Towards the end of June, Prime Minister Boris Johnson announced that the UK would be entering the next phase in lifting the lockdown which had been introduced in March. This followed the re-opening of ‘non-essential’ shops earlier in the month and signalled that a return to a normality of sorts was underway. Within the investment community, attention naturally then turned to the UK recovery and how it might look.

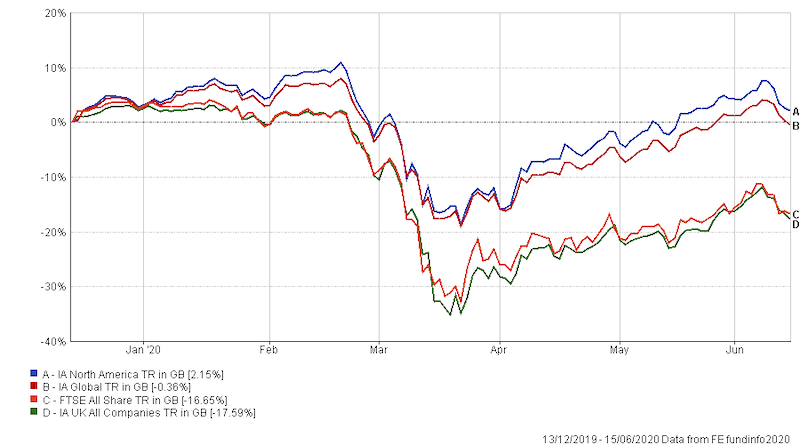

Unlike the United States, which despite having been hit harder by the Covid-19 pandemic is in a period of recovery, largely driven by US equities, UK equities have continued to lag. UK equities have suffered a significant downturn since the start of the year and have fallen faster and harder than other leading economies. The Investment Association UK All Company sector has lagged considerably compared to the IA Global Equity sector, having been at one stage down by almost 35%, as the chart below shows.

Where the UK differs from the US is that the latter includes big technology stocks, which have been better equipped to handle – and in some cases even prosper from – life under lockdown. Businesses like Zoom, Apple and Amazon, to name but three, have all benefitted from consumers moving more of their lives online. The UK stock market does not have the same composition, with very few global technology companies to support it.

The make-up of the UK equity sector is in fact one of the main reasons for its recent underperformance. The FTSE 100 includes a lot of energy companies which have been affected by the collapse in the oil price and financial services industries, which have been impacted by low interest rates. These businesses are also largely cyclical in nature and tend to underperform in periods of weak economic growth.

Other issues are also playing out in the UK equity sector, which are exacerbating the problems caused by the Covid-19 pandemic. The UK has been one of the hardest hit by coronavirus and the UK’s dreadful death toll has huge implications for the economy as a whole. There also remains the prospect of a no-deal Brexit which is once more looking like a possibility. In such an event, even the most well-prepared fund groups will be affected.

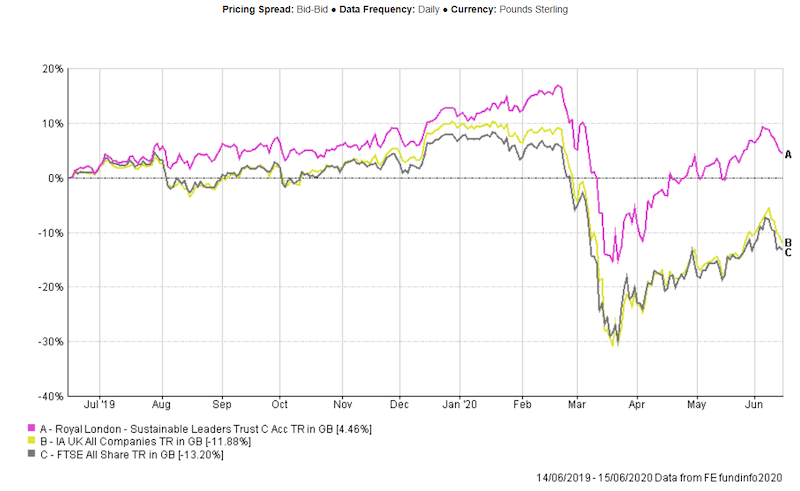

So then, where should the investor who is committed to UK equities turn? Despite the general gloom, UK equities are often quick to turnaround in the aftermath of a crisis. Following the crash of 2008, the IA UK All Company sector took just 18 months to reach its pre-July 2008 peak and at fund level, there are opportunities for capital growth. The Royal London Sustainable Leaders Trust is one example, which has grown 4.46% over the last 12 months, as the chart below shows.

The fund has a 5-crown rating and is on the FE Investments Approved List. It has a relatively concentrated portfolio, with 43 holdings, and has a high exposure to technology stocks and to healthcare, including AstraZeneca and Glaxosmithkline. The fund invests in companies which make a positive contribution to society and its mandate allows it to invest up to 20% of its assets outside the UK. It is also taking advantage of the US equity upturn, holding more than 10% of its AUM in these stocks. Crucially, it also avoids oil and gas companies, which as we have seen, have been affected badly this year.

Trying to call short-term market movements is very difficult to do consistently and this becomes particularly hard to do during such uncertain times. The road ahead for UK equities may be bumpy, but there are still opportunities to be had and with the right blend, they remain an important staple of a balanced portfolio. As ever, managing risk and planning for down as well as upturns will be vitally important for the UK equity investor.

Charles Younes is a research manager at FE Investments