This summer, FE Investments published the second of its biannual crown ratings, which track the performance of investment funds. Highly valued by financial advisers, investors and fund groups alike, the ratings provide a unique insight into how certain funds have performed in different market conditions. Eligible funds (funds must have had a three-year period of performance) are given a ‘crown score’, with the top 10% being awarded the highest five-crown rating.

Once again, the latest rebalance makes for some positive reading for sustainable funds, which were among the best performers. Among the 17 funds gaining the highest rating, three sustainable funds are worth noting. These are BNY Mellon’s Sustainable Global Equity, Jupiter’s Global Sustainable Equities and Montanaro’s Better World funds, which gained the accolade at the first time of asking.

See also: Liontrust and Baillie Gifford see previous winners demoted in latest FE rebalance

The strong performance of sustainably focused funds has largely come about from a combination of favourable market conditions and growing interest in ESG investing from both investors, who are looking beyond returns and wanting to know where their money is going, and institutions and fund groups who are looking to diversify their propositions.

The technology sector, where a lot of sustainable funds are concentrated, continues to perform well too, as many economies are adopting a hybrid home/office working approach as they emerge from the Covid-19 pandemic. Additionally, as ESG investing has taken off, many sustainable funds are now coming into maturity, having been launched three or more years ago and are now eligible for a crown rating. That so many have been rated so highly and so soon, is testament to the strength of their proposition and their ability to capitalise on current market conditions. These three funds have been no exception, as the chart below shows.

Over the course of the pandemic from February last year, all three have broadly tracked their IA Global sector benchmark, which itself was a strong performer, with LF Monanaro’s Better World fund generating the highest returns. You will note that despite dipping throughout March, April and May, all had generated positive returns just several months after the market collapse.

Looking forward however, we are already seeing something of a rotational shift within the markets, which was also reflected within the latest crowns rebalance. And, as the economy reopens, we can expect to see these shifts become more apparent. Those equity funds which were riding the crest of the technology boom seen during lockdown will increasingly find it hard to replicate their outstanding performances over the past 18 months.

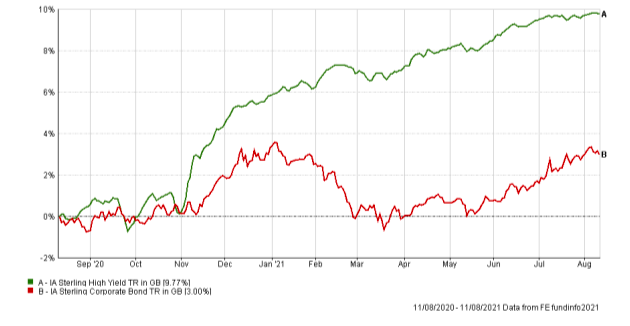

In today’s climate, investors are looking for funds to generate income and are hunting yield wherever possible. It was no surprise then to see the bond markets performing particularly well over the past six months, with the IA Global EM Bonds sector in particular seeing 9 out of its 31 funds (29%) gaining a five-crown rating. Over the past six months the bond markets have been one of the few places to offer these pockets of yield, so for many investors, it will be pleasing to see so many bond-orientated funds performing so well.

As the chart below shows, over the past year, the Sterling Corporate and the Sterling High Yield Bond sectors have generated positive returns, with the latter in particular enjoying a very strong performance during this period.

The next crown rebalance is set to take place in January 2022. Hopefully by then much of the political and economic turmoil which has governed the markets over the past 18 months will have subsided. While the rotational shift may have flipped once again as we move into 2022, investor appetite for ESG or sustainable funds are set to continue, and, with many more of these funds reaching the all important three year performance history marker, we will see whether BNY Mellon’s Sustainable Global Equity, Jupiter’s Global Sustainable Equities and Montanaro’s World funds have further competition.

Charles Younes is a research manager at FE Investments