Social bonds are emerging as the most prominent of sustainable bonds in 2020, echoing the fast-rising growth of green bonds in recent years, as Covid-19 fuels the rise of fixed interest assets seeking to support healthcare, employment and housing amid the pandemic crisis

Credit fund managers said they have witnessed the strongest growth in social bonds on record since the start of this year, with issuance catching up with that of green bonds, an area which has traditionally dominated the sustainable bond markets.

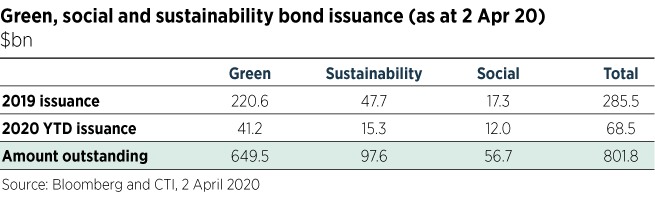

Year-to-date to 27 May, the green bond market has issued $69.3bn (£54.96bn) whereas social bonds have issued $30.4bn. In comparison, for the entirety of 2019 green bond issuance stood at $220.6bn, dwarfing social bond issuance which was $17.3bn for the year.

Johannes Böhm, Union Investment’s green bond specialist, commented: “Over the past couple of months, the sustainable bond market has moved out of its niche. We had tremendous growth especially in 2017 and 2019 and even this year amid the Covid-19 crisis.

“We have seen a shift away from green bonds to social bonds.”

Simon Bond (pictured), fund manager and director of responsible investment portfolio management at Columbia Threadneedle Investments (CTI), added: “There has been a tangible shift to widen from the green bond market to issuance focusing on health, mental health, employment. There has also been around $36.5bn in Covid-related issuance, which is pretty substantial.”

In the Bloomberg Intelligence note Covid-19: Social Bonds Rise During Pandemic, written by head of ESG Adeline Diab and ESG analyst Simone Andrews, it was predicted that social and sustainability bond issuance is on track to almost double last year’s total issuance volume of $54bn, on expectations “borrowers will raise additional debt to address social issues emerging from the virus”.

It highlighted total social and sustainability bond issuance had seen a “meteoric rise in 2020”, and “if the pace continues, issuance could reach just under $100bn by the end of the year”, putting the asset class on the same trajectory as green bonds.

The nascent Covid-19 bonds market

CTI’s Bond said Covid-19 issuance has been and would continue to be the main driver of growth in social bonds. Echoing statements from many equity fund managers, the pandemic has placed emphasis on the ‘social’ aspect of ESG, where previously a lot of focus was on the ‘environmental’ side.

“With Covid-19, green bond issuance has slowed. There have been some plain vanilla green bonds, but the focus is now on social – commercial servicing, SMW lending, health, employment.”

He added there has also been an increase in specialist sustainable bonds that are not labelled as a Covid-19 bond, but by analysing the ‘anecdotal statements’ from the issuers the team can identify the money is going towards fighting the pandemic crisis.

The spread of coronavirus around the world has had devastating impact, and is something that governments, corporates and individuals have been ill-prepared for. The International Monetary Fund has predicted “the cumulative loss to global GDP over 2020 and 2021 from the pandemic crisis could be around $9trn, greater than the economies of Japan and Germany, combined”.

As a result, “hundreds of billions dollars” is needed to cope with and recover from the crisis, Axa Investment Managers’ responsible investment analysts Théo Kotula and Marie Fromaget commented.

They added: “One response to this challenge has been the emergence of Covid-19 bonds. We see the nascent Covid-19 bonds market as a new area for impactful debt issuance, with similarities to green and social bonds. We believe these bonds can help to address the current and future societal challenges of the pandemic.”

There have been two types of Covid-response bonds coming to the market, they added:

- General Purpose bonds (or ordinary operation bonds), as part of a broader Covid-19 response plan by the issuer;

- Use-of-Proceeds bonds, which can be issued under a framework that is aligned with the International Capital Market Association’s (ICMA) Green, Social & Sustainability bonds principles and guidelines (GSSBP) – or a specific Covid-19 response framework.

Supranationals set the example with social bond issuance

In a Morningstar note Covid-19 Linked Funding Expanding Social and Sustainability Bond Market, written by senior vice president and head of European research Gord Kerr and vice president of sovereign ratings Adriana Alvarado, the need for financial support to recover from this crisis was identified as the main driver in the rise of social bonds, and they said it is the supranational community that is leading this.

“In the same way that supranationals helped to grow the green bond market by issuing the first green bonds starting back in 2007, issuance by supranational institutions is leading to the expansion of the market for social bonds. The opening of this market has prompted other issuers to approach the social bond market for funding. In January 2020, Ecuador became the first country to issue a sovereign social bond, backed by a guarantee from the InterAmerican Development Bank (IADB), to support affordable housing,” it said.

CTI’s Bond also said the supranational community had issued more than $9bn of debt to tackle Covid-19 in just three weeks (to 4 April). These were through the IFC Social Bond; the IADB Sustainability Bond; the African Development Bank Social Bond; the Nordic Investment Bank Response Bond; and the two most recent, the European Investment Bank and the Council of Europe Development Bank, which were both €1bn issues and were 5.9 and 3.9 times oversubscribed respectively.

