Fund buyers made investment trusts a larger part of portfolios for income and alternatives during the pandemic, but issues remain around liquidity and capacity making it highly unlikely they will completely usurp their open-ended counterparts.

Investment trusts have come into their own over the past year as the pandemic hit markets, particularly from an income perspective. Their ability to use revenue reserves to maintain dividends was evident when companies slashed or cancelled shareholder payouts.

The ability to access illiquid assets through a liquid structure has also been highlighted as one of investment trust’s biggest strengths a year on from the raft of open-ended property fund suspensions.

This was borne out in the increasing purchases of trusts on adviser platforms, which according to the Association of Investment Companies was £1bn in the 12 months to September 2020, compared with £960m in the previous 12 months and £964m in the year before that.

AIC communications director Annabel Brodie-Smith (pictured) says: “Their ability to draw on revenue reserves to support dividends understandably proved popular during the dividend drought, as did their ability to offer access to illiquid assets within a suitable structure.”

The trade body has found more than four-fifths (85%) of equity income-paying investment companies increased or maintained their dividends in 2020 despite the impact of the pandemic.

How have trusts compared with open-ended sisters during pandemic?

But while income has remained steadfast during the pandemic, what about returns? Portfolio Adviser looked at the performance of 10 equity investment trusts versus their open-ended sister mutual funds since the sell-off took hold on 20 February last year until 16 March 2021.

It found, based on FE Fundinfo data, that since the sell-off and throughout the pandemic, in six cases out of the 10 the mutual fund performed better (see table).

| Investment trusts and sister mutual funds | Return | Winner |

| Trust: Standard Life UK Smaller Companies Trust PLC | -5.72 | |

| Fund: ASI UK Smaller Companies Ret Platform 1 Acc | 1.68 | Fund |

| Trust: Baillie Gifford Monks Investment Trust PLC Ord 5P | 34.68 | Trust |

| Fund: Baillie Gifford Global Alpha Growth B Acc | 27.38 | |

| Trust: Baillie Gifford Keystone Positive Change Investment Trust plc ORD 10P TR | -12.06 | |

| Fund: Baillie Gifford Positive Change B Acc | 60.90 | Fund |

| Trust: Baillie Gifford Pacific Horizon Investment Trust PLC ORD 10P | 122.78 | Trust |

| Fund: Baillie Gifford Pacific B Acc TR | 63.10 | |

| Trust: Blackrock Income And Growth Investment Trust Plc Ord 1P | -9.79 | |

| Fund: Blackrock UK Income D Acc | -1.98 | Fund |

| Trust: Fidelity Special Values PLC TR | 0.22 | Trust |

| Fund: Fidelity Special Situations W Acc | -1.15 | |

| Trust: Finsbury Growth & Income Trust PLC Ord 25P | -4.83 | |

| Fund: LF Lindsell Train UK Equity Acc | -3.31 | Fund |

| Trust: Invesco Income Growth Trust plc TR | -6.19 | Trust |

| Fund: Invesco Income & Growth (UK) Z Acc TR | -9.83 | |

| Trust: Temple Bar Investment Trust PLC TR | -10.95 | |

| Fund: Ninety One UK Special Situations I Acc | -1.09 | Fund |

| Trust: Polar Capital Technology Trust PLC Ord 25p | 25.29 | |

| Fund: Polar Capital Global Technology I | 34.49 | Fund |

Share price total return for trusts, NAV total return for mutual funds 20 Feb ’20 to 16 Mar ’21. Source: FE Fundinfo |

