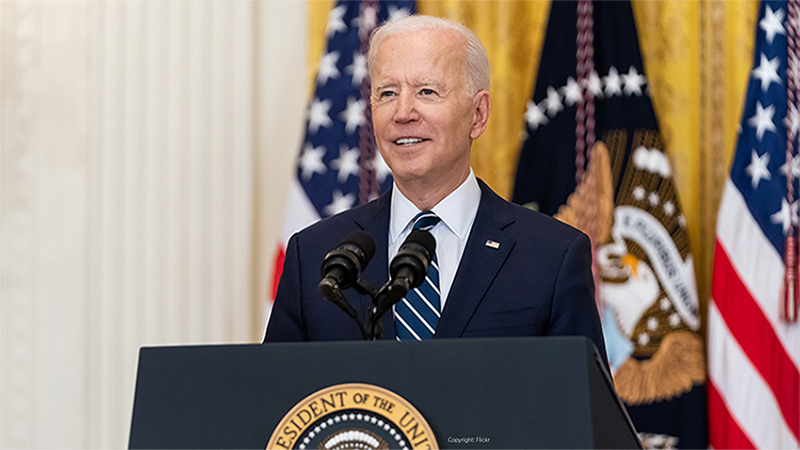

US GDP growth was notably stronger than expected for the fourth quarter of 2022, rising 2.9% against economist expectations of 2.6%. President Joe Biden indulged in a little triumphalism, saying: “I’m not sure… that the news could have been any better.”

However, the data may raise more questions than it answers.

The first problem, at least on initial inspection, is it makes it less likely that the Federal Reserve will halt its plans to raise interest rates. Weaker inflation data had created mounting expectations across financial markets that the US central bank would dial back on tightening monetary policy. This is partly responsible for the rally equity markets have been enjoying since the start of the year. However, with the US economy powering ahead, any ‘pivot’ seems less likely.

That said, most economists believe that the strong performance is unlikely to endure. Oxford Economics said: “Most of the advance occurred early in the quarter and the core of the economy was soft, meaning a repeat performance in early 2023 is unlikely. Looking ahead, restrictive Fed policy and the past tightening in financial conditions will lead GDP to flatline in Q1 before a mild recession starts in Q2. Hope for a soft landing is alive, but the Fed’s track record of achieving this favourable outcome is not encouraging.”

Nor is the make-up of growth promising. The biggest boost came from higher inventories – almost certainly a reflection of the deglobalisation impulse among US companies in response to sclerotic supply chains. Net trade was also a factor, but Oxford Economics says neither can be relied on to continue in 2023.

Consumer spending data has been notably weakening, with retail sales falling in November and December. Steven Bell, chief economist at Columbia Threadneedle, says that spending data may wilt further from here, with consumers hurt by high prices and borrowing costs, and the progressive erosion of the cushion of Covid handouts. He adds: “In the US, the ‘Covid piggy bank’ was higher than elsewhere, but they have spent more of it. Had they cut spending in line with lower incomes, we would have seen a serious recession. However, with much of it gone and inflation eroding the value of the remainder, we expect [consumer spending] to be weaker going forward.”

This suggests that the stronger GDP growth may not be as bad news for interest rates as it initially appears. Bell points out that there is still plenty of good news on inflation – manufacturing price pressures have eased considerably, according to the latest ISM surveys, while service prices are running less ‘hot’ than they were.

He also sees easing in areas such as used car prices, while rents and housing investment also appear to be weakening. Rents are dropping, with US online real estate marketplace Zillow reporting the fastest month-on-month fall in seven years. Oxford Economics says: “Residential investment fell for the seventh straight month – the longest streak since the housing crisis – down 26.7% in Q4.” And with the Fed’s interest rate increases not yet fully digested by the economy, more pain is looming.

As such, on most measures, hopes for a pivot from the Federal Reserve would appear realistic, but there remains one problematic area: wages.

Bell says: “Wage growth is still too strong. It may have peaked, but only at a really high level. [Its current level of] 5% is way too high to be consistent with 2% inflation. Wages are a very powerful negative on the inflation front.”

He believes unemployment needs to be nearer 5% to bring inflation back into line and there are few signs of that happening. The most recent data showed unemployment claims at 186,000, 17,000 less than predicted. Bell adds: “The labour market is still very tight and there needs to be a reduction in labour demand. The US needs to have a recession to push inflation lower.”

A final wrinkle in the dollar. The greenback has been weakening since September as other countries have caught up with the US on interest rates and there has been more hope of a pivot from the Fed. This has eased inflationary pressures. But there is a danger that the recent strong GDP numbers pushes the dollar higher, which will exacerbate the inflation problem and trigger Fed nerves once again.

As it was, the dollar rallied a little versus sterling and the euro in the immediate aftermath of the news, but has dropped back down subsequently. It is clear that forex markets don’t believe the data moves the dial on interest rates for the time being.

With all these moving parts, does it mean the US GDP data is good or bad news?

On balance, it is neither, which is almost certainly why markets have barely reacted. It doesn’t influence whether the Federal Reserve will pivot – only a significant change in wage growth and unemployment is likely to change the central bank’s thinking. For the time being, this is where markets are focusing their attention.