A campaign for reforming investment company cost disclosure rules has doubled down on its calls for a change of interpretation of the EU alternative investment fund manager’s directive (AIFMD) rules, which it says has hindered the sector.

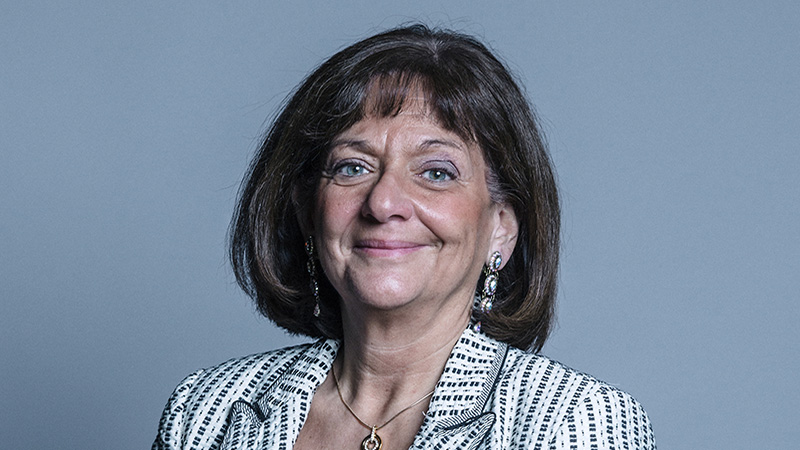

In a letter to The Times, co-signed by 114 signatories including AIC chief executive Richard Stone, Baroness Bowles, Baroness Altmann, MP John Baron and Lord Davies of Brixton said that for the last two years the UK’s investment trust sector has been “spiralling into a deepening crisis”.

“They have been shunned by investors and investment platforms because of EU regulation which, although it does not apply to any listed investment companies in Europe, remains on the UK statute book,” the trio said.

See also: Could one spreadsheet column solve the cost disclosure crisis for trusts?

A range of senior industry spokespeople have campaigned for cost disclosure regulation reform for investment trusts over the past few years.

The campaign has also launched its own website.

Under the AIFMD, investment companies are required to disclose costs in the same way that unit trusts are.

However Bowles, Altmann and Davies said that under UK interpretation investors are told that management charges are an additional cost, which is misleading as it effectively leads to publicly-listed investment trusts ‘double-counting’ their costs.

“All expenses, comprehensively and transparently expressed by investment companies, are paid by the company and are reflected in the share price. Investors are deserting these companies, stalling their ability to raise capital, when they are perfect vehicles for long term investment into vital public services such as healthcare, housing, energy and transport,” the trio said.

The letter follows the House of Lords’ reading of Baroness Altmann’s bill to remove investment trusts from the AIFMD on 1 March.

During the reading, Bowles called the FCA’s interpretation “illegal, irrational and inconsistent” and said the FCA had been “presiding over a market failure caused by knowingly tricking the consumer”. The FCA was approached for comment.