||

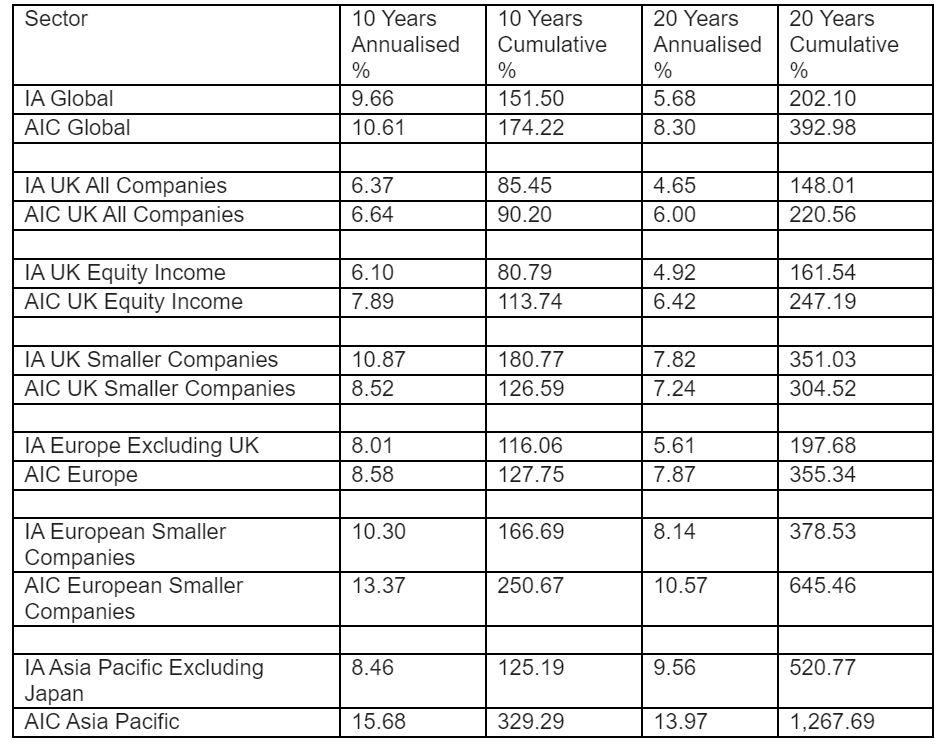

But over longer time periods, the merits of the trust structure are evident when it comes to performance, according to research from Interactive Investor. The platform provider found on average, investment trusts have outperformed funds in almost every major sector on an annualised basis over 10 and 20 years (see table below).

It found the average global investment trust has outperformed its fund equivalent by almost one percent (0.95%) a year over the last 10 years, and by 2.62% per year over the last 20 years.

The UK Equity Income sector has seen investment trusts outperform funds by an average of 1.79% per year over 10 years and 1.5% per year over 20 years.

Sector comparisons – investment trusts (AIC) versus funds (IA)

Source: Interactive Investor using Morningstar as at 31 Jan ’21. Total (NAV) returns for IA sectors and market (price) returns for AIC sectors.

Increasing use of trusts for illiquid assets

According to the AIC, UK Equity Income was one of the most purchased investment company sectors by advisers and wealth managers on platforms in the first three quarters of 2020, but so too were Property – UK Commercial and Infrastructure, demonstrating the strong demand for illiquid strategies.

Brodie-Smith says: “Investment companies’ closed-ended structure is ideal for holding illiquid assets and their stock exchange listing means investors can continue to buy and sell even during market stress, so it’s not surprising to see Property – UK Commercial among the most bought sectors last year, with intermediaries recognising these benefits.”

Tilney managing director Jason Hollands says there is anecdotal evidence that wealth managers have been increasingly using investment companies to access asset classes such as infrastructure, renewables, private equity, music royalties, leasing and property sub-sectors such as logistics.

“You just can’t access these asset classes through open-ended funds and most wealth managers don’t want to commit to locking their clients up in limited partnerships for several years,” he says.

AJ Bell has increased the use of investment trusts across portfolios, but head of active portfolios Ryan Hughes says it’s crucial the right structure is used for the right asset class.

“Over the last couple of years, issues in the open-ended market with Woodford and commercial property have highlight the importance of liquidity and how using the right structure for the right asset type is essential for portfolio construction and management.”

Trusts simply can’t handle large inflows

But Hollands does not see this as part of a major generalised shift away from open-ended funds into investment companies, or a trend as pronounced as the growth in use of exchange traded funds, because liquidity is a vital consideration.

“The median investment company – excluding VCTs – has a market cap of around £284m and over one in five closed-end funds have market caps of less than £100m, which will make them problematic to invest in for many larger discretionary managers, especially those with highly centralised investment processes.”

Fairview Investing investment consultant Gavin Haynes also flags the liquidity issue, especially when larger wealth managers get involved.

“The one factor that acts against increasing their prevalence is liquidity, which can make it difficult, particularly for larger wealth managers running models or limited buy lists to invest in trusts with smaller market capitalisations.

“Open ended funds still offer a simplicity of structure and wider choice across many investment areas than trusts, so will remain popular.”

Another factor holding back further adoption of trusts is their limited availability on investment platforms.

Hughes says: “Until all platforms offer full open architecture, giving advisers and investors the ability to use investments trusts wherever they manage their money, it will remain a challenge for investment trusts to full compete with their open-ended cousins.”