They’re already doing factory and warehouse work, and 20 of them even raced in a half marathon in Beijing last week. Humanoid robots are here, and soon they could be farming our food and looking after our elderly parents.

The US and China are vying to be the leaders in ‘embodied AI’, and start-ups and tech giants are investing huge sums in this area. But what is it, and what are the risks and opportunities for investors?

Embodied AI is when artificial intelligence is integrated into a physical entity such as humanoid robot. With AI powering the ‘brain’, the robot ‘body’ is able to perform complex tasks in the real world.

Agility Robotics has created a robot called Digit which can load and unload boxes and pallets to help fill the labour gap in logistics and manufacturing. Apptronik’s Apollo robot, designed for “friendly interaction” is also starting its career in manufacturing and warehouses, but the company plans to extend its use into construction, oil and gas, retail, home delivery and elder care.

Nvidia and Google DeepMind have both collaborated with Apptronik as big tech moves in on this exciting area of innovation. Meanwhile Tesla is developing a ‘Tesla Bot’ called Optimus, named after the Transformers character Optimus Prime, which, it says, will be able to perform “unsafe, repetitive or boring” tasks.

See also: Two-thirds of advice firms plan to invest more in AI

Until now, automation has been used primarily in highly specialised tasks such as industrial robots welding cars or assembling electronics, explained Rahul Bhushan (pictured left), managing director at ARK Invest Europe and global head of index at ARK Investment Management. These robots, though, aren’t suited to tasks that need human flexibility and versatility.

“Humanoid robots change the game. Designed explicitly for generalised tasks, these robots mimic the human form factor and versatility, enabling automation of jobs in environments built specifically for humans— from warehouses to restaurants, from hospitals to hotels,” he said.

“Current examples already emerging globally include Tesla’s Optimus, Sanctuary AI’s Phoenix, Figure AI’s Figure 02, and Boston Dynamics’ Atlas, each capable of performing increasingly sophisticated physical tasks across industries.”

Three reasons why humanoid robots are having their moment

Bhushan identified three reasons why humanoid robots are the next big area of technological development.

One is the recent breakthroughs in AI such as advanced large language models, vision recognition systems and neural networks “which now enable robots to understand, reason, and interact seamlessly with humans”.

The second is that components such as sensors and actuators (used for physical motion) are becoming cheaper, reducing cost barriers to development. Finally, huge global labour shortages are a driving force behind robot development.

“Countries globally face escalating labour shortages, particularly in developed markets,” said Bhushan. “Robots capable of general-purpose labour could fill these critical gaps, providing relief and efficiency at scale.”

He noted the US agricultural sector has seen a 32% decline in farm labour over the past two decades, while retail and small-scale manufacturing has also been hit hard by labour shortages. Humanoid robots could offer a cost-effective alternative for small companies, as they could be priced as low as £30,000 to £50,000, democratising access to robotics and helping smaller companies remain competitive.

Anjali Bastianpillai (pictured right), senior client portfolio manager for thematic equities at Pictet Asset Management, agreed that a recent leap in the capabilities of generative AI has shortened the R&D cycle for robotics. Data analysis, predictive capabilities, and virtual simulation have improved, all of which are crucial for the design and testing of humanoid robots, she said.

“GenAI has transformed how robots learn and interact with their environment by enabling them to observe and imitate human behaviours through natural language, imitation, and simulation,” she explained.

Humanoids may capture much of the spotlight, but they represent just one aspect of intelligent robotics. Broadly speaking, the concept of ’embodied’ technology encompasses any machine equipped with computational inference capabilities and cameras that gather visual data to navigate and interact with the physical world, she explained.

How investors can benefit from the robot revolution

So how can investors tap into this exciting area of the market? Holding Nvidia, Alphabet or Tesla will give you exposure to the robotics theme in the US, but it is harder to access China’s robot makers.

“The market is very small and nascent and with very few listed companies that produce humanoid robots at scale, including China where many newcomers in the unlisted space have emerged – 64 new companies in 2024,” said Bastianpillai.

“In the US, the main companies are Nvidia through its project GR00T (Generalist Robot 00 Technology), Tesla with its general purpose autonomous humanoid robot Optimus, and Figure AI, which is not listed.”

