More than 170 years have now passed since James W Marshall first discovered gold in Coloma, California. Over the following seven years some 300,000 prospectors from around the world moved to California in search of their fortune during the goldrush. In the volatile markets of 2020, something similar is now happening, albeit in a more conventional way, as investors flock to the ‘safe-haven’ of precious metals and gold funds in particular.

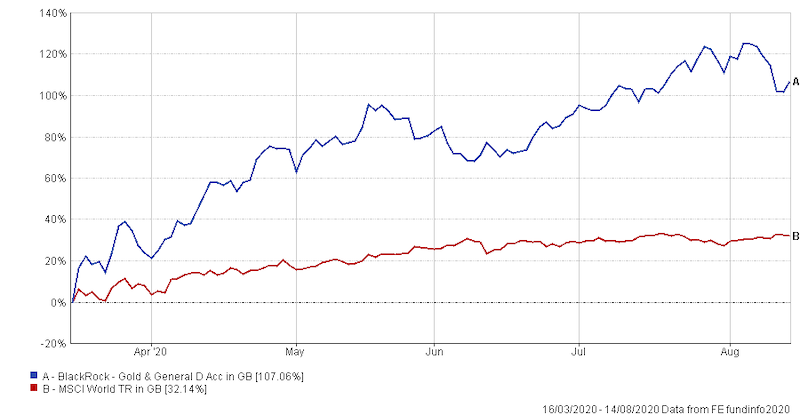

The success of gold in 2020 is undeniable; in early August the price of an ounce of gold broke the $2,000 barrier for the first time, surpassing the previous $1,900 high in 2011, while its overall price this year has risen by about a third since January. As the chart below shows, gold-focused funds have enjoyed a boon over the previous months. Taking Blackrock’s Gold & General fund (one of the largest funds in the sector by assets under management) as an example, it returned a staggering 125.38% at its peak in early August, from the depth of the market sell-off in mid-March. By comparison, the MSCI World returned 32.14% in the same period.

Blackrock Gold & General performance during coronavirus

There are many reasons why investors have chosen to move to gold in recent months. One of the most compelling remains that in falling markets, it is perceived to be a ‘safe bet’ because as a finite resource, it will largely retain its value. But, despite its performance this year, is gold the sure bet many think it is?

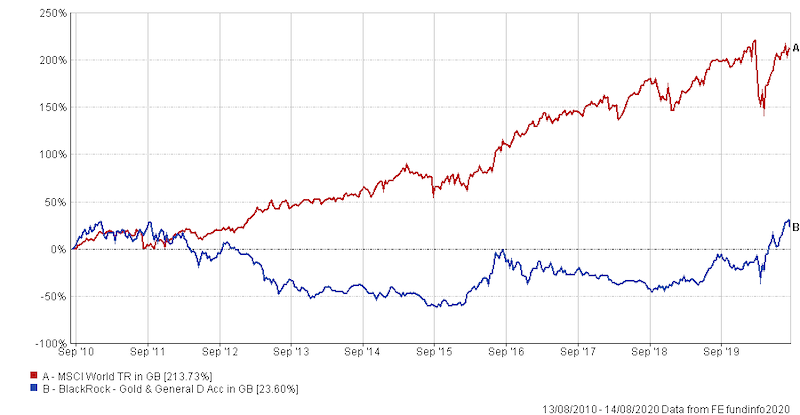

We at FE Investments do not hold gold funds in any of our portfolios. Even before it rallied, we had some reservations about its investment potential, which is largely down to our risk-targeted approach. We avoid the inherent risk of predicting markets. We don’t make calls on the movements of equities, gilts, bonds, or any other asset, and instead focus on managing risk. As we have seen in the volatility of its pricing, we believe gold is an inherently risky investment. Looking at the Blackrock Gold & General example again, we see that while this year’s performance has been impressive, it has only just recovered to where it was a decade ago, as the chart below shows.

Blackrock Gold & General performance over 10 years

What this essentially means is that investors would have had to endure nine years of losses – including a drawdown of 70% at one stage – in order to stand still. As a managed portfolio service (MPS) provider, this is a long time to justify diversification for periodic performance. Long term returns from the main asset classes have much better constancy over time and by including gilts, which are uncorrelated to equities you can achieve better diversification.

The other issue that we see with gold is that it is very difficult to value and consequently, holding positions within it can veer more into speculation than investment. While it may be a finite resource, it produces little of intrinsic value and is firmly linked to investor sentiment. It doesn’t produce dividends and its value increases only when demand grows in accordance with its scarcity or increasing inflation. With bonds – another traditionally ‘safe’ bet – by comparison we are able to assess their value by looking at the coupon or the financial security of the company, while with an equity we can analyse ratios such as its price to earnings ratio or the dividends it pays.

There is every reason of course to believe that gold will continue to rally in 2020, particularly if markets continue to show the signs of volatility they did earlier in the year, or if fiscal and monetary stimuli continues. Like the 300,000 who upped sticks and moved to California more than a century ago, the current fluctuating price might be an acceptable risk for those with high-risk convictions, but for those looking for a more stable portfolio and longer-leading returns, we remain convinced that gilts, rather than gold present better opportunities in the long term.

Charles Younes is a research manager at FE Investments