A growing feeling that the industry is reaching ‘peak ESG’ has prompted calls that the opposite trade, in beaten-up ‘vice’ stocks, is poised to outperform this year even as value continues to trail growth.

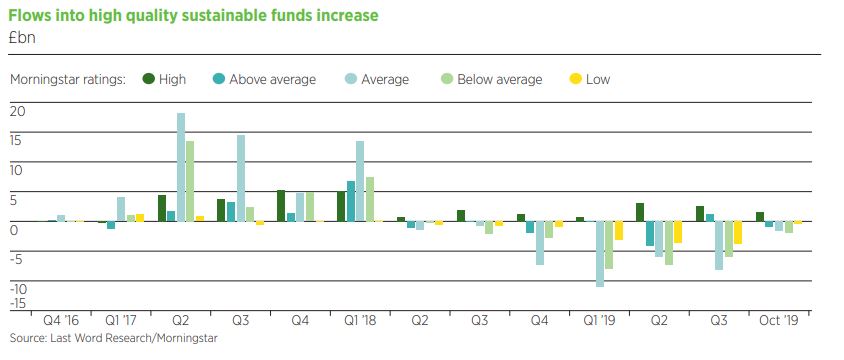

Never has ESG been so ingrained in the investment industry’s conscience. According to Morningstar data, investors are becoming more discerning in their responsible fund choices, with funds rated ‘high’ in its sustainability rating experiencing consistent net inflows since 2017. During the past three years, an impressive £30bn has flowed into these funds, compared with net outflows of almost £14bn from funds rated ‘low’ (see chart).

In January, Larry Fink, chief executive of the world’s largest asset manager Blackrock, used his annual note to investors to pledge to reverse the firm’s track record on climate inaction. Fink said Blackrock will require companies to provide a plan for operating within the Paris Agreement’s goal to limit global warming to two degrees.

“We will be increasingly disposed to vote against management when companies have not made sufficient progress,” he wrote.

Asset managers continue to be targeted for their role as investors in companies seen to be climate damaging. Last month, both Baillie Gifford and Hargreaves Lansdown found themselves on the receiving end of Extinction Rebellion protests outside their offices over investment in fossil fuels.

Against the flow

Such is the momentum behind investing in quality growth ESG stocks that Psigma Investment Management chief investment officer Tom Becket has taken the contrarian view that beaten-down value stocks in controversial sectors such as oil, tobacco and alcohol could outperform in the year ahead.

“When we start hearing Larry Fink talking about what he did last month, as well as seeing signs that Wall Street sees this as the new opportunity to make money, this strikes me as being somewhat of an opportunity to do the opposite in the short term, and makes me want to take the contrarian side of the trade,” he says.

Despite a brief value rally in September last year, global growth has outperformed value over all time periods for the past decade (see chart below). The dispersion between the valuations of the two styles has never been greater.

But Becket sees value stocks outperforming over the short term, especially in a world where growth sectors are loved and most sectors trade at near record valuations. “The dislike and dismay hanging over tobacco and oil stocks could lead to outperformance, with valuations low and ownership minimal.”

He adds: “If we are anywhere near right, and the biggest understated risk for markets is inflation, then one can make a case for commodities and gold companies to make headway in the months ahead.”

Financial as well as ethical benefits

According to Morningstar director of passive strategies and sustainability research, Hortense Bioy, it is not as simple as value potentially outperforming growth based on huge inflows into quality ESG while value stocks are beaten-up. She says many investors are divesting from certain names for financial as well as ethical reasons

“While it is true that more investors than ever are looking to avoid controversial stocks for ethical reasons, many investors are also avoiding or divesting from them for financial reasons,” she says.

“Screening approaches are evolving and these are increasingly based on the materiality of risks. There is a gradual overlap of the line between ethical and financial considerations.”

Bioy points to tobacco as an example of a sector where companies face significant regulatory risk that can severely affect profitability in the future.

“Oil companies can be avoided for environmental and financial reasons. A growing number of investors believe fossil fuels have no place in a sustainable world and prefer to back companies that will still be in business in 20-30 years,” she says. “They also believe the risk of high carbon taxes in the future, which will inevitably increase costs for fossil fuel companies, is not currently fully priced by the market.”

