Ewan Markson-Brown is thoroughly enjoying boutique life at Crux Asset Management. Despite moving from a significantly bigger outfit, it’s still very much business as usual.

He remains Edinburgh-based, helping to establish Crux’s new office in the region. His Crux Asia ex-Japan and China funds, which are about one year old, follow the exact same investment processes and growth style he used while running money at Baillie Gifford.

To make it into the portfolio, companies must be able to double their revenue over rolling five-year periods. Statistically, firms with long-term earnings momentum tend to double their share prices and outperform on average.

“Being long-term and growth investors really works in Asia and I think it works better here than most other markets.”

Markson-Brown thinks three to five years is the “optimal timeframe” in Asia. Typically, investors in the region hold positions for less than a year, he says, with quarterly numbers and news flow heavily influencing decisions to stick or twist.

“That’s why we are based in Edinburgh. Stand back, look at the world, don’t worry about the noise.”

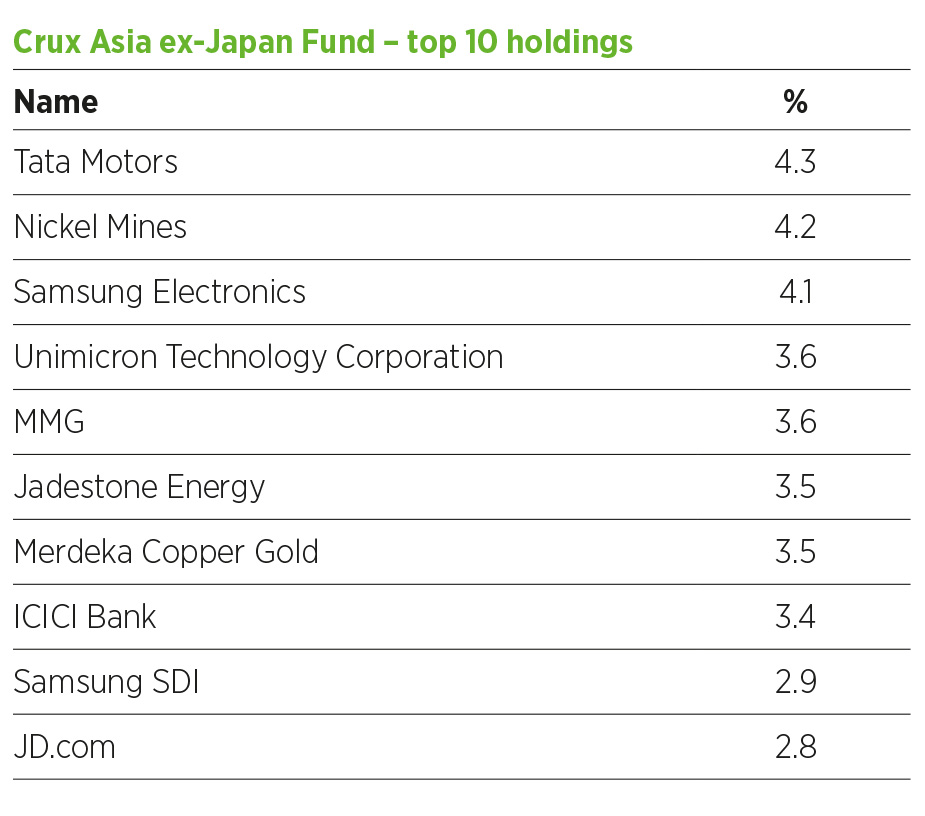

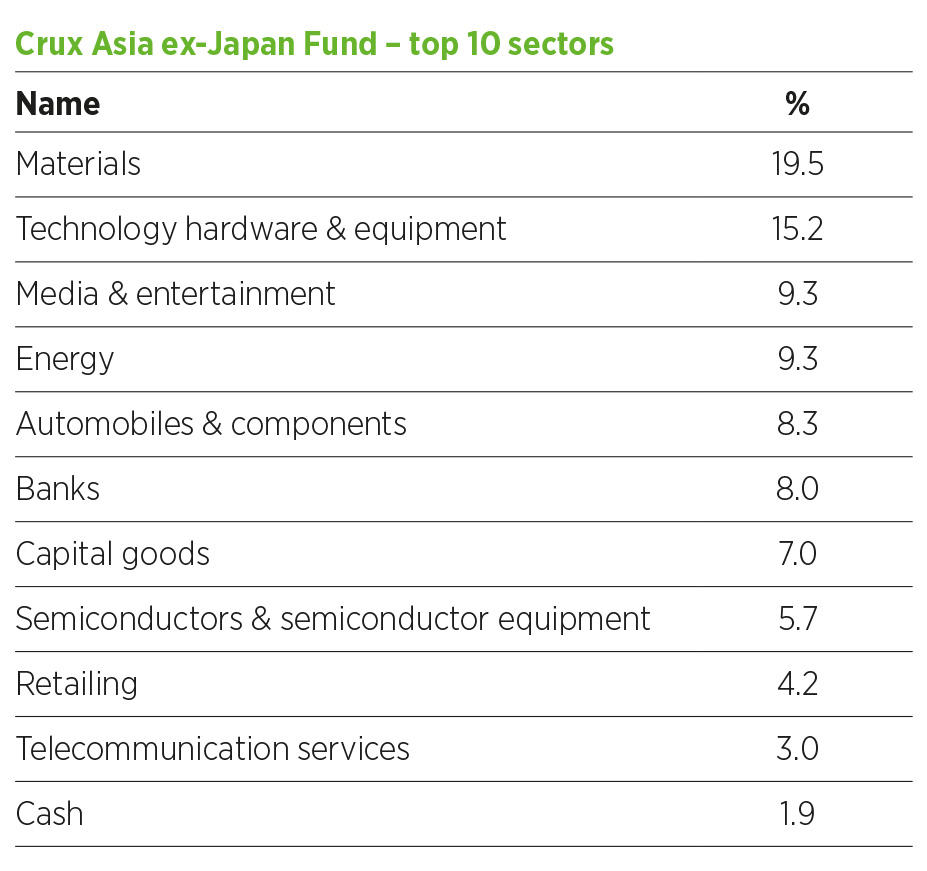

While Markson-Brown is a self-professed ‘growth’ manager, many of his investee companies aren’t in sectors that would be traditionally classified as such. Materials is his largest overweight, accounting for 19.5% of Crux Asia ex-Japan. Commodities also feature prominently, with Nickel Mines, MMG and Merdeka Copper Gold in the fund’s top 10 holdings.

“Asia is highly cyclical as a market,” he explains, “the currencies move quite dramatically and there’s lots of regulatory change. We’re open to all different types of growth.”

Culture clash

This is a big departure from his Baillie Gifford Pacific Fund. Back in 2018, the fund had zero exposure to commodities and materials, and high-flying tech names made up half the portfolio.

Only 25% of Crux Asia ex-Japan is held in tech companies. While JD.com is a top holding for this fund and the China strategy, Markson-Brown has shunned other obvious internet giants such as Alibaba and Tencent.

He owned both stocks while at Baillie Gifford but started reducing the positions “aggressively” in February 2021, fearing a backlash from increasing regulation and an impending slowdown.

This was met with “huge amounts of internal pushback” at Baillie Gifford, with the pair of internet darlings held by some of its biggest vehicles, including James Anderson’s Scottish Mortgage Trust.

Markson-Brown says it was subtly communicated he was not toeing the party line. “It wasn’t like, ‘don’t sell this, you’re wrong’. It was more like a tap on the shoulder, saying maybe you shouldn’t be doing that months later.”

