Until recently, investors who have jumped on the ESG and sustainable investment bandwagon have enjoyed a relatively smooth ride.

Avoiding industries that are home to the biggest polluters, such as oil and gas, miners and transport, has been a good call in the growth-driven bull market of the past decade.

Square Mile points out in the latest edition of its Good Investment Review that responsible investment (RI) UK and global equity funds have, on average, outperformed their traditional counterparts during the past five years.

In tougher years for trading, this outperformance has been even more stark. In 2020, the average RI global strategy returned 24.8%, while the average IA Global fund returned 15.7%.

RI funds’ leg-up on performance and a growing public awareness of the climate crisis have resulted in a wave of money flooding into green-friendly products, a fact that has not gone unnoticed by the asset management industry.

Despite the uncertainty of the coronavirus pandemic, 505 sustainable funds were launched in Europe in 2020, according to Morningstar, a record-shattering year in which net inflows into open-ended sustainable funds and ETFs hit €233bn (£195.71bn).

In the UK, specifically, flows into sustainable products reached £37.1bn in 2021, which Morningstar noted was nearly £10bn higher than the wider market total. However, the fallout from the war in Ukraine, which has caused the largest commodity shock since the 1970s, threatens to derail this momentum.

Sustainable funds slump against traditional counterparts in Q1

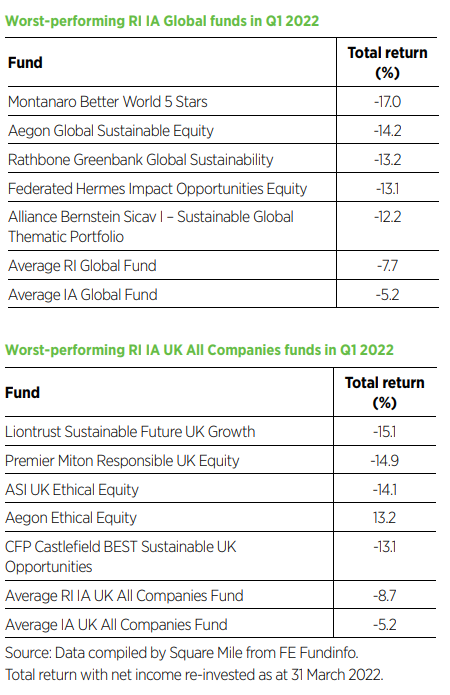

Most RI funds in the IA UK All Companies, Global and Sterling Corporate Bond sectors are sitting on higher losses than their respective averages over Q1, Square Mile’s Good Investment Review found.

Only 12 global RI funds have beaten the IA Global average of -5.2% over the first quarter. The worst performer, the €782m Montanaro Better World Fund, is down 17%, while the €505m Aegon Global Sustainability Equity Fund is not far behind.

In the UK market, which has a more cyclical bias towards tobacco, oil and gas, mining and banks, the number of outperformers is even smaller. Just three funds have done better than the IA UK All Companies average, at -5.2%.

Here, the Liontrust Sustainable Future UK Growth Fund, which is just shy of £980m in assets, and the £210m Premier Miton Responsible UK Equity Fund have delivered the biggest losses.

The performance of RI sterling corporate bond funds was on par with their non-RI counterparts over the first quarter, with the average RI fund returning -5.4%, a 0.2 percentage point improvement on the sector average.

Only four funds – Family Charities Ethical, Foresight Global Real Infrastructure, Schroder Global Sustainable Value Equity and VT Gravis Clean Energy – mustered a positive return out of the 70 vehicles reviewed by Square Mile.

ESG funds tend to attract stickier assets

Despite some disappointing quarterly figures, so far investor demand has not wavered. Morningstar reported the first quarter of 2022 marked the widest gap between sustainable fund inflows of £1bn and non-sustainable fund outflows of £1.1bn.

Performance is likely not the be all and end all for many who have chosen to park their cash in a fund with an ESG or sustainable label, but it is still a key factor.

In a recent survey by our sister title ESG Clarity, one-fifth of UK fund buyers cited performance as the main reason for the shift into ESG, just behind climate change concerns (30%).

“The reality is performance always drives demand,” says Jake Moeller, senior investment consultant at Square Mile.

“A lot of money has gone into these funds in the past couple of years without investors appreciating the types of biases they have. I think the slight bout of underperformance has probably caused them to look a little bit more closely at the portfolios, so that might not be a bad thing.”

RI and sustainable funds are, by design, investing in long-term structural trends, such as clean energy, climate action and zero hunger. As such, Moeller thinks they will tend to attract stickier assets.

When conferences are all about the same thing, you know the bell is tolling

Andy Merricks, fund manager at 8AM Global, does not believe investor appetite for sustainable funds will wane significantly just yet.

But he thinks the weight of the energy crisis and war in Ukraine will expose the difference between investors who just say they care about being green and those that actually do.

