The big success story of late has been global equities. The Refinitiv Lipper classification Equity Global has raked in £16.9bn from UK investors over the 12 months to the end of March. That is heavily loaded towards the back end, with £5.5bn in the last quarter of 2020 and £6.5bn in the first quarter of 2021.

Global equities’ popularity is not simply a facet of the broader asset class. Asset allocators and academics have long mourned investors’ home bias to the detriment of optimising risk-adjusted returns. That is certainly not the case now, as Equity UK has shed £1.8bn over the past year – losing £2.2bn in the first quarter of 2021 alone – despite the rally in the shares of UK PLC.

Rising tide

This rising tide does not, however, float all boats to the same degree. Almost half of the money over the year has gone to just four funds: ACS Climate Transition World Equity, HSBC Developed World Sustainable Equity Index, Baillie Gifford Positive Change, and ACS World Low Carbon EQ Tracker. Two are actively managed, two are passive, but the notable connection is all four are badged as ethical.

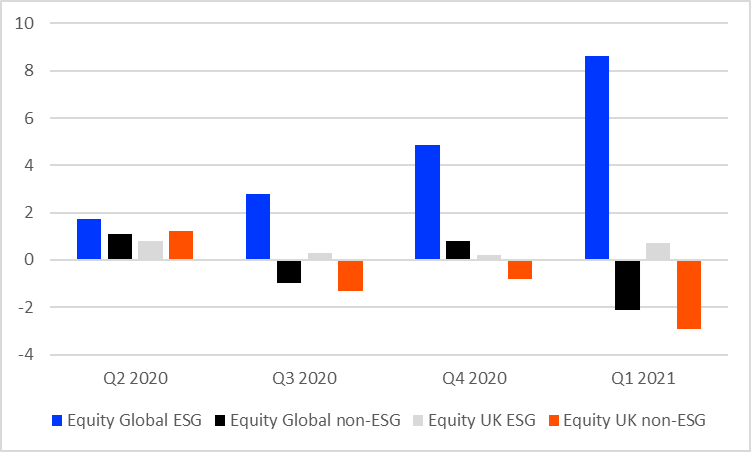

Is, then, this trend to global equities while shunning their UK peers largely down to environmental, social and governance (ESG) considerations? The following chart would suggest so – remember, the new economy behemoths attracting much of the ethical cash these days are to be found overseas, with the UK equity market having a bias towards financials, and oils and miners.

Equity classification flows over 12 months: ESG v non-ESG (£bn)

Source: Refinitiv Lipper, all data to 31/03/21

Of the four funds mentioned above, Baillie Gifford Positive Change has the most concentrated portfolio, with the 10 largest holdings accounting for half of its assets. The other three are far more diversified. Those concentrated bets have come good over past year and the Baillie Gifford fund has returned 79% against an average of less than half that for the classification.

That, however, looks modest when compared with the classification’s top returner over 12 months – Schroder ISF Global Energy Transition, which delivered 126.7%. More than 60% of this fund is in industrials and utilities, so it is clearly doing something more than having a low-carbon footprint by staying safely in IT and consumer discretionary stocks.

The next best performer, the L&G Battery Value-Chain UCITS ETF, returning 119.2%, is also – as the name suggests – a rather specific theme. Investors have not followed the money so far, with the former netting £81m, although L&G Battery-Chain has done rather better, attracting £331m.

This trend to ESG proves to be more than a statistical anomaly among the top money-takers, as ethical funds took £17.8bn over the year, while ‘conventional’ global funds lost £883m – as you can see broken down by quarter in the chart above.

Not-so green bonds

These ESG flows are still largely an equity phenomenon. Turning to the classification’s fixed-income equivalent, Bond Global GBP, the respective 12-month flows are £214m and £3.3bn. Whether this is a result of fewer ESG bond products, or a performance issue, is not clear. Average returns are 5% for ESG global bonds and 8% for their conventional peers, while the figures for equities were 38.9% versus 36.8, respectively.

There is also the question as to whether the outperformance of ESG equity funds will persist in this environment, with value having rallied since November 2020. ESG stocks tend to be more of a growth play, and many high-profile stocks such as Tesla have shed value over the first quarter of this year.

Selected Global Equity Ethical Performance over the Past Two Quarters (%)

| 3 month | 6 month | |

| MSCI World TR | 4.1 | 12.3 |

| L&G Battery Value-Chain UCITS ETF GBP | 6.9 | 48.4 |

| Schroder ISF Global Energy Transition E Acc GBP Hgd | 1.6 | 43.2 |

| Baillie Gifford Positive Change B Acc | -1.9 | 12.9 |

| ACS Climate Transition Wld Eqty X1 Acc GBP | 4.1 | 12.3 |

Source: Refinitiv Lipper, as of 31/03/21

Nevertheless, as the above table shows, the heavily diversified ACS Climate Transition World Equity has performed in lockstep with the MSCI World over three and six months. And while the Schroder and Baillie Gifford funds have underperformed over three months, the L&G Battery Value-Chain ETF is ahead year to date. This, however, has a less growth-oriented portfolio.

Which raises an interesting point: a significant degree of ESG outperformance has come from avoiding oils and miners and exposure to tech, not least big tech. As the shine comes off the FAANGS – however temporarily –could this open the way for more focused ‘darker green’ ethical funds to take the lead in the ESG space, where performance is less driven by low-carbon big tech?

Shades of green

It will be interesting to see when the dust settles on the EU’s recently introduced Sustainable Finance Disclosure Regulation and how many funds opt for Article 8 or Article 9 status – effectively light or dark green, respectively. While the UK has yet to determine the shape of its ESG regulatory offering, it will likely not look too different – though hopefully incorporating lessons learned from the European experience.

As the demarcations become clearer, will we see a migration from light to dark green – as investors become more demanding and more inclined to see the more tangible impacts offered by the dark green Article 9-classified funds. Or will light green suffice?

Dewi John is head of research, UK & Ireland at Refinitiv Lipper