The received wisdom suggests that a global economic lockdown should strike fear into the hearts of investors, and send them scrabbling into safe assets to avoid the catastrophe that shall inevitably befall equities, writes Hugo Thompson, multi-asset investment specialist at HSBC Asset Management.

Interestingly, the reality of the Covid-19 pandemic was rather different.

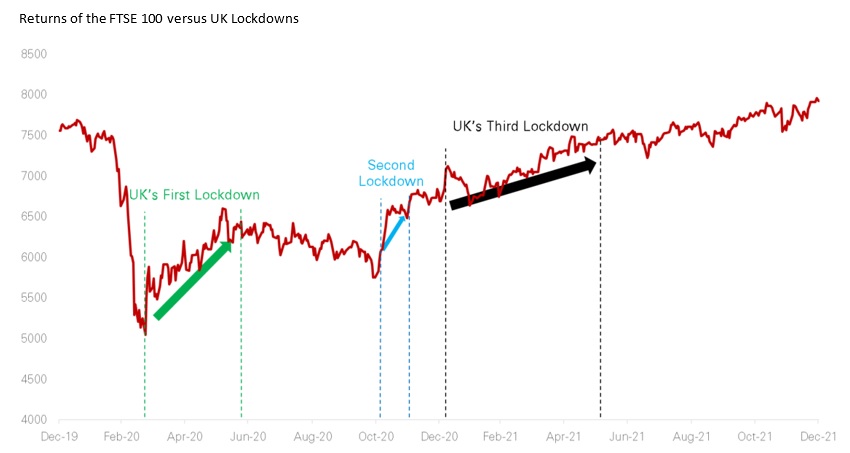

As the chart below demonstrates, markets bottomed on the announcement of lockdowns and then delivered very strong returns while the measures were in place. Market performance while the economy was open looked comparably anaemic.

Upon first seeing this chart I chalked it up to coincidence; another spurious correlation. But there are some compelling arguments for why the pandemic might benefit global capital markets. Below I examine four of them and consider what they mean for post-pandemic investing.

Opportunities for corporate expansion

Austrian-born political economist Joseph Schumpeter hypothesised that economic growth is a function of Creative Destruction; adversity clears away companies that operate ineffective or outdated business models, making room for better organisations to flourish.

For example, a well-capitalised organisation such as an international coffee chain is more than capable of surviving a few months of closed stores, or reduced footfall. Sadly, the same is not true for ‘Sam’s Morning Brew’ – my local coffee shop.

After the pandemic, the empty shopfront that was once Sam’s now represents an opportunity for the international coffee chain to expand market share, earnings and profitability. Seen through this lens, lockdowns are an opportunity for the large and mega-cap companies that comprise the vast majority of global markets and therefore investors portfolios.

Rising labour productivity

Resolving flat-lining labour productivity was the main objective for the leadership of most developed countries after the global financial crisis. In 2020, labour productivity finally spiked. Why?

The government’s imposition of home working reduced travel time, removed office distractions, and accommodated a wider variety of working styles. This led to a happier, more effective workforce.

Ironically, after the hundreds of policies that have tried and failed to improve labour force productivity over the past decade, it was keeping workers out of the office that finally worked.

Going forward, home working won’t be ubiquitous, but flexible working for white-collar workers probably will be. This will arguably be even better for productivity than compulsory home working, as it will allow each employee to choose a working configuration that suits them best. Improved productivity promotes economic growth and buoys market performance.

Improving inflation environment

The pandemic provided another previously illusive solution: finally lifting inflation towards its target level.

The high headline CPI figures printed on newspaper front pages might seem frightening in the context of the negligible inflation of recent history. However, the academic literature could not be clearer: low levels of inflation are suboptimal.

Consistent, predictable, and moderate price level rises are what create the ideal conditions for economic growth and, therefore, equity market performance. What’s more, inflation benefits a whole raft of other asset classes: property, securitised credit, infrastructure debt, commodities, and emerging market debt, to name a few.

The robust inflation precipitated by Covid-19 will therefore benefit investors with diversified multi-asset portfolios.

Bond market normalisation

In the years leading up to the pandemic unprecedentedly low central bank rates distorted government and corporate bond prices alike. Not to mention the impact of newly printed money flooding directly into capital markets. The pandemic seems to have initiated a return to normality.

Bond yields have started to rise – with 10-Year US Treasuries already 1.2% higher than their 2020 lows. As central banks make more and more noise about rate rises, this normalisation is likely to continue.

The return to a world of higher rates will cause some short-term pain in bond markets, but it will also allow for the proper functioning of the asset class. Bonds will return to performing two important and long forgone tasks; providing investors regular income and downside protection. Over the long run, this normalisation will be beneficial for capital markets.

In light of the above allow me to offer three key takeaways for investors.

One, if the pandemic does prove itself a force of creative destruction and labour force flexibility does increase as expected, the global economy could be significantly reshaped. Capitalising on these opportunities requires a global portfolio.

Two, if inflation does persist, investors should look to diversify into those asset classes that are most likely to benefit, simple bond and equity portfolios might struggle.

Three, the end of monetary stimulus suggests investors will have to work harder to find returns in bond markets, static portfolios are likely to suffer, active asset allocation is going to be key.

This article was written for Portfolio Adviser by Hugo Thompson, multi-asset investment specialist at HSBC Asset Management.