It’s a trend he has seen play out at other larger companies he’s worked for, such as Pimco, Merrill Lynch and Newton Investment Management.

“Usually what happens is that anytime the top investor gets too much power, if anyone crosses him, they get quite cross. The key is to never let an individual, however good, control the decision making for everybody.”

Toward the end of his tenure at Baillie Gifford, Markson-Brown felt the portfolio managers had become detached from one another, especially during the pandemic.

“That whole company culture of ‘let’s talk to each other’, ‘let’s interact between the different teams’ – it didn’t happen for two years. It didn’t really happen much before that, anyway. It was forced.”

At Crux, his team consists of deputy manager and ex-Martin Currie manager Damian Taylor, as well as analysts Ishaan Bhatia and Ryan Soh. Taylor is based in the Edinburgh office with Markson-Brown, while Bhatia is in Mumbai and Soh splits his time between London and Malaysia.

“I have far more direct resources, ironically, than I did at Baillie Gifford. They had a China team, but we didn’t actually use it. We were quite sceptical, and I think that’s been proven right.”

Think small, win big

Markson-Brown has been an all-cap manager for the past 20 years, but his preferred hunting ground is in the mid- to small-cap space.

Around 11.6% of his Asia ex-Japan fund was in companies with a sub-$2bn (£1.7bn) market cap at the end of May, while 26% was held in businesses worth $2-$15bn. In the China strategy, around 43% of holdings fall under the second bracket.

His goal is to outperform the mega-cap names like Alibaba and Tencent, companies that any of his clients can go out and buy. “All you need is one or two [holdings] to go from $5bn companies to $30bn or $50bn. That is really what we’re looking for.”

He adds: “There are people who invest in small caps and expect all their companies to remain small. I invest in small companies because I think they can become big companies.”

According to their latest factsheets, Crux Asia ex-Japan has around 90 positions, while Crux China has 76. Like his former outfit, Markson-Brown also believes in the power of asymmetric returns, namely that a handful of holdings will drive the bulk of portfolio gains over a long period of time.

“We are conviction stockpickers. But we realise we live in a world of massive uncertainty and volatility, and a lot of our companies won’t work out. Therefore, we need a diversified portfolio with a long tail to try and find the right way to give stability.”

Focusing on the upside not the downside has not been a winning trade in this year’s volatile market environment. Crux Asia ex-Japan is now down 23% since launching on 1 October 2021, while the MSCI Asia ex-Japan has lost 7%. Crux China also lags behind the MSCI China All-Shares, down 12% against the index’s 4% dip.

