UK equity income managers are moving away from Britain’s blue-chips and hunting for opportunities further down the market-cap spectrum, which have been decimated by projections for an “Armageddon-like” UK recession.

For the first time in years, the UK has pulled ahead of most major stock markets. The FTSE 100 is up nearly 6% over the past year, while the S&P 500 is trending 4% lower and the Euro Stoxx is limping behind, down 10%.

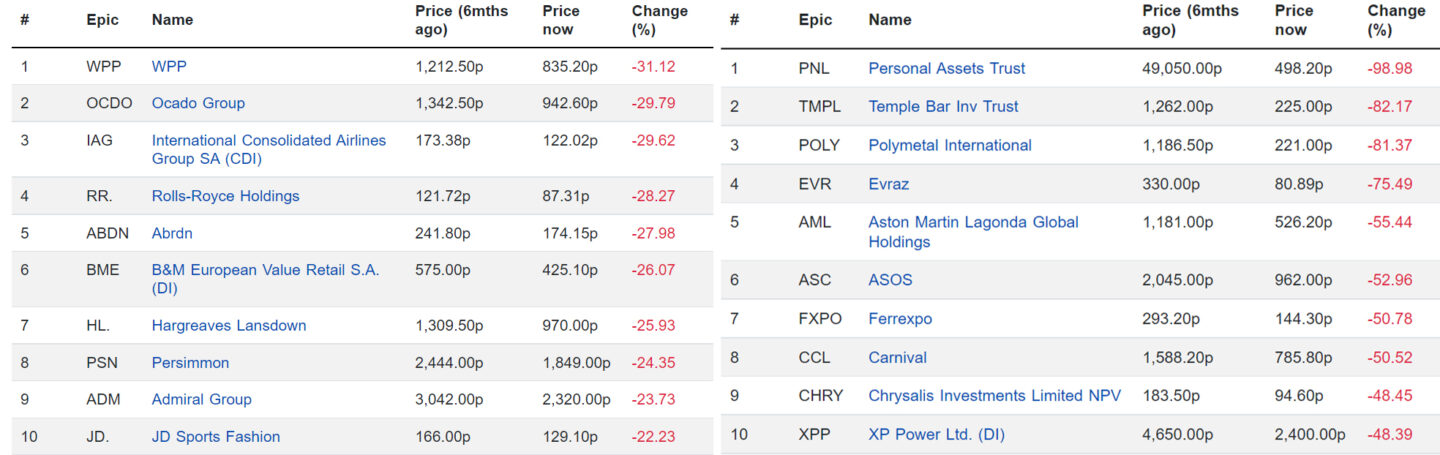

But looking at the more domestically-focused parts of the market, it’s a very different story. The FTSE 250 is 14% lower compared to a year ago. Its biggest flops have lost an eye-watering amount – between 48% and 99% – in the past six months.

The worst FTSE 100 performers, WPP and International Consolidated Airlines Group, are down 31% and 30% by comparison.

FTSE 100 fallers vs FTSE 250 fallers

However, Ben Russon, manager on the FTF Franklin UK Equity Income fund, says the FTSE 100’s stronger showing is somewhat misleading since it is skewed toward a handful of stocks.

Astrazeneca, for instance, has seen its shares leap 30% year-to-date. Demand for its Covid vaccine and antibody treatments has remained resilient, allowing it to smash revenue expectations.

Abrdn UK High Income Equity and Fidelity Moneybuilder, the top two active performers in the IA UK Equity Income sector, both count the pharma giant as their largest holding and own chunky positions in other top risers, such as Shell (28%) and British American Tobacco (22%).

Top five UK equity income funds total return (%) ytd

| Abrdn UK High Income Equity | 8.45 |

| Vanguard FTSE UK Equity Income | 7.48 |

| Fidelity Moneybuilder Dividend | 6.82 |

| UBS UK Equity Income | 6.56 |

| Jupiter Income Trust | 6.55 |

Source: FE Fundinfo

Not as Armageddon-like as markets have priced in

Markets are pricing in extreme pessimism, following a string of bleak data points and forecasts. The Bank of England kicked off the month with a particularly gloomy update, predicting inflation will reach a higher-than-expected peak of 13% later this year at which point the UK will have plunged into a recession.

