Technology adoption is rapidly becoming a key differentiator for wealth management firms in a lockdown working environment where digital communication and portfolio management are taking centre stage.

A survey conducted by Dunstan Thomas during the first three weeks of June found 69% of the wealth managers, discretionary fund managers, banks and platform providers think digital engagement with clients will be accelerated because of the coronavirus outbreak.

It said this trend is likely to be exacerbated by the experience of client portfolios throughout the sell-off. According to the survey, the average portfolio fell 12.5% between mid-February, as news of the Covid-19 outbreak in Wuhan began, and mid-June.

Plummeting portfolios highlight need for speedy technology

Dunstan Thomas chief innovation officer Andrew Martin told Portfolio Adviser at a time when clients most needed advice and guidance, a lot of companies were constrained by the level of true personal advice they could give because their IT infrastructure was not up to scratch.

“We heard stories of companies where call centres were out of action, effectively for two to four weeks, when they were just scrapping around getting solutions in place and buying and installing software,” says Martin.

“That shines a light on automation being much quicker,” he adds. “As long portfolios are ready on the back of proper risk profiling and objective setting, you’re able to respond to these kinds of things from a customer need perspective.”

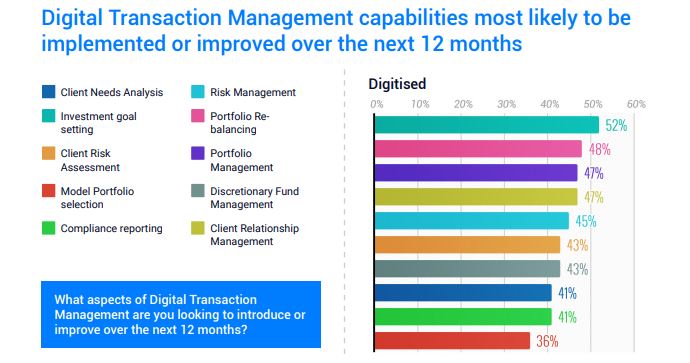

In terms of specific areas of digitsation over the next 12 months, the survey found more than half (52%) of firms said risk management, 48% said portfolio rebalancing and 47% said portfolio management.

Source: Dunstan Thomas

Nextwealth chief executive Heather Hopkins (pictured) says lockdown has taught financial advisers and wealth managers that tech is essential to a slick operation. “Use of clients portals, digital signatures and the like are through the roof,” she says. “These changes will be lasting.”

The move to digital signatures

But the industry has still not managed to replace trust building through initial face-to-face meetings, she adds.

A Nextwealth report from earlier this year found only 5% of advisers reported having a digital advice offering, either in-house or outsourced, while 79% said they did not have one, with 11% considering it.

Martin highlights a need to strip paper out of the industry, particularly in the wealth management sector which has a legacy of face-to-face relationships and wet signatures.

“Platforms were born out of technologies so they’ve all been about technology whereas asset managers have grown up around paper and face-to-face contact and that personal service,” he says.

The survey found more than a fifth of investment advisory firms struggling with enabling fully-digital end-to-end onboarding processes. The top three challenges associated with this were enabling digital signature acceptance, making new business applications paperless and obtaining consent to access bank accounts via plug-ins.

In terms of digital signatures, 38% of firms said they already do it and don’t feel it needs improving, 38% said they already do it but plan to improve it, and 22% said they plan to introduce it.

Hopkins says from her experience only about half of financial advisers use digital signatures, but that is changing.

“I’d expect that number to rise dramatically as more providers support acceptance of digital signatures,” she adds. “Financial advisers often have a pretty slick client proposition but things fall apart when providers get involved. The industry needs to do more to improve the user experience of back office systems in particular.”

Digitisation can also drive down costs, Martin adds. “Obviously, if you’re trying to onboard and service your customers much cheaper than you currently are, 200 basis points is probably too much, especially in a low-return environment.

“So we obviously see digitisation and technology as a real enabler to start to drive costs down, especially for small and medium wealth businesses.”

Self-directed investing set to flourish but not take over

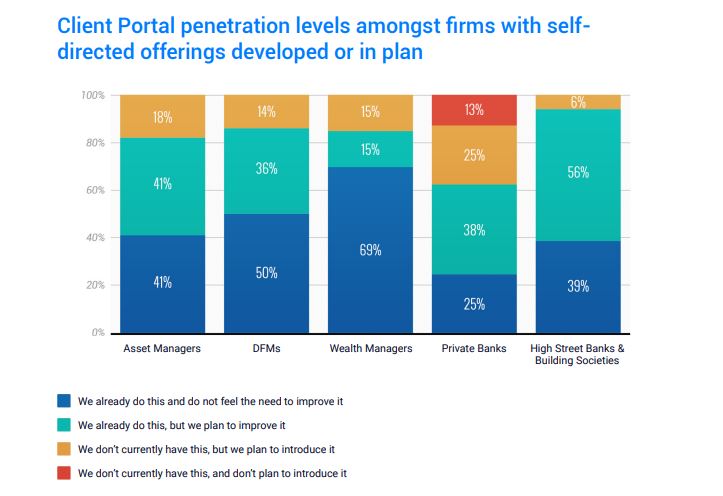

Another trend highlighted was a move towards self-directed investment offerings over the next 12 months. According to the survey, 38% of the investment advisory firms are planning to roll out a self-directed investment platform within the next 12 months while 41% already have one in place.

Of those that already have one, 39% are looking to improve their client or adviser dashboards during the next 12 months.

Source: Dunstan Thomas

But the industry is unlikely to move to a fully digital process, argues Hopkins who expects a hybrid model to evolve “allowing humans do what we do best and machines do what they do best”.

“Humans are better at behavioural coaching, helping people to manage emotions and helping people to articulate their financial goals and values,” she says. “Machines are better at crunching massive data sets. Both are needed for proper holistic financial planning.

“I think there will be progress to better guided solutions but that the demand for quality financial advice will continue to rise. Life’s complicated and you only get one shot at it.”

See also: Brooks Macdonald teases tech partnership as it unveils new strategy