“Productivity isn’t everything,” the Nobel prize-winning economist Paul Krugman has observed. “But in the long run it is almost everything”. To put it another way, the amount produced per person employed is the key to longer-term economic growth.

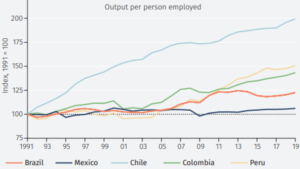

In this respect, there are important differences between Latin American economies. As the following graph illustrates, in the largest economies of Mexico and Brazil, productivity growth since 1991 has been quite weak, running at annualised rates of 0.2% and 0.7%, respectively.

Productivity trends in Latin America

Source: International Labour Organization. Data as at 01/10/19

Over that period, Chile has been the stand-out success story, with annual average productivity growth of 2.2%. That success was due, initially, to Chile’s adoption of free market economic and market reforms; and more recently to sustainable fiscal and sound monetary policies.

That begs the question as to how the economies in the middle of this productivity ranking – the likes of Peru and Colombia – are likely to fare? Can they emulate Chile’s success?

Peru – fiscal discipline

In Peru, the signs are encouraging. The country’s macroeconomic stability over the last 20 years has been the result of the implementation of orthodox economic policies and adherence to fiscal discipline.

GDP growth in the country has outperformed the average for Latin America over the last 10 years and is projected to reach 3.7% and 4.1% in 2019 and 2020 respectively. Recent economic growth has been driven by strong domestic demand and gross capital formation.

The unemployment rate in the country, currently at 6.6%, is below the average of the region, which is closer to 8%. With inflation under control at 1.3%, real wage growth will provide a boost to private consumption, which is estimated to grow by 3.4% in 2019. Earlier in the year Peru’s central bank cut interest rates by 25 basis points to 2.50%, taking advantage of a benign inflation environment.

On fiscal policy, Peru’s budget deficit has deteriorated in recent years due to low revenue collection and a continuous increase in expenditures aimed at supporting economic growth in the country. The adherence to a fiscal rule since January 2000 has, however, enabled the country to engage in countercyclical fiscal policies that have contributed to a smoothing of the economic cycle during years of weak commodity prices.

Colombia – encouraging progress

Colombia has had less success than Peru in bringing inflation and interest rates down but has still made encouraging progress. Inflation remains slightly above the central bank’s target of 3%. This has mostly been attributed to supply shocks that affected food and tradable goods prices. Interest rates have remained stable at 4.25% and the central bank has recently kept interest rates unchanged, highlighting the need to keep inflation close to its central target.

Colombia, alongside most of the Latin American smaller economies, has followed a strategy of opening its economy to the world by creating appropriate institutional conditions for investors and a competitive tax framework. The country aims to reduce its fiscal deficit to 2.4% of GDP in 2019 and 1.5% in 2022, in line with its fiscal targets.

The Colombian economy is expected to grow by 3.2% in 2019 and to pick up further in 2020, according to projections from the central bank. This reflects contributions from stronger domestic consumption and investment in machinery, equipment and infrastructure.

On balance, these two economies are in a good position to see sustainable growth, coupled with sound economic policies, over the medium term.

Daniel Murray is global head of research at EFG Asset Management