The coronavirus outbreak has been blamed for equity fund inflows dipping sharply in January, putting an abrupt end to the Boris bounce experienced after December’s general election.

Latest fund flow data from global funds network Calastone showed net inflows into equities fell by more than two thirds to £618m in January. It said £540m of this was into index-tracking equity funds while just £78m went into active equity funds.

UK equity funds took in two-fifths of the overall flows, but the stream of money coming in dropped by three quarters between December and January. Calastone put this down to a fading in the post-election bounce and news of coronavirus hitting sentiment.

Calastone’s data for December revealed equity inflows hit a two-year high of £2bn, with £1bn flowing into UK equities alone. Calastone said at the time this was “no doubt” because of the UK election result, which saw Boris Johnson’s (pictured) Conservative party sweep to victory.

Asia and active equity hit hard

Outside of UK equities, Asian markets and active strategies in general were particularly hard hit in January.

Asia focused funds suffered their worst month in two-and-a-half years as a net £61m left the sector in January, the weakest since July 2016.

Index funds took in 90% of overall net equity flows in January, while the value of capital subscribed to active funds dropped 93% month on month. Calastone said active funds were hit much harder by the coronavirus outbreak because they are more sensitive to changes in sentiment.

“The small £78m inflow for active funds belied how confidence drained away as the month progressed,” it said.

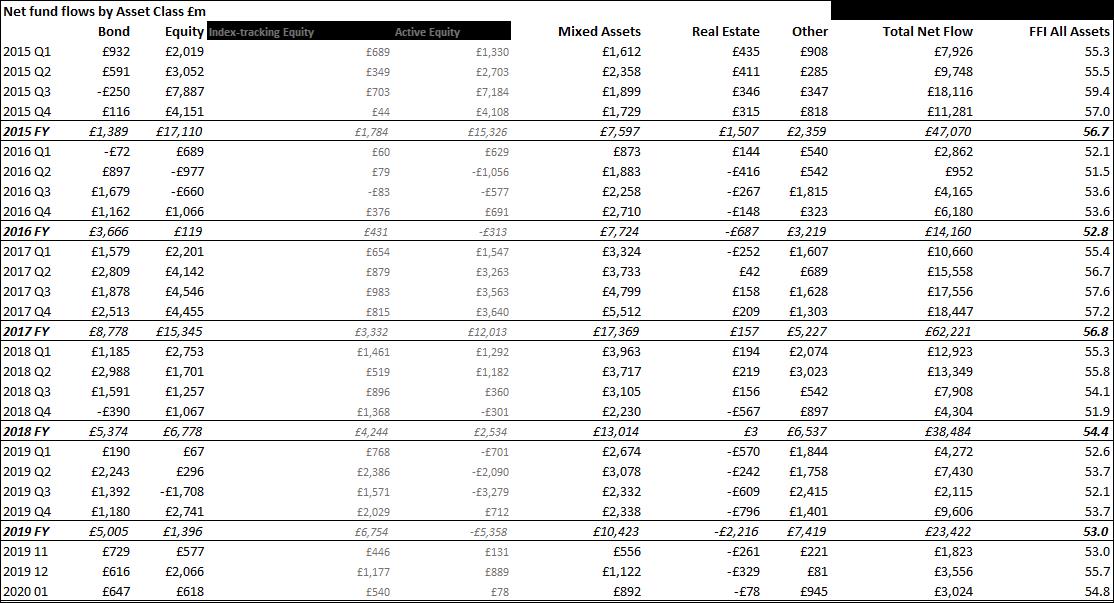

Net fund flows by asset class (£m)

Source: Calastone

A month of two halves

Calastone described January as a “month of two halves”. Before news of coronavirus hit headlines, equity funds saw £475m of inflows, but this slowed to £141m in the second half of the month.

It said this was a “distinctly active equities phenomenon” as inflows of £206m into active equities in the first half of the month turned to outflows of £128m in the second half. Index funds, meanwhile, were relatively unaffected, Calastone said.

Calastone head of global markets Edward Glyn said: “Stock markets have swooned since the coronavirus hit, as share prices have been marked down sharply in the expectation of slower global growth. The response of fund investors shows how the virus was most impactful for fund categories where its effect will be greatest, like Asia. But active funds also faced problems. The investor verdict on active equity funds was swift and decisive but passive funds were untouched.

“In times when confidence is weak, active funds bear the brunt of selling, while passive funds are relatively unscathed.”