Prior to the Covid-19 pandemic, one of the most common questions facing the fund industry concerned the value that active fund managers were offering their investors over and above increasingly popular passive or tracker funds. In buoyant markets, investors increasingly questioned the fees charged by active managers, when passive funds appeared to be achieving the same results.

As markets collapsed a year ago, the value of active fund management really came to the fore. While passive funds were held captive to these falling markets, the best active managers were able to avoid the worst of the downside and capture the upside more quickly.

Each year, FE Investments tracks and rates the performance of active fund managers through our Alpha Manager ratings. By analysing the whole careers of UK retail-facing managers through their ability to create risk-adjusted alpha, outperforming markets, and consistently beating their benchmarks, we are able to build up a composite picture of the best-performing during different conditions.

The 2021 Alpha Manager ratings were released in February this year, almost a year after global economies went into lockdown and offer some interesting results into exactly how the best performing active managers managed the challenges presented by Covid-19.

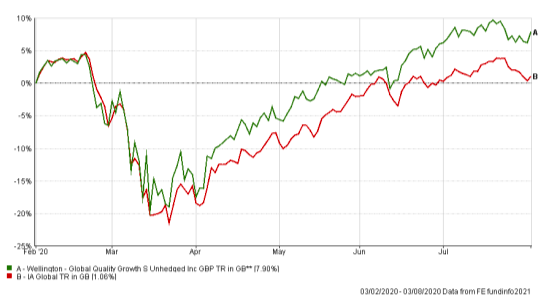

This year, a record 72 new fund managers were awarded ‘Alpha’ status, with John Boselli from Wellington Management topping the rankings for a second year in a row. John manages the firm’s global, non-US developed-market, and European quality-growth portfolios which have consistently beaten their benchmarks and we can get a sense of this from the chart below. This tracks how Wellington Global Quality Growth fared against the IA Global Sector during the six months period of extreme volatility that affected global markets from February to August last year.

As we can see, while John’s Wellington fund wasn’t immune to the rapid sell-off (at one stage losing 20%), throughout March it saw sharp periods of recovery and began to climb steadily in April. By mid-May it had largely recovered, while correspondingly, it took the IA Global Sector almost a month to reach the same point, before dipping again. It then started to climb from July, although not as steeply as the Wellington fund.

The benefits of active management and good stock picking are plain to see. The Wellington fund invested heavily in growth tech stocks, holding positions in the likes of Microsoft, Amazon, Apple and Facebook, as well as online retailer, Alibaba, all of which saw impressive growth as much of the world turned to online working and expenditure.

Additionally, the flexibility that active managers have in market downturns largely enabled them to position their funds towards to these high growth stocks. If we look at the breakdown of John Boselli’s fund, we can see it is positioned strongly in telecoms, media and technology businesses, with 43.9% of its holdings invested these businesses. This is in comparison to the IA Global Sector, which has a lesser weighting of 26.3%. This means investors tied to tracker or passive funds which are linked to the IA Global Sector will have missed out on the full extent of returns, driven by this growth.

We hope, of course, 2020 will not be repeated. In any case it would be unreasonable to expect tech stocks to enjoy as much of a boom in 2021 as they did last year – particularly as economies open up – but, the best active managers, as identified by the Alpha Manager ratings, will already be well aware of this and positioning their funds accordingly. Passive funds meanwhile, will not be able to take advantage of this change in economic environment as quickly as their active counterparts.

Charles Younes is a research manager at FE Investments