EQ Investors has cut its annual discretionary fund management charges for advisers as part of a new charging structure.

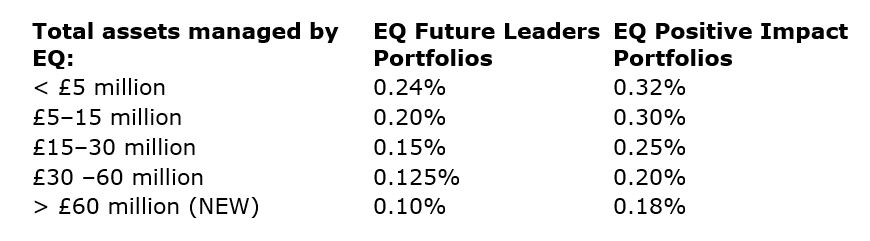

The standard charge for the EQ Future Leaders passive portfolios has been cut from 0.25% to 0.24% while the EQ Positive Impact active portfolio charge has been reduced from 0.33% to 0.32%.

And for firms investing over £60m, a new tier has been introduced with charges set at 0.10% for Future Leaders and 0.18% for Positive Impact.

Rowley Turton director Scott Gallacher said: “The charges seem competitive but the charge reduction, while welcome, is just 0.01% for the EQ Future Leaders passive Portfolios and EQ Positive Impact active Portfolios. This isn’t going to make a huge difference.”

Informed Choice Independent Financial Planning director of client education Martin Bamford said lower investment charges are always welcome.

“There is considerable downward pressure on pricing for asset management and investors always benefit when costs are lowered,” he said. “You would expect a B Corp like EQ Investors to behave in an ethical way like this and reduce their charges as economies of scale allow.”

Under the new charging structure, firms investing between £30m and £60m will be charged 1.125% for Future Leaders Portfolios and 0.20% for Positive Impact Portfolios, respectively.

EQ Investors’ new charging structure

Source: EQ Investors

“Our ability to continually reduce our charges is possible as we pass on economies of scale advantages to our clients. At the core of our strategy is a commitment to ensure clients benefit directly from the continued success of the business,” said EQ Investors joint CEO Sophie Kennedy (pictured).

“We hope this new tier will be attractive not only to our existing IFA partners, but to intermediary firms and their clients that are looking to invest sustainably and haven’t worked with EQ before,” Kennedy added.