The Rathbone Greenbank Global Sustainability Fund recently celebrated its three-year anniversary, outperforming both its sector and benchmark over that time. Lead manager David Harrison says the secret has been sticking to a bottom-up process with a focus on quality businesses that tick all the boxes from a sustainability perspective.

Between inception on 18 July 2018 and 1 September 2021, the fund returned 68% on a total return basis compared with the IA Global sector average of 44%, according to FE Fundinfo. The overall aim, however, is to deliver a total return greater than the FTSE World Index, after fees, over any five-year period. Since the fund’s launch, the benchmark has returned 48%.

“The three-year benchmark we’ve just gone through is really important because it shows what we’ve done in terms of performance, and it shows we’ve generated good performance in a very volatile time,” says Harrison.

Harrison believes the focus on quality has aided performance while the investment process enables the team to identify under-the-radar businesses, or “hidden gems”, that tend to be more interesting, more sustainable and ultimately winners.

“The focus on quality is really important, and even more so than three years ago, given we’re seeing more greenwashing come into the market, as well as more companies and more capital flowing into the space,” says Harrison.

To make it into the fund, a company needs to tick three boxes. First, it must be a fundamentally good business; second, it has to be tangibly providing a solution that is sustainable; and finally, it has to be open to engagement even before it is in the portfolio.

The team has a universe of about 3,000 companies to sift through and Harrison says a lot of them fail to meet the quality metric, but an increasing number are open to engaging around sustainability. Plus, a growing number are supporting the UN Sustainable Development Goals (SDGs), which is a key tenet of the investment process.

Virtual benefit

According to Harrison, the team meets more than 300 management teams a year, a process that has become easier in the past 18 months because of the switch to virtual communication.

The £94m fund has a negative screen at the start of the process which eliminates companies in certain sectors, but if they progress beyond that then they must gain the approval of Rathbone Greenbank Investments, the dedicated ethical, sustainable and impact investment unit of Rathbones.

Greenbank feeds Harrison and the team with independent analysis into the sustainability credentials of the companies and is the final judge on whether an investment makes the cut and is added into the portfolio; it also monitors holdings for their ongoing suitability.

Using the 17 SDGs as a starting point, Greenbank has mapped these goals to a set of eight sustainable development themes and underlying sub-themes. Harrison and the team seek to invest in alignment with these themes. But Harrison says just paying lip service to the SDGs isn’t enough for a company to pass muster.

“If you look at an annual report, they can have 15 SDGs listed but they’re making really tenuous links to their business. That happens a lot,” he says. “We often prefer they choose two or three, and they can explain it to you.”

He adds fewer than 50% of companies actually get through from the start of the process to the end, but having Greenbank’s added layer of scrutiny gives a better understanding of companies and information for revisiting ideas down the line.

“Even if something fails, it goes into our database,” Harrison says. “We’ve had companies that failed maybe two or three years ago, but then there’s an improvement around transparency, disclosure, or the business changes. Having that audit trail has been really powerful.”

Companies often fall short when they can’t demonstrate they are providing a tangible sustainability solution. “Again, that’s the benefit of Greenbank, because sometimes the MSCI data misses things. The additional work they do around looking at supply chains or going to other sources of information often reveals issues that have not been picked up.”

The fund has performed well since lockdowns were introduced, with a total return of 85.4% since 16 March 2020 until the time of writing, compared with the FTSE World’s 68.9% and the IA Global’s 65.3%. But how has Harrison seen the perception of ESG changing during the pandemic?

“Three years ago it felt like a lot of people were starting to think about ESG from the client base, but we’ve seen a big change in the perception of ESG investing and I think a lot of that is down to the performance, as well as what we’ve gone through over the past 18 months.”

He says the pandemic has shown investors two things about companies: first, that they can provide real clarity around the social factor of ESG, which is how they are treating their people and the wider community and supply chains. Second, a lot of companies in this space have a story to tell, for example about electric vehicles, a sector that is starting from a low base but has multiple years of growth ahead of it.

