Hold tight, we’re about to embark on a commodities supercycle – like a cycle, but … more super. That, at least, is the call from many in the market, with the highest profile proponent being Goldman Sachs, which has suggested this is a structural bull market that could last up to 10 years – an investment cycle akin to what we saw coming out of China in the 2000s.

For his part, over at Bloomberg, John Authers has even blown the dust off Kondratieff Wave theory to describe the phenomenon, implying a very long run for the cycle – Kondratieff Waves run over multiple decades – bestriding numerous ‘normal’ business cycles.

He argues equity and commodity cycles tend to be inversely correlated, as “more expensive materials eat into corporate profits, push up inflation and divert resources that might otherwise have been spent on something more productive, or on equities.” He adds: “That implies worrying things for the equity market… When denominated in terms of raw materials prices, the S&P 500 has never looked more expensive. A reversal looks like a real risk.”

Not, then, an unambiguously good thing. However, I’m sceptical as to whether it is an ‘either-or’ scenario – especially in this environment, where the combination of cheap money and fiscal largesse could conceivably push both equities and commodities up. Or, given the many fragilities of the global economy, it could also be ‘neither-neither’.

No one loves a doom-merchant, however, so let’s move swiftly on and instead have a look at the case for the supercycle.

What’s powering the cycle?

There are a few factors tipped to support this development. First is the post-pandemic recovery, as pent-up consumer demand explodes, and we all jump on board flights and behind the wheels of our cars again and reacquaint ourselves with the joys of long-distance travel.

That is certainly having an effect. Published in April, the World Bank’s predictions for the oil price – forecasting an average of $56/barrel in 2021 before rising to $60 in 2022 – are already starting to look out of date, as prices climb above $65.

Riding this wave, equity sector energy funds have delivered more than 12% between the start of the year and the end of April. The second-best performer, Schroder ISF Global Energy S Dis GBP AV, has more than 90% exposure to oil and gas (the top performer, returning 35%, is Geiger Counter Ltd, an investment trust specialising in uranium. Clearly, Uranium Rocks).

That alone is unlikely to be the makings of a cycle, and certainly not a super one – it is a mean reversion in the wake of global economies being shut down in 2020 because of Covid-19. The commodities case has more to it than these shorter-term effects.

