Investment professionals are optimistic markets will recover in H2, with those in the US expecting the S&P 500 to be down just 3.6% by the end of the year, but volatility and how it is handled remains a top concern in the meantime.

A survey by Natixis Investment Managers found more than half (51%) of advisers and other investment professionals, including wealth managers and broker/dealers, from across 16 countries expect markets to right themselves by the end of 2020 – and in fact deliver returns closer to those seen in 2018 than 2008.

According to FE Fundinfo, the S&P 500 delivered a total return of 0.96% in sterling terms in 2018 while the MSCI World returned -3%. Natixis figures put the return in 2008 for the two indexes at -37% and -40.3% respectively.

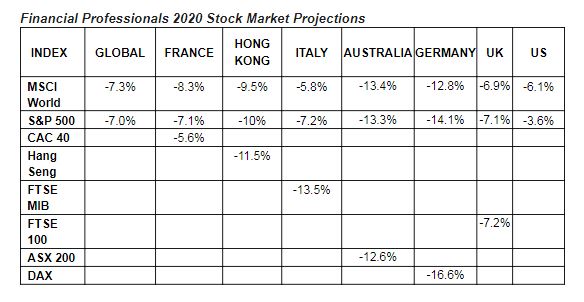

Despite losses of as much as 34% in the first few weeks of the coronavirus crisis, global investors are confident that the major stock indices will bounce back. US investors are the most bullish, not just in their own stock market but also the global index, the MSCI World, which they predict will end the year with a return of -6.1%. UK investors are the second-most confident, expecting a -7.1% return for the S&P 500, -6.9% for the MSCI World index and -7.2% in the FTSE 100.

But investors in Hong Kong, Australia, Italy and Germany all foresee double-digit losses for the year as volatility continues to spook confidence.

Two-thirds (69%) of professionals globally cited ongoing volatility as the top risk to portfolio performance followed closely by recession fears (67%). For UK respondents specifically, 78% said volatility was a top risk.

Natixis Investment Managers managing director, UK retail and wholesale sales, Darren Pilbeam says: “With economies slowly reopening, financial advisers around the world are bullish on recovery, but they are also focused on how to shield clients from the volatility they expect to come with it.”

Central banks stimulus stokes volatility

Commenting on recent volatility, Whitechurch Securities senior investment manager Simon Jaffe (pictured) notes equity markets bounced back strongly in Q2, driven by both fundamental factors and technical issues after investor sentiment was battered in March.

“At this point central banks stepped in to provide unheard of levels of support through huge bond buying programmes,” he says. “This then fed back into investors’ expectations around the shape of economic recovery but more importantly the extra liquidity acted as a support mechanism for risk assets. Higher prices then encouraged more buyers back into the market.”

Jaffe says this backdrop has made Whitechurch “relatively cautious” about the economic outlook globally in both the short and long term, but he recognises the sheer scale of the fiscal and monetary stimulus that policy makers have implemented.

“We believe there is a risk that short-term deflationary pressures are eventually replaced by reflation. It is for this reason that we have bought a position in the CG Absolute Return fund which has a spread of assets to reflect exactly this mix of risks including a significant holding in index-linked bonds, to hedge against future inflation.”

Escalating US/China tensions biggest risk for Psigma

Psigma Investment Management head of investment strategy Rory McPherson believes the obvious threat for the rest of the year is a second wave of the virus and/or collateral damage from the shutdowns making for a slow recovery. But he sees a bigger risk in a potential serious escalation in the US/China tensions as deadline day in the US elections looms.

According to the Natixis survey, almost half (47%) of respondents globally said uncertainty surrounding geopolitical events posed a risk to their portfolios, and this was even higher for UK investors at 60%.

With regard to volatility, McPherson thinks market choppiness is likely to remain in which case he expects gold to continue to perform well along with select areas of the credit markets.

He adds: “The intervention we’ve seen is generally much more credit friendly, ie it is aimed at shoring up companies’ balance sheets by restricting dividends and discouraging buy-backs.”

As such, Psigma’s portfolios are overweight credit, have a meaningful exposure to gold mining shares and are targeted within the equity allocation.

“Specifically, we are quite light on equities as we believe credit can do a lot of the heavy lifting, but we are then bar-belled between the high quality parts of the market, ie tech and healthcare stocks, and cheaper parts of the market such as UK equities that we think will benefit from a ‘reflation’ trade and an increase in risk-appetite.”

Iboss sees UK value stocks making a comeback

Like McPherson, Iboss managing and investment director Chris Metcalfe says a second or even a third wave of the virus will be headline grabbing, but he thinks markets will just demand more action from the Fed and other central banks.

“If they come up short, markets will sell off aggressively and continue doing so until such time as markets feel the central bank ‘put’ has been re-established,” he says. “The market participants know they cannot afford not to intervene.”

Iboss expects the relative rebound of value stocks in many parts of the world to continue, especially in the UK where the economic outlook has been dogged by Brexit talks and up until December last year, a weak government and ineffective opposition. “There is a lot of bad news priced into UK equity markets,” he says.

Metcalfe says the Iboss portfolios are overweight gold, treasuries/gilts and cash.

“We have tilted slightly more towards active managers outside of short-dated bonds where we see limited scope for active managers to outperform their passive peers net of fees,” he adds. “Our equity overweights are to the UK, emerging markets and Asia. Our fixed income remains tilted to the shorter dated bonds and our managers collectively holding their highest quality credits.”