The liquidity crisis emanating from Chinese real estate giant Evergrande has caused widespread fears of possible contagion, but fund managers are quick to dismiss the idea it poses a long-term risk to the Chinese and global financial systems.

The bigger question is around why it happened, given the Chinese government’s regulatory crackdown this year, and what this says about the future of China as an investment opportunity.

With more than $300bn (£222bn) in liabilities, Evergrande is China’s most indebted property company and is likely to be the subject of the country’s biggest ever debt restructuring, which could cause serious ructions given the property sector makes up as much as 28% of China’s GDP, according to Bank of America (BoA).

Red flags have been waving over the company for the best part of a decade, but things came to a head at the end of August when it warned over defaulting on its debt after a slowdown in sales stymied its cash-raising ability. It subsequently failed to make an $83.5m coupon payment due on 23 September for one of its dollar bonds and had 30 days before a default would be officially triggered.

It has also been battling a slowing property market. Official data published in September shows prices of new homes across China’s 70 biggest cities crept just 0.2% higher in August compared with July – the slowest rate of growth in eight months. Indeed, in mid-September, Evergrande disclosed monthly sales had fallen from ¥71.6bn (£8bn) in June to ¥38.1bn (£4.4bn) in August.

The situation has been exacerbated by a regulatory crackdown last year by Chinese authorities on the reckless borrowing habits of property developers to cool the sector. It came as part of its wider agenda to tackle the excesses of capitalism, which has also seen it target online education and gaming companies this year.

The short-term effect on markets was obvious as investors fled the debt of Chinese companies, particularly those involved in the real estate industry. The average yield on the ICE BoA Asian Dollar High Yield Index spiked to 12% the week of 20 September, from 7% at the start of the year. Hong Kong’s Hang Seng fell by 5% in five days, while the S&P 500 dropped nearly 2% on 20 September. But investors are less fazed by the longer-term implications.

Speaking at the recent Square Mile Investment Consulting and Research conference, M&G chief investment officer of public fixed income Jim Leaviss said while it is set to be the biggest default in a long time, no one bank has huge exposure to Evergrande, meaning it is unlikely to develop into another Lehman Brothers.

He said Evergrande is still a worry, however, particularly the potential knock-on effects on the Chinese property sector and economy, and as with all crises, it can be a bit like playing “whack-a-mole”. “You think you’ve got it under control but there is always somebody who has made a stupid decision somewhere else, and that is the worry for me,” said Leaviss.

‘Controlled explosion’

For Matthews Asia portfolio manager Teresa Kong, previous cases suggest the fallout from Evergrande is unlikely to cause long-term harm to China’s financial system. She believes the government will actively manage the firm’s restructuring to ensure its liquidity problem does not spill over to the Chinese financial system.

“The company does have a large debt burden, but it is insignificant given the scale of China’s financial system,” she says. “It’s worth noting that, in recent years, two companies with similar magnitude debt burdens, Anbang and HNA, were successfully restructured without creating systemic damage.”

Kong also plays down the risk of the issue developing into a full-blown global crisis. “‘Too big and strategic to fail’ does exist in China as it does in the rest of the world, such as systematically important financial institutions like the largest banks in a country,” she says. “However, in this case, we expect the issues surrounding Evergrande to be largely contained within China.”

Federated Hermes’ base case scenario is for an orderly default, facilitated by the Chinese government in the form of administrative rather than financial support. Credit analyst Robin Usson points to the government’s initial reaction to the crisis, including its move to centralise all court cases against Evergrande, as a sign it will manage the fallout.

In addition, major banks including Minsheng, Zheshang and the Shanghai Pudong Development Bank, have agreed to extend some project loans, which would help avert a fire sale.

“While the Chinese government is likely to allow Evergrande to fail, we agree it will do so in the manner of a controlled explosion,” adds Usson. “China’s leadership values order above all else, and we believe it is working behind the scenes to limit the social and economic domino effect of the company’s demise.”

As such, Usson expects Evergrande to ultimately file for bankruptcy, but any contagion will be limited both globally and domestically because of the Chinese authorities’ action. This could, he adds, see numerous companies across the mainland and beyond be used to absorb the shock and spread out the impact.

“While the opaqueness of the Chinese market means interconnections are harder to predict, we can confidently say Evergrande is far from China’s ‘Lehman event’ as some have suggested,” he adds.

Caught in the crossfire

According to Usson, the Evergrande situation is a story of a company caught in the middle of China’s past and future.

He explains: “Evergrande stands in the crosshairs of China’s demographic shift, its urbanisation and property boom, and the end of its decade-long economic growth spurt. In addition, increased personal wealth has seen property investment soar towards bubble territory.”

In managing Evergrande’s exit from the market, Usson argues the Chinese government is asserting its commitment to the so-called ‘three red lines’ imposed on developers last September. The aim was to cool the property market against the backdrop of an ageing population, slowing birth rates and a small-family culture that endures despite the end of the one-child policy.

“These stringent measures were accompanied by curbs on bank lending. It is ultimately all of these things – from demographics to regulation, speculation and growth – that caught up with Evergrande in the end,” says Usson.

Psigma head of investment strategy Rory McPherson says Evergrande’s $300bn debt burden has grabbed attention, but that retail investors in wealth management products and those buying houses should be reasonably protected from any fallout. He says the measures taken this year by Chinese authorities have been quick and, while arguably drastic, are to the long-term benefit of the economy.

“We see the recent actions as a pivot towards a more stable economy that has a greater focus on the welfare of both consumers and workers. It is a move to rebalance some of the inequalities that have been a function of the last decade-plus of easing that has benefited capitalists through asset price rises, notably in housing and technology shares.

