UK equity funds recorded their fifth consecutive month of outflows in October as surging Covid-19 cases and renewed Brexit uncertainty tainted investor sentiment.

Calastone figures revealed £358m flowed out of UK equities during October, marking the fourth-worst month on record for the asset class.

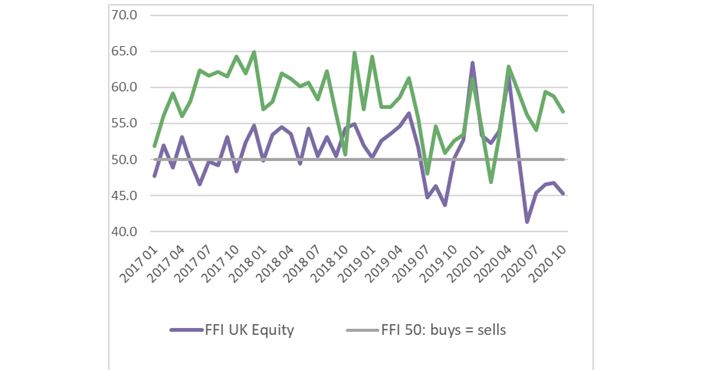

The data provider’s UK equity fund flows index, which tracks sell orders against buy orders, with a reading of 50 indicating parity between new money and redemptions, fell to 45.2 – one of its worst-ever readings.

Calastone UK equity fund flows index

Source: Calastone

Calastone head of global markets Edward Glyn said: “Investors voted with their feet in October, both as they anticipated the second round of lockdowns being imposed across England and Wales and watched as Brexit brinkmanship from the EU and the UK dramatically increased the risk of a no-deal crash out when the UK’s departure transition period ends this year.”

The data provider found income funds, which are disproportionately invested in UK equities, suffered a worse fate during the month as £763m left the sector. The FFI for equity income plummeted to 34.6, indicating sell orders roughly doubled the value of buys.

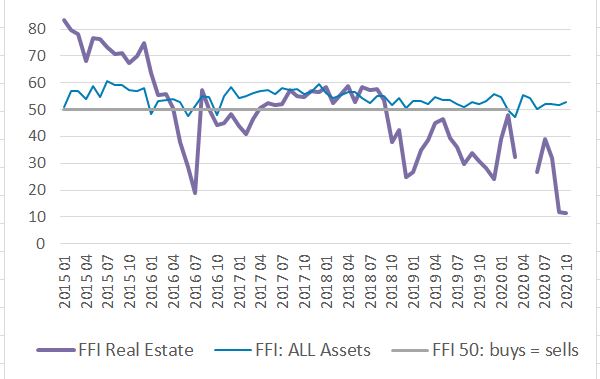

Property funds suffered their third-worst month on record, with £336m outflows, as investors took their cash after the recent Covid-induced raft of suspensions started to lift.

Calastone real estate and all assets fund flows index

Source: Calastone

See also: £5bn worth of UK property funds remain suspended despite clarity on valuations

European equity funds saw £69m of outflows in October.

Winners during the month were ESG and index funds. The former received £542m compared with £625m of outflows for non-ESG funds, while equity index fund inflows brought in £378m compared with a £460m outflow from active funds overall.

Elsewhere, ESG bonds welcomed a £125m inflow helping push overall bond flows to £716m, marking the best month since November last year.

Glyn added: “The fact that UK-focused funds are suffering so much more than their European counterparts, despite the pandemic inflicting lockdowns equally severe in many parts of the continent, suggests that investors view the double whammy of Covid-19 and Brexit as uniquely damaging for Britain.

“Global markets have been nervy in the last couple of weeks as concerns over the global economy have grown, but investors have not shown the same fear they did in March at the resurgent pandemic.”