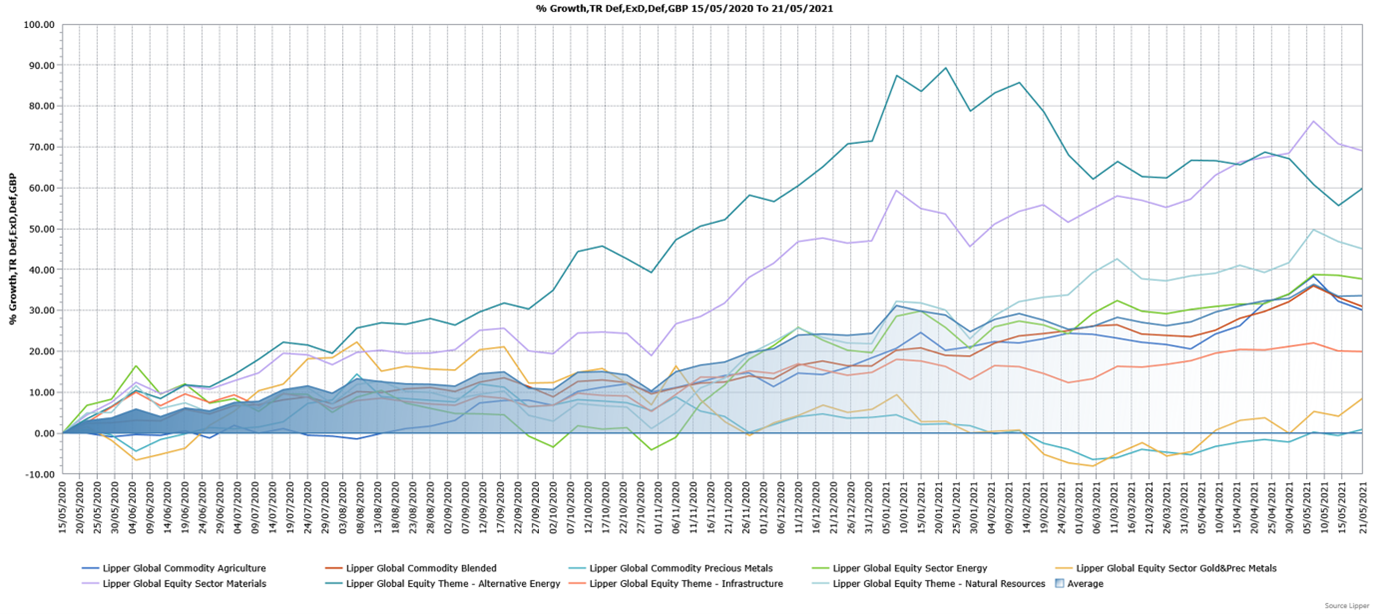

Chart 1: Commodity-exposed Lipper Global Classification performance from 2006

Source: Refinitiv Lipper, to 30/04/21

Longer-term drivers are not unrelated to Covid-19, the commodity bulls argue – for instance, government responses to the pandemic, such as US president Joe Biden’s stimulus package, should boost consumption, particularly for lower earners, and therefore increase demand for commodities.

Then there is the predicted effects of the transition to a sustainable economy, such as the EU’s Green Deal, shifting capital expenditure from oil and gas towards renewables, thus increasing metal demand. This is not nationally specific, like the China-driven commodity bull market of the early 21st century, but a global phenomenon. Even without this longer-term impetus, the World Bank forecasts a metal price rise of nearly 30% in 2021 before dropping back in 2022 as stimulus-driven growth eases and supply constraints are resolved.

Goldman Sachs predicts such developments will be supported by a strong macro tailwind as a weakening dollar pushes commodities higher, which further weakens the dollar, creating a feedback loop. Incidentally, if this looks like a recipe for inflation, then that strengthens the case for gold and silver – traditional inflationary hedges.

Pedal to the metal?

How is this being reflected in fund allocations and performance? And are investors – literally – buying the commodity supercycle? Here at Refinitiv Lipper, we analysed the performance of relevant sectors to see what is performing, what is not and where the money is going. As we have illustrated in recent reports on UK fund flows, investors have yet to jump on board the case for commodities to any significant degree. When we look at the sub-sectors, however, a more nuanced picture emerges.

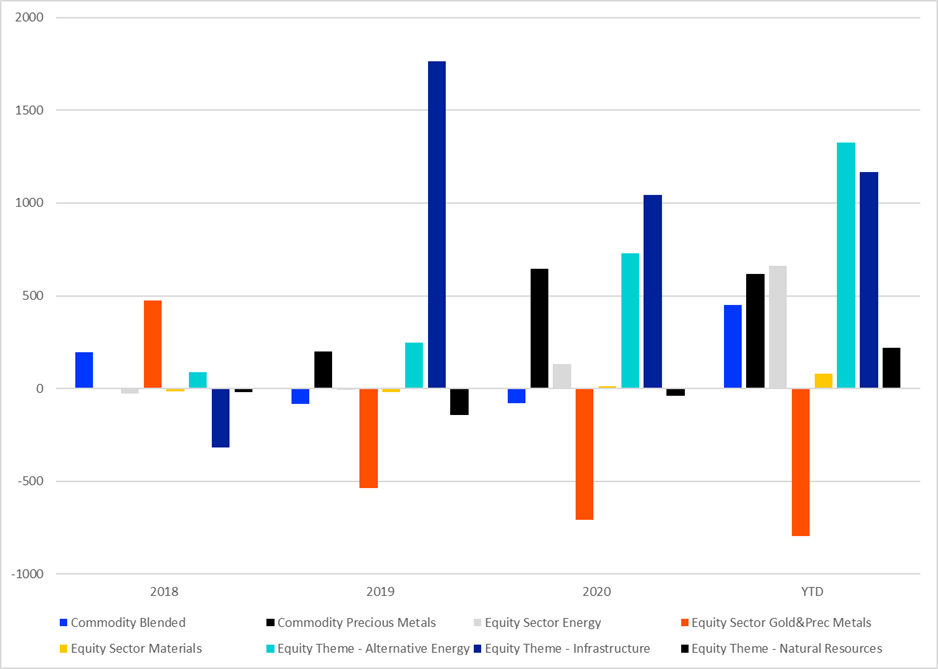

The first thing to note is that investors do not seem to be convinced of the case for gold. Even the volatility of last year did not see them flock to ‘the ultimate safe haven’ while, over the year to date, equity sector gold and precious metals has seen the only outflows (-£794m).