“The shifts have been going on for some time now and – we would argue – been reasonably well telegraphed.”

The bulls and bears

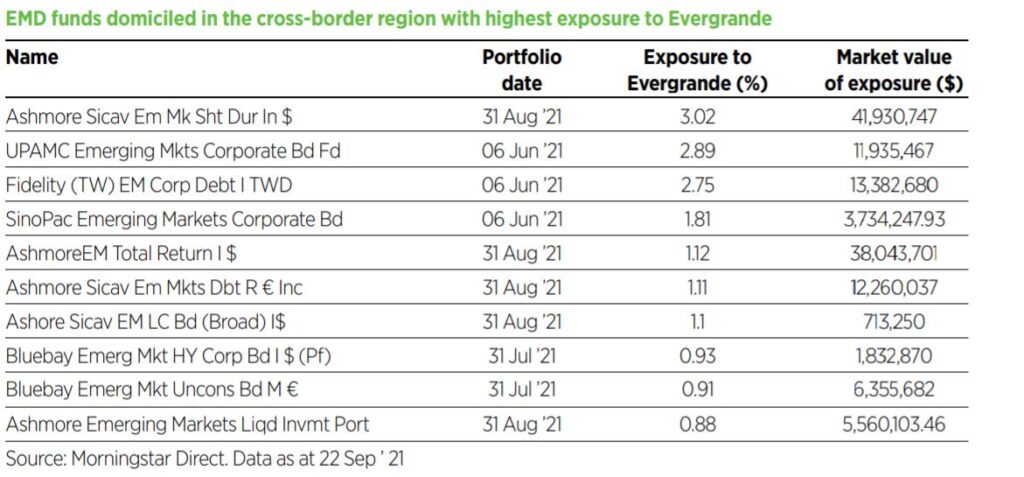

Fund groups are split on their positioning when it comes to Evergrande. Data from Morningstar reveals the emerging market debt funds in its cross-border funds database with the largest exposure to Evergrande’s bonds: Ashmore has five funds in the top 10, while Bluebay has two, and Fidelity, Sinopac and UPAMC have one each (see table).

Ashmore has $146m held across several portfolios. The Ashmore Emerging Markets Short Duration Institutional ESFIX had the largest individual stake in Evergrande at 5.2% of assets at the end of June 2021, with multiple other open-end funds posting exposures greater than 1% of assets.

UBS, meanwhile, had total exposure to China Evergrande debt totalling $283m across multiple portfolios, based on portfolio data ranging from June to August 2021 collected by Morningstar.

In addition, Morningstar notes as Evergrande’s bonds reached distressed levels in mid-September, Blackrock added the company’s debt to five strategies, including a 0.5% off-benchmark stake in BSF Emerging Markets Short Duration and a 1.13% off-benchmark stake in BSF Emerging Markets Flexible Dynamic Bond.

“With Evergrande’s chances of a distressed exchange or takeover by a state-owned company considerable, the recovery value of the bonds is likely to exceed their current price of roughly 30 cents on the dollar,” says Morningstar.

On the other hand, Morningstar found the emerging markets teams at Pimco, Barings, and T Rowe Price have avoided or have been significantly underweight Evergrande in portfolios since at least mid-2020, when the Chinese government announced its stricter debt limits for highly leveraged companies.

On the equities side, investors are split in terms of exposure to China. According to McPherson, a standard balanced risk Psigma client has about a 3% exposure to Chinese equities, in the context of a 6% exposure to emerging markets, predominantly Asia-focused.

“We think this is appropriate given that China is the second-biggest economy in the world, is growing healthily and it’s now a question of when and not if China will overtake the US as the world’s biggest economy and engine room of the world.”

Richard Bernstein Advisors, meanwhile, has been reducing Chinese equities exposure for more than a year, based on deteriorating fundamentals. Chief investment officer Richard Bernstein says exposure peaked at about 13-14% during Q1 2020, but this has dropped to about 1%.

“Investors should look for opportunities outside of China. Liquidity conditions and corporate profits remain favourable in Europe, the US and parts of Asia.”

In terms of emerging market credit, Bernstein notes emerging market high yield has historically had a lower default rate than US high yield, but Evergrande could affect this. “However, with overall global corporate profits and cashflow improving, investors should not shy away from emerging market credit as an asset class just yet.”

Matthews Asia’s Kong also notes the potential for negative sentiment resulting from a default temporarily spilling over into the rest of the Asia high-yield universe.

Active management is necessary

SYZ Banque head of discretionary investment Luc Filip believes the crisis highlights the need for selectivity in the Chinese domestic market to navigate pockets of leverage or excessive valuations.

“Looking past this painful period for Evergrande investors, we anticipate a lasting impact on the Chinese real estate sector, that accounts for 30% of GDP,” he says. “In this context, we believe the most important impact of the Evergrande situation is less on the bond market than on the potential negative impact on Chinese GDP.

“Therefore, we have become more cautious in the short term for Chinese equities, even if the long-term prospects for China and the region remain compelling.”

McPherson also says an active approach is necessary, given the prevalence of Chinese shares within passive benchmarks. Psigma favours specialists such as Matthews Asia and the Mirae Asia Great Consumer Fund.

He says Matthews Asia offers exposure to the small and mid-cap areas of the market, which are attractively valued and benefit from the expected cyclical recovery. Meanwhile, Mirae provides access to growth markets such as India, but also growth areas in the Chinese markets that are trading at 20-30% discounts on valuation terms to global peers.

He adds: “We’d also note the attractiveness of Asian bond markets and have a 2.5% holding via the UBS Full Cycle bond fund within balanced portfolios. This yields close to 4% for investment-grade-rated bonds.”

This article is taken from the October 2021 issue of Portfolio Adviser. Read more here