A timely reminder in recent weeks that even with the most well-thought out and risk-adjusted investment strategy, unforeseen political risks are part and parcel of the investment process.

A standout performer during the pandemic, Chinese technology stocks which underpinned the strong returns of many Chinese equity funds took a tumble throughout August and September as the Chinese government turned its attention to removing spheres of ‘Western’ influence in its economy. Chief among these was a ‘tech crackdown’, with popular companies like Tencent and NetEase being affected by regulatory changes, which have largely been seen as an attempt by the government to exercise control over the technology industry and online platforms in particular.

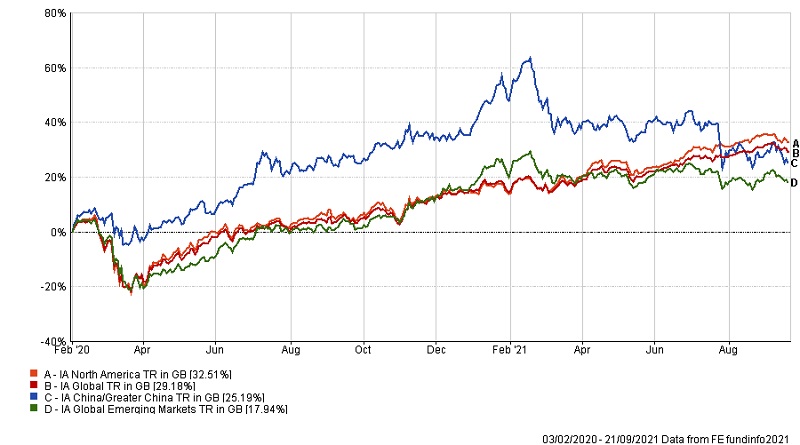

The immediate effects of this policy change can be seen in the chart below, where the IA China/Greater China sector had, until very recently, consistently outperformed markets in North America, the IA Global and the IA Global Emerging Markets sectors as well:

All of this goes to show that for investment managers, factoring in political risks is an extremely complicated business and something beyond their control. At FE Investments, we focus on controlling risk and maximising diversification, rather than predicting the markets and have largely tried to avoid Chinese equity funds because of this inherent risk.

Invesco China Equity’s fortunes change on antitrust regulation

Nonetheless, the Invesco China Equity fund which is on our approved list has not gone unscathed. We like this fund as up until now it has been a fairly safe bet. Its mostly defensive strategy has protected investors from much of the downside seen in the Chinese markets over the past two years. It has done this with clever stock picking, where, until recently technology stocks were seen as a fairly safe bet. The Chinese government, keen to promote its own domestic technology firms, such as Alibaba, Weibo and Tencent to compete with the likes of Facebook, Twitter and Amazon, enjoyed relative market freedoms and government support.

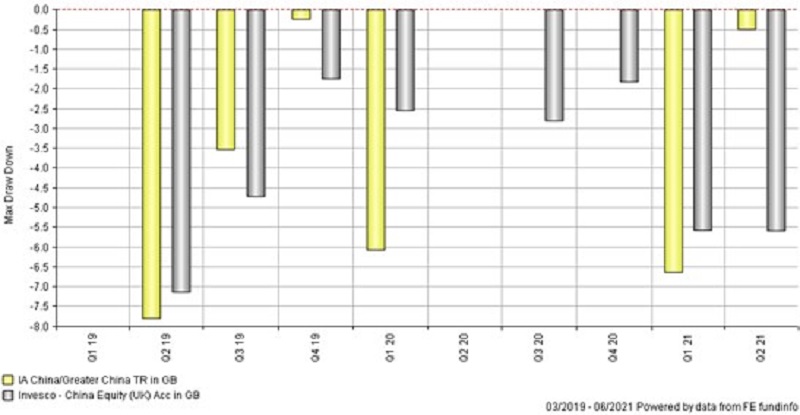

But how quickly things can change. If we look at the chart below, we can see that for the most part over the past 18 months, the fund’s own maximum drawdown periods have been significantly less impactful than the wider sector, yet the difference between Q1 2021 and Q2 2021 is stark:

Here we can see how the maximum drawdown comparison between fund and sector has completely rotated as the fund has borne the brunt of the political changes sweeping through China in the second quarter of the year. While the sector has only suffered a maximum drawdown of -0.5%, the fund has exceeded -5.5%. Unfortunately for the fund managers, Lorraine Kuo and Mike Shiao, their stock picking has been in previously ‘safe’ companies that are now right at the heart of the storm. The holdings in Tencent and online retailer Meituan have been significantly impacted by the antitrust regulations. The latter too has been particularly affected by a further tightening of ‘Edtech’ service providers, having launched a livestreaming service for education businesses towards the end of last year. Education, seen by the government as one of the key sectors of its economy, has been deeply affected.

Managers sticking to strategy

Nonetheless, despite the sharp downturn in performance, we have seen nothing that has changed our opinion of the running of the fund and its management. The fund managers are not deviating from their underlying strategy, which is to have a preference for private enterprises over state-owned ones. These companies drive them away from financials and energy, giving them a strong bias towards technology, consumer-related sectors and healthcare in the portfolio. This, of course, is the same strategy which insulated investors from market downturns seen within the sector just a few months ago. Indeed, when you take a longer-term approach to investing, political risk becomes inherent.

As we move towards the end of 2021, another year which has been impacted by volatility, the only certainty is that markets will fluctuate once again. Already there is talk within Chinese markets that other sectors such as real estate will enter significant periods of slowdown and the Invesco China Equity fund has avoided some of these risky stocks in risky areas.

Charles Younes, research manager at FE Investments