At Pictet, Bastianpillai is investing across the robot value chain, including semiconductor makers. She sees increasing demand for advanced logic and memory chips such as DRAM and NAND, which also have applications in growth areas advanced driver-assistance systems, autonomous vehicles and renewables.

“In our portfolio, we hold names that are essential enablers of humanoid robots including semiconductor design for chips that will act as the ‘brain’ of the robot, while analog semiconductors that may be used in the ‘body’ of these robots for power management or motor control as well as technologies that help robots sense, perceive and interpret their environment,” she said.

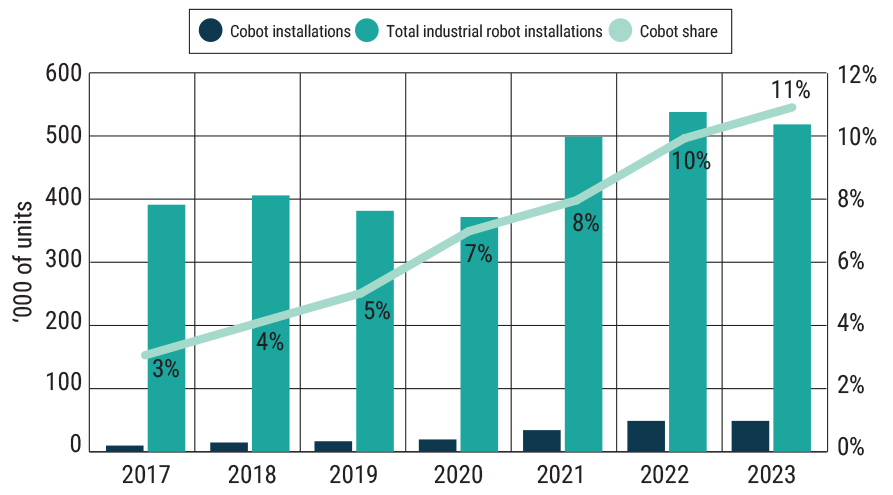

Pictet is also backing the ‘cobot’ or collaborative robot theme. Cobots are automative tools designed to work alongside humans, and built with safety in mind. Bastianpillai notes that investment in collaborative robots has been growing at six times the pace of investment in industrial robots (see graph below).

Cobots outpace industrial robots

“In general, we expect to see a continued high pace of capital formation and growing interest from some of the most well-resourced AI and technology firms to drive the physical AI theme across a range of verticals including autonomous vehicles, drones, humanoids, logistical and warehousing robots, autonomous systems and more,” she said.

How to assess value in an emerging sector

It can be tricky to assess value in a sector where profitability may be years away, so Bhushan looks for value driven by intellectual property and data accumulation.

“The real value in robotics lies in the data collected over time. As robots perform tasks, they generate data that feeds back into the central AI systems, making the robots smarter and more efficient. This means the companies that can gather the most comprehensive data early on will have a competitive advantage, as it allows them to continuously refine their robots,” he said.

ARK is also looking for companies that have formed strategic partnerships with larger firms, particularly in sectors such as manufacturing, logistics, and healthcare.

“The global robotics market is expected to grow at a CAGR of 25% from 2021 to 2028, indicating significant potential for those able to capture early market share. In short, assessing value in robotics involves a focus on innovation, first-mover advantage, and the ability to leverage data for continuous improvement.”

Four more robot-related investment themes from Pictet

- Automation: The reshoring trend is increasing investment in factory automation and industrial robotics, with growth in collaborative robots and humanoids benefiting the automotive sector. Improved IT budgets are supporting cloud migration and AI monetisation, transitioning from ‘proof of concept’ to large-scale deployment, with growth moving from generative AI to agentic and physical AI.

- Consumer & services applications: The industry is entering a period of multiple new product cycles, strengthening long-term competitive advantages.

- Reshoring trend: Initiatives like the US Chips Act, Stargate Project and many joint ventures are increasing supply chain resilience across industries and geographies.

- Electrification and digitalisation: Strong trends in electrification and digitalisation are evident in hyperscalers, software, semiconductors, ADAS/AD, and general content increase.