Amid a brewing cost-of-living crisis, consumer confidence has plummeted to an all-time low, and UK output has also showed signs of slowing.

Jobs figures on Tuesday showed the unemployment rate was virtually unchanged at 3.8% in the three months to June. While 160,000 new jobs were added in July, this was below the 256,000-increase forecast in a Reuters poll of economists. The number of vacancies also slipped for the first time since the summer of 2020 but remained historically high at 1.27 million.

Simon Murphy (pictured), who manages the Tyndall Real Income fund, says six of his 35 holdings have price to earnings ratios that are lower than their dividend yield.

“Normally that is a sign that the market is incredibly bearish and thinking the dividend yield is going to be cut or the earnings are going to collapse.”

Murphy thinks fears of a sizeable economic downturn have been overblown. We are entering a challenging economic period without the usual ingredients needed for a recession – the labour market is tight; corporate and consumer balance sheets are stronger thanks to government stimulus provided during the pandemic; and the housing market remains strong.

“It’s not as Armageddon-like as the markets generally and some commentators have been fearful of,” says Murphy.

Plenty of mid-cap stocks yielding over 6%

A prime example is UK housebuilders. Despite fears of an impending slowdown, they have reported record order books and rising house prices, which have offset higher building and energy costs. On top of this, Murphy notes they have “rock solid balance sheets” and loads of excess cash they have been returning to shareholders. And yet, most are down 30-40% this year.

Vistry, which is currently on a P/E of 6x and a dividend yield of 8%, is one of the top 10 holdings in Murphy’s Tyndall Real Income fund.

Around three quarters of the ex-Merian Global Investor manager’s fund is held in mid-sized companies that have a market cap between £1bn-£20bn, with other holdings including industrial firm Vesuvius and interdealer broker business TP ICAP, which are both on a P/E of 7x and 7% yield.

One Savings Bank, which specialises in mortgages for the buy-to-let market, is yielding 6% but its shares are still cheap on 6x earnings, despite recently reporting strong figures showing no signs of impairment worries.

“There’s lots and lots of income that you can find. You just have to be prepared to dig a bit deeper and to go a little bit further down the market-cap spectrum.”

Taking a punt

Russon and his FTF Franklin Templeton Equity Income fund co-managers have also been hunting for bargains further down the market-cap spectrum. At the start of this year, the £909.1m fund was overweight the FTSE 100 with 87% in British blue-chip companies. But that has now fallen back to 81%.

The team has snapped up a stake in food producer Cranswick, which has seen 15% wiped off its shares this year. Investors have been worried about the impact of rising energy, labour and feed costs on the FTSE 250 business.

However, co-manager Jo Rands says the fact it specialises in cheaper proteins, like pork and poultry, makes the stock more defensive against a cost-of-living squeeze. It also benefits from a strong management team and has an unbroken dividend track record of over 30 years.

Another recent purchase is Spectris, which supplies industrial businesses with precision instruments. The business had sold off sharply on slowdown concerns, and because the management team tried to execute a large acquisition “which the market didn’t like”, says Rands.

“Since we bought the shares, the management came out with the disposal of quite a large bit of the business at a valuation, which was higher than the group valuation itself.”

There is less balance sheet risk taking a punt on mid-cap names now than in previous slowdowns, Russon says.

“Going into the global financial crisis, a lot of sectors were quite highly leveraged – the banks, the miners, the housebuilders, etc. Through that journey, you were taking massive balance sheet risk because if they didn’t recover or the stimulus didn’t come through, a lot these companies would need to recapitalise or go bust.”

‘BoE haven’t been able to forecast anything in front of their names’

As for the surprise rebound in stock markets toward the end of July, Murphy thinks it is more likely a “bear market rally” than an inflection point.

However, he thinks the impending recession will be “shallow and short”, not nearly as long as the Bank of England has forecast.

“Given that [the BoE] haven’t been able to forecast anything in front of their noses for the last few years, I find it staggering that they think they can forecast the next five quarters to be honest,” he says.

“I think that was a very unusual statement to make and a sign that the BoE is under quite a bit of political pressure.”