You could be forgiven for thinking during a time of pandemics and lockdowns all investors would retreat to the safest possible positions in their portfolios – but you’d be wrong. Data by Last Word Research shows that, in the UK at least, there was plenty of appetite among fund buyers for a wide range of different asset classes in early March before the peak of the lockdown-induced sell-off.

At the beginning of March, we asked the top fund selectors across the UK for their forward-looking investment sentiments over the next 12 months.

Fund buyers headed into the coronavirus with an appetite for risk

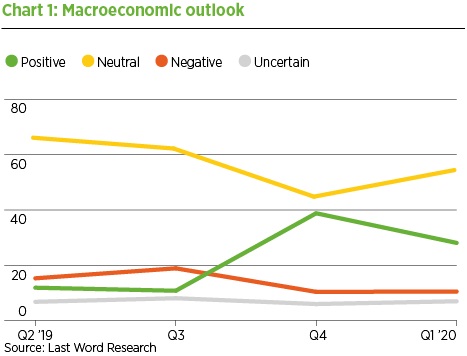

As chart one reveals, at the time our data was gathered, UK investors on the whole continued to have a positive macroeconomic outlook, with most being optimistic or neutral. Since then, of course, the situation has developed quickly – yet most of the writing was on the wall at that point, meaning the picture is more positive than you might expect.

There was also plenty of appetite for risk, with fund selectors looking to increase their allocation to certain asset classes.

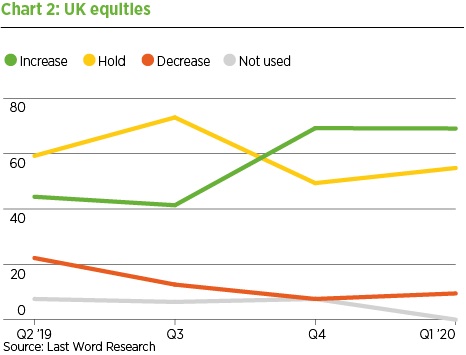

A clear winner is UK equities, as chart 2 illustrates. With all our respondents having exposure to this asset class, more than half were planning to increase their allocation over the following next 12 months.

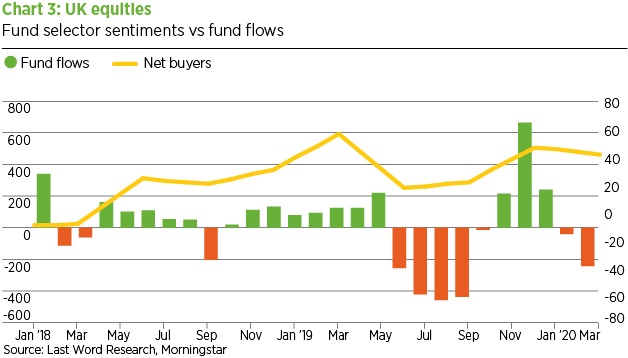

While the 12-month view might be positive, however, that doesn’t necessarily match the short-term picture. Data from Morningstar shows that through much of Q4 ’19 and the beginning of 2020, there were significant net inflows into the asset class. But in March 2020, Morningstar reported significant net outflows from UK-domiciled UK equity funds – outflows totalling an impressive £243m.

Disparities revealed

This does not seem to be in line with what our respondents said. To understand this better, Last Word Research has overlain fund selectors’ net sentiments over the top of Morningstar’s fund flows, as can be seen in chart 3.

When using this chart, it is important to follow the direction of travel. If we look back at last year, in March 2019, despite there having been plenty of net inflows into the asset class, our respondents were looking to decrease their allocation to UK equities. Three months later, in June 2019, Morningstar reported significant net outflows from this asset class.

An upward curve

In this time of uncertainty should we have been led by Morningstar data and followed the money, or listened to what the fund selectors were saying, who believed money should have gone into the asset class?

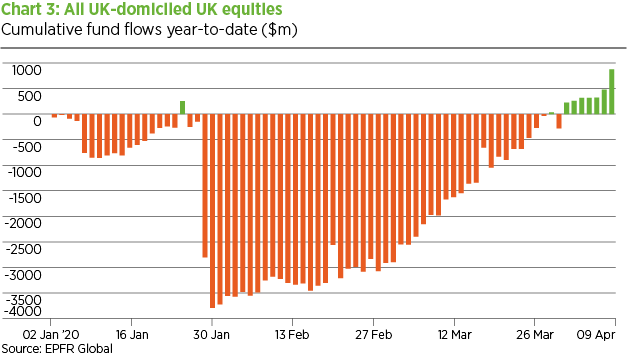

To address this question, Last Word Research has broken this data down even further. Using figures provided by EPFR Global, we looked at the cumulative flows for all UK-domiciled UK equity funds.

As chart 4 reveals, the asset class bottomed out with net outflows of $3.7bn at the end of January. However, since then there was a steady improvement, which accelerated towards the end of March 2020.

As our research suggested, plenty of money moved into this asset class in April 2020, with EPFR Global tracking more than $877m of net inflows moving into UK equities between 1 April and 15 April 2020.

If this trend continues, then our fund selectors are in fact in line with the general movement of funds.

What all of this shows is how important it is not to pay too much attention to the short-term twitches of market participants but to stick to your convictions and ride the storm.

This article was written by Lottie McGurk, a quantitative researcher at Last Word Research

All this data, and much more, is available. If you are interested in getting access to this data by participating in our research, please contact lottie.mcgurk@lastwordmedia.com