“At a time when you’ve got huge financial stress in the world, these companies have a genuine positive story to tell,” he says.

Top-down stimulus

The other factor emerging from the pandemic has been the huge amount of top-down stimulus in sustainability in terms of UK green infrastructure and the ‘build back better’ mantra, which is targeting the journey to net-zero. Harrison says the green infrastructure push is throwing up lots of opportunities for the fund as renewable energy uptake increases and the efficiency of buildings and water infrastructure improves.

But the digital acceleration of industry is probably one of the biggest trends Harrison is seeing as a driver of opportunities. There is a digitalisation of how a normal business will work, in terms of everything from its supply chain, how it thinks about its software spend and business practices.

He says a lot of companies have boosted investment in new business practices and digitalisation during the pandemic in order to cater for remote working. He thinks the move to homeworking has potential benefits for productivity, living standards and the environment.

“Closed businesses had to shovel money into technology to ensure they could operate remotely and to ensure they could sell online,” he says. “Arguably, many companies were very slow in embracing the digital age, but the pandemic suddenly made it an imperative.”

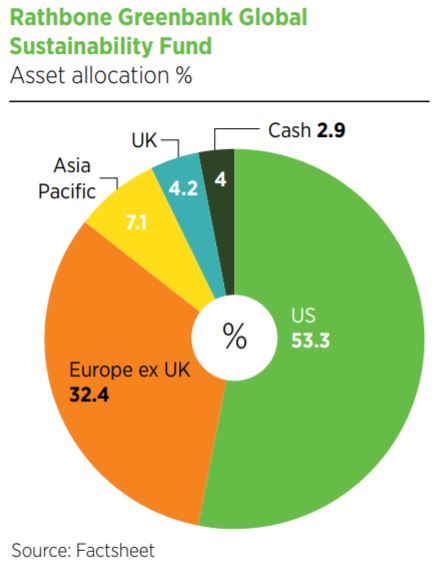

About half the portfolio’s 45 holdings are US companies, and Harrison believes the US has undergone the biggest change in terms of ESG and sustainability.

“When you get slightly below the radar, we are finding a lot of hidden gems there.” He highlights Aptiv, which produces the “nerve centre of electric vehicles”, for a range of manufacturers from BMW to Hyundai. Then there’s Littelfuse, a Chicago-based producer of control chips and technologies for electric vehicles as well as renewable energy sources.

Europe represents over 30% of the portfolio and Harrison says the region is under-researched, which offers the chance to find winners. The team likes Swedish lock and entry system maker Assa Abloy, a leader in its field in the US market.

Harrison says finding Asia stocks has been a struggle because of transparency issues, but this is changing. Japanese small motor manufacturer Nidec is a portfolio holding.

The US is where the team has seen the biggest step change in terms of transparency and engagement. “They’re providing the data we need, it might be social or environmental factors – they have adopted that really well. Asia is still getting there.”

As well as a focus on green infrastructure and digitalisation, the team anticipates more activity in the circular economy cluster of the portfolio. This includes Shopify, which allows small businesses to trade using its online e-commerce platform.

Among recent additions to the portfolio is Evoqua Water Technologies, which treats water and wastewater for local authorities and companies predominantly in North America. Another is American plastic pipe manufacturer Advanced Drainage Systems, which stands to benefit from increasing demand for underground infrastructure related to new homes.

But Harrison is keen to stress that while momentum is gathering, we are still at the start of this journey. “It’s been a really strong 18 months, and we’ve had very strong performance in the sector and in the fund. But if you look at some of the metrics like in electric vehicles, for example, penetration is only about 5%, or well below 5% in an area like the US.

“You’ve got an early glimpse of what of what’s going to happen but we’re only just at the start of that pivot.”

This article first appeared in the September 2021 issue of Portfolio Adviser