“In aggregate, these bonds will support products and services contributing to health conditions and maintaining living standards for communities impacted by the Covid-19 virus.”

Axa IM and Rathbones among the assets managers tapping into Covid-19 bonds

In another indicator of the level of demand for these bonds, Bond pointed to IFC which has been issuing social bonds since 2017 – by the end of 2019 it had raised $1.5bn across 28 bonds. However, its latest social bond is a $1bn issue, which he explained “almost doubled its social bond book in one fell swoop”.

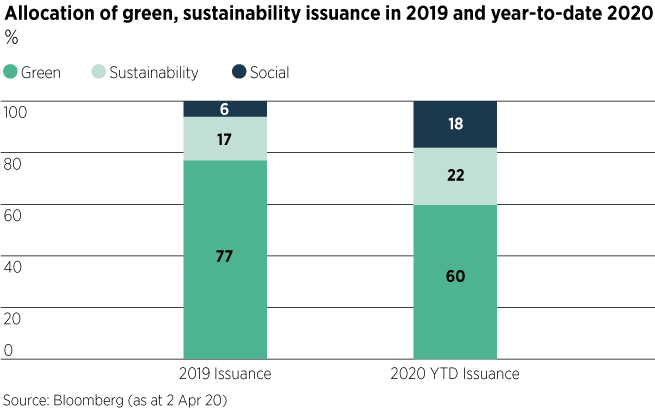

“This trend is broadly reflected when we look at the global issuance of specific use-of-proceeds bonds. Social represents 18% of these year-to-date, which is an unprecedented proportion, and it is thought that this trend will continue as we move through and out of the pandemic.”

Demand may also be driven by these bonds’ potential to assist investors in meeting their UN Sustainable Development Goals (SDGs).

Morningstar’s Kerr and Alvarado explained: “Investors have also been steadily developing mandates to incorporate ESG strategies. The issuance of social and sustainability/SDG bonds increases options for investors to meet the social and governance of ESG investing as to date the ‘E’ has dominated the market for funding. The expected increase in the issuance of social bonds broadens the options for investors with ESG investment mandates.”

Axa IM has already invested approximately €230m in Covid-19 bonds to support the fight against the pandemic, while managers of the Rathbone Ethical Bond Fund, Bryn Jones and Noelle Cazalis, purchased the first bonds issued to aid the response to the global Covid-19 pandemic in March.

> See more: Noelle Cazalis: From farmer’s daughter to fund manager

The pair said: “We bought deals in the form of the African Development Bank’s Covid-19 response bond – a five-year social bond – for those in need of medical help in Africa. And in a similar vein, the Inter-American Development bank – also a five-year bond – to help Latin America.”

Could the UK see a campaign for a social gilt?

The unprecedented demand for these bonds is unlikely to go away from both sides, but CTI’s Bond would like to see things move further with more issuance from governments and even high street banks.

He said: “I think this heightened level of issuance will continue and there will be a need to widen out the type of issuance. Green bonds started with the supranationals, then we saw social bonds, then Covid-response bonds.

“Supranationals and agencies are the first movers with corona bonds but these are all similar institutions and structures – what we would like to see is similar coming from the high street banks.”

He said RBS issued a social bond in November 2019 and Spain’s CaixaBank issued similar in September of that year. More recently, on 27 May Spain’s Banco Bilbao Vizcaya Argentaria (BBVA) launched an inaugural €1bn social bond specifically aimed at “mitigating the economic and social impact caused by the Covid-19 pandemic” – the first European bank to do so.

However, Bond said he would like to see this further develop across banks and with more social bonds aimed at Covid-19 recovery.

“We would also like to see it from national governments,” he added.

“CTI has campaigned for a green gilt, for example, and this could be extended in to the latest crisis. The most effective way to support the economy through this crisis would be to pay for it through a gilt. We would like to support infrastructure but also the direct response to Covid-19. Hundreds of thousands of people have been furloughed, paying for this could be helped with a social gilt.”

Axa duo Kotula and Fromaget said so far financial institution groups are missing from the market but do not anticipate this will remain the case.

“We expect them to pick up and contribute to its growth, as some possible hurdles have now been lifted. As an example, ICMA has stated that government-guaranteed loans can be included in Covid-19 bonds issued by banks.”

Morningstar’s Kerr and Alvarado also said they expect the type of issuers to expand and vary as demand builds.

“We expect that supranational institutions, development banks, regional governments, and sovereigns, as well as national and international banks will continue to approach the debt markets to fund programmes to support health systems and economies affected by coronavirus, with some of them issuing social bonds. As a result, the small market for social bonds and sustainability bonds is set to grow strongly in 2020.”

However, CTI’s Bond called on governments to take further action and the opportunity to finance the rebuilding of economies and communities in the wake of the crisis.

“Further issuance is required and is an invitation for governments to step-up and structure social bonds. We expect to see further behavioural shifts from corporates towards social outcomes when we exit this crisis and believe social investing is here to stay.”

For more insight on responsible investment, please click on www.esgclarity.com