With markets as cheap as they are, he now thinks his companies should double at least over three years.

Calling the bottom is easier said than done. After moving underweight China in mid-2021, in the fourth quarter, Markson-Brown began buying back into the region, feeling “regulation was going to flatline and not get worse” and stocks everywhere else looked expensive. What he wasn’t counting on was China’s zero-Covid policy.

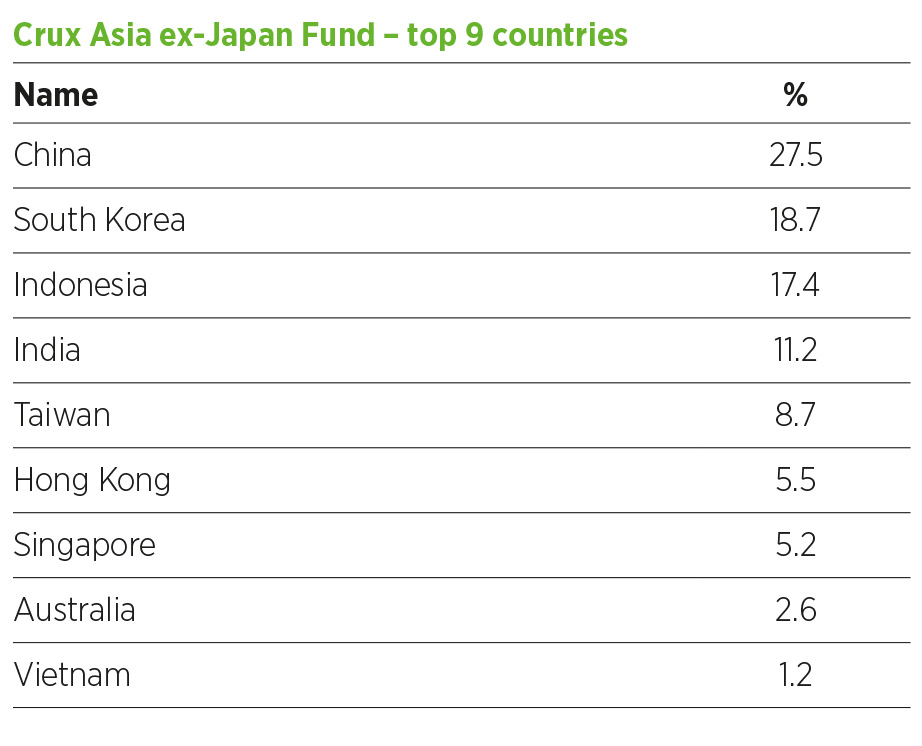

More recently, he has moved overweight China in the Asia ex-Japan Fund. “We are at the economic nadir with policy being counter-cyclical compared with other developed market economies.”

The ‘electrification of everything’

Markson-Brown also thinks we are past the peak in technology regulation in China. His exposure to the region can be distilled down to three buckets – internet stocks, cyclicals and, one he fancifully refers to as, the “electrification of everything”.

The first includes holdings such as Sea Limited, a Singapore-based gaming and e-commerce firm, and Kuaishou, a Chinese short-video platform which is a rival to TikTok. Cyclical names include restaurant chain Jiumaojiu, which specialises in sauerkraut fish, a national delicacy.

Sales have taken a major hit during the Covid crisis, but Markson-Brown expects the restaurant to rebound rapidly when restrictions are loosened in Q1 2023.

“We’ve seen that across the west. Once you’re free of restrictions, everyone goes out and spends their money.”

In the final bucket, he owns CATL, which is responsible for 40-50% of the world’s batteries, including those used for electric vehicles, and Sungrow Power, which makes solar inverters.

Investors have become increasingly anxious China is losing its toehold, as geopolitical tensions and supply chain bottlenecks, exacerbated by Russia’s invasion of Ukraine, have accelerated a shift toward de-globalisation. Markson-Brown admits this will impact certain sectors like healthcare. China is responsible for 90% of vitamin C production so he expects more countries to beef up local production efforts.

Semiconductor manufacturers such as TSMC and Samsung might also start to build more plants in the US. But other areas like solar and wind look more resilient to change, given the cost and effort of constructing towers.

“There will be certain things where 20% of manufacturing needs to be local. But my bet is that in 10 years’ time globalisation has continued, it just looks a little bit different.”

Manufacturing jobs lower down the value chain are likely to leave China, with companies seeking more cost-competitive countries. Markson-Brown thinks Indonesia, his largest country overweight at 13% of the Asia ex-Japan Fund, will be a beneficiary.

“Indonesia will be the big battery manufacturing hub because it’s going to be the lowest-cost producer of high-grade nickel in the world, if you discount Russia.”

BIOGRAPHY

Ewan Markson-Brown joined Crux Asset Management on 9 September 2021. He has worked in the investment industry for over 21 years, most recently as an investment manager in the EM equity team at Baillie Gifford from 2013 to 2021. Prior to that he was a senior vice-president in emerging markets at Pimco and worked at Newton for five years as a lead portfolio manager.

This article first appeared in the July edition of Portfolio Adviser Magazine