“Words are easy to put out there but acting upon them is a different matter entirely,” he says.

“No one would argue that the ESG movement didn’t make perfect sense from a moral point of view, but change can be a long process.

“Investors may say they’re investing for the long term, but the long term is made up of lots of shorter terms, and if those shorter terms lead to a financial loss, the longer term can shorten accordingly.”

If investors lose their appetite for ESG funds, says Merricks “it’s an absolute certainty the fund providers will too”.

“I’m a veteran of investment conferences and I’ve seen in the past that when the presentations at these conferences are virtually all about the same thing – I’m thinking technology in the late 1990s, property in the lead up to the financial crisis in 2008 and fixed interest in the subsequent bond rally from 2010 onwards – the bell is tolling for the sector in question.

“Last autumn was exactly this scenario for sustainable and ESG funds as conferences got under way again after the pandemic,” he adds.

Regulatory initiatives could buoy flows

Although the performance tide has turned against ESG and ‘growth’ stocks, Laith Khalaf, head of investment analysis at AJ Bell, thinks this won’t stop money flowing into RI products.

There is genuine consumer demand for these products and asset managers “have sunk a lot of marketing dollars” into launching new funds and rebranding hundreds of existing products, he says.

Greater disclosure requirements on green investments could also encourage further flows into RI funds, Khalaf adds.

The EU’s Sustainable Financial Disclosure regime has been quickly embraced by the industry, with 42% of European assets now classed as either Article 8 or 9 funds. And in the UK, the Financial Conduct Authority is currently consulting on its own green labelling regime.

“The widescale adoption of regulated ESG classifications in Europe suggests the endgame is likely to see the majority of funds incorporating some kind of ethical framework into their investment process, especially those offered by large investment houses,” says Khalaf.

“Rules governing how advisers integrate their clients’ ESG preferences are also heading down the track, which will encourage asset managers to add a responsible investment lens to even more funds.”

Moeller agrees advisers have become better educated on responsible investing in recent years and that will “percolate down to the client level”.

Growth area

As such, he thinks mixed-asset responsible mandates could be a growth area moving forward.

“You have seen a number of launches of product suites in the mixed-asset space which have a responsible mandate. They are increasingly popular as the financial adviser can satisfy risk profiles for clients in a straightforward way.”

He doesn’t expect the uncertain environment to put fund groups off from launching new RI products.

“There will be some fund groups that haven’t got their Article 8 funds done yet or haven’t got their mandate changes forward to shareholders and things like this. A little rotation out of RI funds probably gives them a bit of breathing space to catch up.”

Volatility represents a buying opportunity

For long term, sustainably minded investors, distressed prices for renewables may represent a good buying opportunity, says Caroline Shaw, a multi-asset portfolio manager at Fidelity.

BMO Gam does not have any sustainable funds in its multi-manager portfolios, but investment manager Scott Spencer says “the current volatility in the space is something we keep a close eye on” as the long-term structural drivers for the sector remain intact.

Merricks invests in alternative energy as a longer-term theme in his thematic funds, owning ETFs focused on clean energy and holdings in electric vehicles, clean water and climate change, as well as Vestas Wind Turbines – all of which, he notes, are down by more than 10% since last September.

His tactical holding in the S&P 500 Global Energy is up over 14% over the same period, by contrast.

“Not one of our investors has made any comment at all on the bit of the portfolio that has made money this year.”

Shaw, who manages a range of sustainable and thematic multi-asset funds, has investments spanning wind farms, solar assets, energy storage and social infrastructure.

She also owns stocks that specialise in the creation of energy efficient buildings, which she points out are responsible for 38% of greenhouse gas emissions.

Fidelity has publicly committed to halving the carbon footprint of its investment portfolios by 2030 and reaching net zero by 2050.

Polluter potential

But could commodity prices, which the World Bank now expects to stay at elevated levels through 2024, tempt investors to allocate more money toward the oil and gas giants and other harmful polluters?

Perhaps, Shaw says. However she believes that co-operation from these companies is necessary to achieve global net-zero targets. “This is a transition, and we cannot disconnect from the oil and gas companies overnight.

“We must continue to engage with them to push for improved renewable solutions and over time we will see an evolution. Not every company will survive but that is typical of all major technological and industrial shifts.”

Many green areas depend on ‘dirtier’ industries somewhere along the supply chain.

“Batteries require mining, wind farms require concrete, and there are exciting sustainability developments in these ‘dirtier’ activities that are crucial to our transition path to net zero,” Shaw says.

Ultimately, she thinks that the war in Ukraine will accelerate decarbonisation efforts with the adoption of alternative energy solutions.

“Governments are now pushing to speed up the transition to sustainable energy and there will be increased investment in renewables, to secure clean energy capacity.

“This theme is now front and centre as policymakers see an urgency in moving away from politically toxic Russian oil and gas.”

This article first appeared in the May edition of Portfolio Adviser Magazine