If this year has taught investors anything, it is that ESG funds are here to stay, and where there is popularity, fee pressures inevitably follow.

Evidence of this can already be seen in the ESG fund space and experts foresee a convergence of fees between sustainable funds and their traditional counterparts during the next few years, but some believe a small premium is warranted for products that are able to achieve true positive impact.

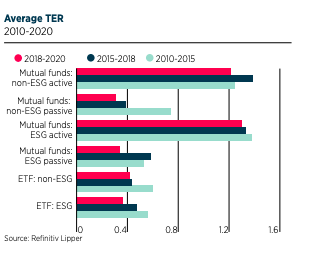

In the past decade, ESG funds have shown a steady decline in fees, according to Refinitiv Lipper, and today fees for ESG alternatives are broadly in line with non-ESG counterparts in both the active and passive space.

While in the past, sustainable funds might have charged in excess of 1%, currently they tend to have much lower introductory rates, usually around 0.45%, according to Tribe Impact Capital. In fact, Jake Moeller, senior investment consultant at Square Mile Investment Consulting & Research, says the idea that responsible funds are more expensive than non-RI counterparts may now be a misconception.

He says: “We have looked at all of the funds in the Investment Association universe and the average OCF is 0.93%. FE [Analytics] have a filter for Ethical/Sustainable funds and the average OCF for those 230 funds is 0.9%.”

According to Fred Kooij, CIO of Tribe Impact Capital, the cost of responsible investing has been going down as a result of two key factors: “First, we are starting to see more sustainable products in the market, and with increasing competition comes increased cost pressure. Second, as managers start to incorporate ESG and sustainable practices more fully into their standard risk assessment process, it becomes harder to justify higher fees to clients for doing ‘additional’ work.”

At the same time, research suggests that many end investors are no longer willing to pay a premium for ESG research. The 2020 Product Trends survey by Alpha FMC, for example, revealed more than 70% of managers do not think specialist ESG and responsible investing products can command higher fees.

“The downward trend in ESG pricing suggests that clients are not willing to pay a premium for ESG research alone,” says Kevin Pollard, senior research analyst at Refinitiv Lipper. “The fund market has responded accordingly and ESG fees are more closely matched now with traditional offerings.”

The same trend can also be witnessed in the pensions space, with Andrew Bang, adviser at Secor Asset Management, telling Portfolio Adviser sister title ESG Clarity the majority of the firm’s pension clients “have not been willing to pay a premium for ESG funds but rather expect ESG factors to be integrated in their existing mandates as part of a responsible investment management programme”.

Picking the winners

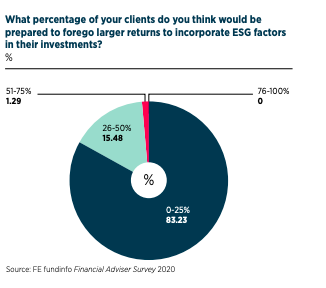

One of the key reasons investors are putting more pressure on ESG fund providers today is the fact that sustainable investing is becoming mainstream and as such, investors are no longer willing to give up on returns to remain true to their principles.

According to this year’s FE fundinfo Financial Adviser Survey, 83% of advisers say only a few of their clients would be prepared to forego larger returns to incorporate ESG factors into their portfolios.

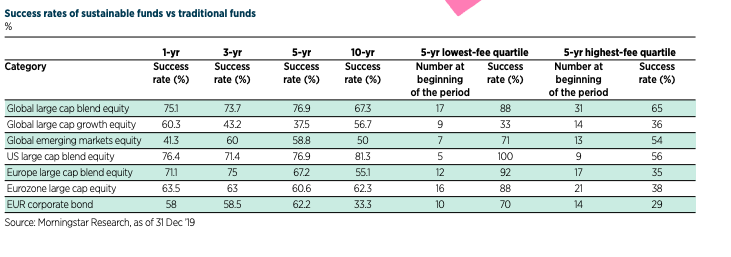

Meanwhile, recent return data unequivocally shows they don’t have to. Morningstar research entitled How Does European Sustainable Funds Performance Measure Up? showed sustainable funds outperformed their traditional peers in all but one category during the Covid-19 sell-off, with excess returns ranging from 0.09% to 1.83% during Q1 2020.

At the same time, the study found selecting a fund in the lowest-fee quartile five years ago would have improved the odds of picking a winner in all categories except global large-cap growth.

Still evolving

However, while overall fees have been going down, this trend has not been uniform across all sectors. For example, while the average charge for ethical and non-ethical funds in the global sector is now identical at 0.75%, according to AJ Bell, the asset classes that are less established in the ESG space are still in a position to charge more.

Paris Jordan (pictured), co-founder of ethical investor network Virtuvest, says: “When it comes to your standard asset classes like UK equities, global equities and even investment-grade bond funds, the market is relatively saturated. These funds tend to be well established and they have substantial assets in them, meaning they can employ economies of scale to reduce their transactional costs.

“Where fees start to become an issue is in relation to asset classes that are evolving in the ethical investment space. For example, the limited supply of ethical alternatives – including absolute return funds, regional equity funds and even to some extent high-yield ethical funds – means there isn’t yet the competition to push fees down to a level that is in line with the rest of the market.”

Jordan Griffiths, investment consultant at Quantum Advisory, adds the range of fees also reflects the different ESG approaches available to investors, with less research-intensive offerings typically charging less.

“Exclusionary strategies are generally lower-cost, while those that make greater use of active engagement with the investee companies tend to be higher,” he says, adding different asset classes charge different fees because “ESG risks may be less visible in some investments and therefore require a specialist understanding to identify and manage these appropriately”.

Meanwhile, the growth of ESG passives is creating even more fee competition in the market, with charges for ESG ETFs falling at a much faster pace than active counterparts, according to Refinitiv Lipper. Some of the largest providers, such as BlackRock, now offer ESG ETFs at little or no fee premium to non-sustainable products.

Future expectations

Given this growing trend, investment experts agree we are likely to see the fees for sustainable and non-sustainable funds in Europe converge over time and the number of low-cost sustainable products to continue growing.

Anna Skylakaki, senior manager at Alpha FMC, comments: “We expect that fee differential, where it exists, to be eroded over time, as the industry moves away from a focus on specialist products and towards integrating ESG and RI criteria across their entire fund ranges.”

Kooij also sees the proliferation of ESG ETFs putting increased downward pressure on ESG fund fees overall, though he also warns “the impact narrative can be watered down” when investing passively.

“In other words, investor caution is required, both in terms of not overpaying, but also making sure the fund you choose is and can do what it claims to be doing,” he says.

As such, he believes “if you see sustainability as the megatrend of the next 20 years”, a small premium to “invest with those who are more aware of impending regulation and technologies, and therefore potentially receive higher returns,” may be warranted.

However, he says those investors willing to pay more for sustainable products “will scrutinise their positions more rigorously, so this requires fund managers to do what they say they are doing”.

“If investors are paying a premium, they would – and should – expect more involvement from their fund manager, whether this is through engagement or impact measurement.”

For more insight on responsible investment, please click on www.esgclarity.com