On the other hand, reflecting the surge in oil prices, equity sector energy netted more money in the first four months of 2021 than it has in any full year since before the global financial crisis, while equity theme – natural resources is seeing its first positive year since 2016, albeit modestly (£219m so far).

The major money takers, however, are equity theme – alternative energy and equity theme – infrastructure. Alternative energy has grown steadily over the past few years, to take £1.33bn so far this year. By way of comparison, last year took a total of £729m, so this is a real gear change for the classification if sustained.

The largest money taker so far this year has been sector veteran Impax Environmental Markets fund (£595m), followed by Guinness Sustainable Energy (£174m). The largest infra money takers so far this year have been FP Foresight Global Real Infrastructure (£466m) and Atlas Gl Infra Ucits Icav Srs B GBP Unhedged (Inc) (£382m).

Chart 2: Commodity-exposed Lipper Global Classification fund flows, year to date (£m)

Source: Refinitiv Lipper, to 30/04/21

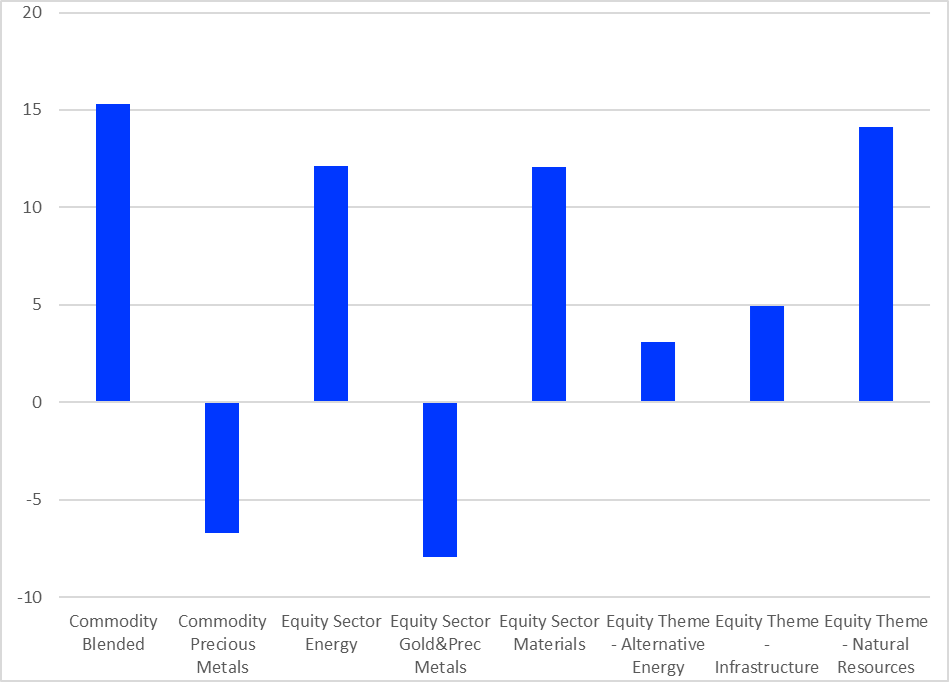

Flows and performance have not moved in lockstep, however. As Chart 3 shows, the top-performing Lipper global classification is commodity blended, which has lagged in terms of asset gathering. The top-performing vehicle here year to date (24.9%) is the Vontobel Fund – Commodity G GBP. The equity sector materials top performer, BGF World Mining D2 GBP Hedged (18.5%), has attracted £9m.

Chart 3: Year-to-date returns by Lipper Global Classification (%)

Source: Refinitiv Lipper, to 30/04/21

Some commodity-exposed sectors are seeing a growth in popularity—not least, as we have seen, alternative energy and infrastructure. The former is certainly due to the growing importance of environmental, social and governance considerations, while the income stream infrastructure provides is attractive in a low-yield world.

Whether or not these themes can build momentum to generate a commodities supercycle is not something I would bet the farm on – especially given muted flows into agricultural commodities – but the case for them was well established before anyone thought to revamp the concept.

Nobody should be thinking of taking back the punchbowl, supercycle or not. The combined flows of the classifications we have analysed in the first four months of the year total £3.73bn. The most popular Lipper global classification in April, equity global, took £2.32bn in that month alone. That would suggest there is still slack in this market, supercycle or not.

Dewi John is head of research, UK and Ireland at Refinitiv Lipper