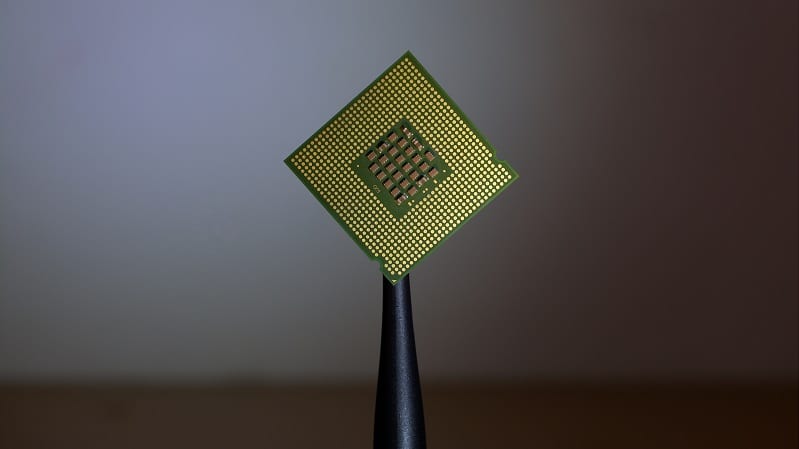

The escalating trade war took another twist last week after a report surfaced alleging that China had smuggled tiny pencil tip-sized ‘spy’ chips into computer hardware made by a supplier to tech giants Amazon and Apple that relied on subcontractors in China.

According to the Bloomberg Businessweek report, evidence of this espionage dates back to 2015 when Amazon was evaluating a potential acquisition company which relied on another firm called Supermicro Computer Inc to assemble motherboards on which the chips were allegedly discovered. Supermicro supplies some of the US’s largest tech companies, including Amazon and Apple.

The probe into this activity, which is still open, revealed that the chips allowed the attackers access to any network that included the altered machines. It is understood that the chips had been inserted at factories run by manufacturing subcontractors in China.

The report notes that China has an advantage executing this kind of attack, given that by some estimates it makes 75% of the world’s mobile phones and 90% of its PCs.

Apple, Amazon, Supermicro and the Chinese government have denied the allegations, but the story has has turned the nature of conflict between the US and China from a trade war into a tech war and in doing so, raises concern over US national security and how this could affect tech stocks.

Tech giants now bigger than the government

For Cole Smead, managing director and portfolio manager at Seattle-based Smead Capital Management, the episode brings up the dangers that have arisen from the governments allowing the booming tech sector to get bigger than the state.

“It brings up the question of how much the government has its hands on this, or what they even understand,” he says. “When they say, ‘You’ve got to be kidding me, we let a foreign agent sit in bank servers and government servers and so on?’ the answer is ‘yes’ because tech is bigger than government the last five years, it’s bigger than global governments. Look at the cash piles.”

Indeed, the Fed’s balance sheet stands at about $4.2trn dollars whereas the combined market cap of Apple, Amazon, Google, Microsoft, Facebook, IBM and Yahoo stood at about $4.4trn, according to statistics website statista.com – a figure taken in June before Apple and Amazon each broke through the $1trn market cap barrier.

Smead partly blames the special tax privilege implemented by the federal government to protect internet companies in the pre-world wide web days when an emergency communication tool, the Advanced Research Projects Agency Network (ARPANET), was created that is understood to have been the technical foundation of the internet.

“The government was backing this ‘infatuation’ with technology, providing protections to it that we’ve never seen in modern America. This was allowed under the belief that we were in the nascent stages of what technology could do,” Smead wrote in a recent blog post.

Faang ‘mania’ could end badly

Smead also notes this has been allowed to fuel a dangerous infatuation with technology, what he terms a “mania” that surrounds the 15 or so tech stocks driving the index relentlessly higher and the misallocation of capital to them. IT is the largest sector weight in the MSCI World Index at 19.1%, while five of the top 10 constituents are IT firms – Apple, Microsoft, Facebook, Alphabet A and Alphabet C.

He says like all manias, this one will end badly, stating that when it does 50-80% declines are not outlandish and even 90-95% is not far fetched.

“Go look at every other mania, how did it end? It was catastrophic, it was nightmarish. We are going to see the madness of men. I’m not saying do not own US stocks, I’m telling people not to own the market and the mania.”

Governance in US tech companies

Louise Dudley, global equities portfolio manager at Hermes Investment Management, says governance remains fundamental when analysing companies within the tech space, particularly policies and processes around data privacy and cyber security.

She adds: “Legislation in this space in also driving change in both the EU and the US. Ongoing education on these topics within companies is important as well as having specific expertise within the leadership team and at board level. It is global, not just US centric.”

Structural growth dynamics still exist

Dale Robertson, co-manager of the Chelverton European Select fund, says the threat from alleged Chinese tech espionage is a valid structural risk that will cause people to rethink their portfolio exposure to technology.

“When you think about the whole technology supply chain, it has been globalised and consolidated so much that any hint of a halt to trade has a ripple effect, so there is an element of this affecting how people are viewing these companies.”

He notes Donald Trump’s efforts to onshore manufacturing in the US is likely to be driven in part by these scare stories.

Despite the heightened risk from a tech war, Robertson believes tech still has strong structural growth dynamics driven by companies’ ongoing need to embrace artificial intelligence, Big Data and the storage of data. All of this will drive the creation of IT services companies supplying storage facilities and microchips.

“These are very strong underlying trends which we believe to be very positive, albeit it is difficult to call the extent of this tech war/trade war. I suspect we will have more exposure to this over the next six months there are some very good companies in Europe that have exposure to this.”

Europe’s thriving small and mid-cap IT sector

Robertson admits Europe is not well known for its tech sector but says there is a thriving small and mid-cap tech space, particularly IT services companies, if one scratches beneath the surface.

“We believe IT services is a pocket of real value in Europe because of the growth of trends that play into it. I suspect we will have more exposure to this over the next six months there are some very good companies in Europe that have exposure to this.”