‘I just can’t make a cake with that’

Schroders global value team co-head Nick Kirrage (pictured) agrees it’s not as clear cut as simply vice stocks rallying on ESG sentiment. While the Schroders value team doesn’t badge itself as ‘ESG’, it comes into everything it does when seeking companies for the portfolio. “That isn’t really about ESG funds in themselves, it’s about doing your job,” Kirrage states.

He says very few people know what they actually mean by ESG; they have a social conscience but defining that is difficult, and there is a trade-off when excluding certain stocks from a portfolio. Only investing in, say, 20% of the index to avoid the likes of gambling, mining extraction industries and predatory lending is going to affect performance, he says.

“If I say, ‘Make the best cake you can but don’t use sugar’, you can still make a very good cake, but it’s not going to be the same. You can’t be certain if it’s going to be as good if you remove 20% of the ingredients. How many ingredients will you have left before you say, ‘I just can’t make a cake with that’?”

Kirrage says Schroders’ approach is to have a “grown-up conversation” with investors about using ESG as a major driver of valuing companies, but in most cases, unless told explicitly by clients, the team doesn’t take a moral judgement on coal or other controversial stocks, for example.

During the past two or three years, investors have been able to avoid companies like BHP Billiton, Rio Tinto or Shell because they have performed badly, but whether to swerve them over the longer term is a more difficult question to answer, says Kirrage.

Shares in Shell have lagged behind both the FTSE 100 and the oil price in the past 12 months, despite a pledge from chief executive Ben van Beurden to return £95bn of cash to investors via dividends and share buybacks between 2021 and 2025. Its latest results revealed a profit of £2.23bn in Q4 2019, down from £4.3bn in Q4 2018.

Says Kirrage: “What if next year the market falls by 20% and BP and Shell don’t fall 20%? In the short term, they’re big, they’ve got attractive dividends and they’re stable, and in the short term, we probably will need oil.

“So now suddenly they’re very positive contributors to performance. How do you feel about the fact there is now a clear performance impact from you not buying them for moral, ethical or personal reasons?

“Certainly, there is a nuanced argument. It’s easy to boil these things down into good or bad but if you want to change the world, you’ve got to get your hands dirty.”

Kirrage also says it is easy to focus on the producers of fossil fuels, such as the extractors, but attention should also be on the consumers, the airlines and logistics companies. “You’ve got to go after demand as much as the supply.”

Pressure on managers is coming from all angles

Liontrust head of multi-asset John Husselbee says he can’t personally engage with CEOs of each company the underlying funds in the portfolios hold, so it is important to have a conversation with the fund managers regarding any controversial holdings.

The Liontrust multi-asset portfolios are put through an MSCI ESG screen that provides not only their overall ESG rating but flags the most controversial stocks in the portfolio, information he can use to open a conversation with the manager.

“We can say, ‘Here are 10 red flags, what are you doing about it? How are you engaging with these companies?’ What we should be doing is being aware of what our risks are and then engaging and provoking fund managers to have the conversation.

“It won’t get to the point where if they don’t have any answers I will sell the fund. But I don’t need to because the pressure is coming from all angles for managers to be having these conversations already.”

Sustainable bonds: no free lunch

Twentyfour recently launched a sustainable version of its Absolute Return Credit Fund on the back of research conducted by portfolio manager Chris Bowie.

His research revealed that a negatively screened portfolio has returns that are more than 1% per annum lower than the original fund, and a higher volatility.

This, according to Bowie, is because the likes of tobacco and alcohol are defensive sectors in credit, as they have decent margins and inelastic demand, which make cashflows very strong. “Stripping that out costs you money.”

But when a positive screen was added, the returns improved, though the portfolio was slightly more volatile because of the smaller subset of sectors and companies.

“Sustainability is good, but it’s not a free lunch,” says Bowie. “It’s a cheap lunch, as we called it, because you can have the same return but you will have a little bit more volatility.”

Bowie believes sustainable credit will outperform over the medium term as regulation pushes asset owners into sustainable strategies, but this will push up the yields on less sustainable credit.

“At some point that means less sustainable credit will probably outperform for a period because those yields will be so attractive,” he says. “But I don’t necessarily think that will happen this year.”