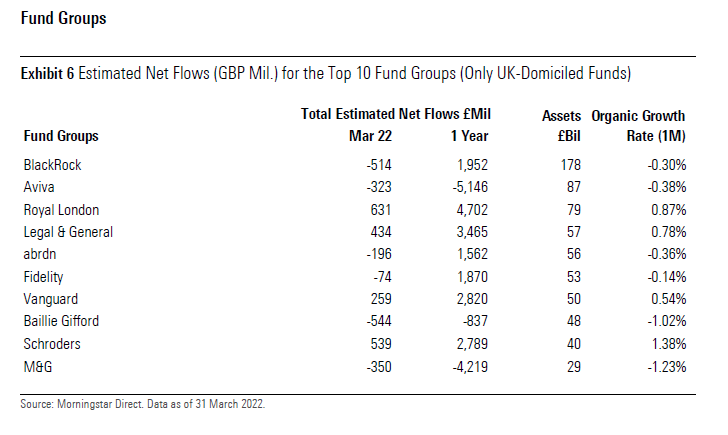

Royal London Asset Management (RLAM) and Schroders surged ahead of other peers for fund flows in March, which also saw investors experience a change of heart about the global equity income sector.

RLAM had the best month of the top 10 largest UK asset managers, recording a £631m net inflow, according to estimated net flows from Morningstar. This boosted assets to £79bn by the end of the month.

Schroders was close behind with £539m worth of subscriptions, bouncing back from a small net outflow of £24m in February.

Most of the UK’s largest fund groups reported redemptions during the period.

Morningstar said RLAM was buoyed by its stable of sustainable funds, including its Emerging Markets ESG Equity Leaders Tracker, which was one of the most popular in the global emerging markets sector.

Sustainable funds continued to drive the £1.96bn worth of client cash that flowed into UK open-ended funds, excluding money market funds, in March, Morningstar said.

This is consistent across the first quarter, with sustainable funds attracting £1.26bn in subscriptions, as non-sustainable funds haemorrhaged £1.12bn.

Baillie Gifford suffers fourth consecutive month of outflows

However, it was another poor month for Blackrock and Baillie Gifford, which saw investors yank over half a billion pounds each.

Blackrock’s ACS 50:50 Global Equity Tracker and European Dynamic funds were among those with the highest net outflows over the period (£822m and £383m respectively), contributing to £514m worth of redemptions.

However, its ACS World Low Carbon Equity Tracker and Natural Resources Growth & Income were among the month’s best sellers, with inflows of £675m and £410m.

Baillie Gifford’s £1.9bn European fund was one of the main culprits behind its £544m of redemptions.

The Edinburgh manager has now suffered four consecutive months of outflows – which last occurred in 2015 – as investors rotate away from expensive tech and growth stocks amid rising inflation and interest rates.

However, the scale of the outflows is considerably greater, with the fund group racking up £3.8bn in outflows in the four months to March 2022 compared to £250m over its worst streak in 2015.

See also: Baillie Gifford endures third month of redemptions as investors pull £1.2bn

Global equity income funds rebound

Elsewhere, Morningstar said global equity income funds saw their highest inflow in nearly nine years at £587m.

The research house said better performance and interest in several high-profile funds has whet investors appetite for the asset class.

Ironically Baillie Gifford’s Global Income Growth fund was one of the top sellers, attracting £169m, while the Fidelity Global Dividend fund brought in £395m.

Strategies from Troy, Evenlode and JP Morgan also piqued investors’ interest, Morningstar said.

Morningstar’s Sector Equity Ecology category was top of the charts, however, with an estimated £1.28bn in net inflows. Despite inflation jitters and lingering volatility from the war in Ukraine, GBP Diversified Bond and Global Emerging Markets were the next best performing categories, bringing in £990m and £640m.

On the other end of the spectrum, Sterling Corporate Bond was the worst selling sector, recording £774m worth of outflows, followed very closely by Europe ex-UK Equity with £771m in redemptions.