Over the past few weeks, as the fallout from the coronavirus pandemic intensifies, politicians, scientists and economists around the world have been unified in saying that we are entering unchartered waters. As we have seen throughout the Brexit negotiations (albeit on a much smaller scale) markets hate uncertainty. During these uncertain times, where the only thing that can be agreed is that the uncertainty is set to last, it can be difficult for investors to know which way to turn.

It is often said that investors turn to gilts and high quality bonds in market downturns. They are generally considered to be less risky than other asset classes such as shares or property (indeed, this has been borne out by the collapse in global equities and the gating of property funds over the past few weeks).

We at FE Investments have always maintained a high allocation to gilts, despite their valuations. Gilts anchor our portfolios and provide capital preservation in times of market stress. High beta equities are combined in a bell-bar approach so portfolios mark time with markets as they rise. While this strategy was not adopted by many during the recent equity bull-run, we believe that this asset class provides a large amount of diversification benefits and is now coming into its own.

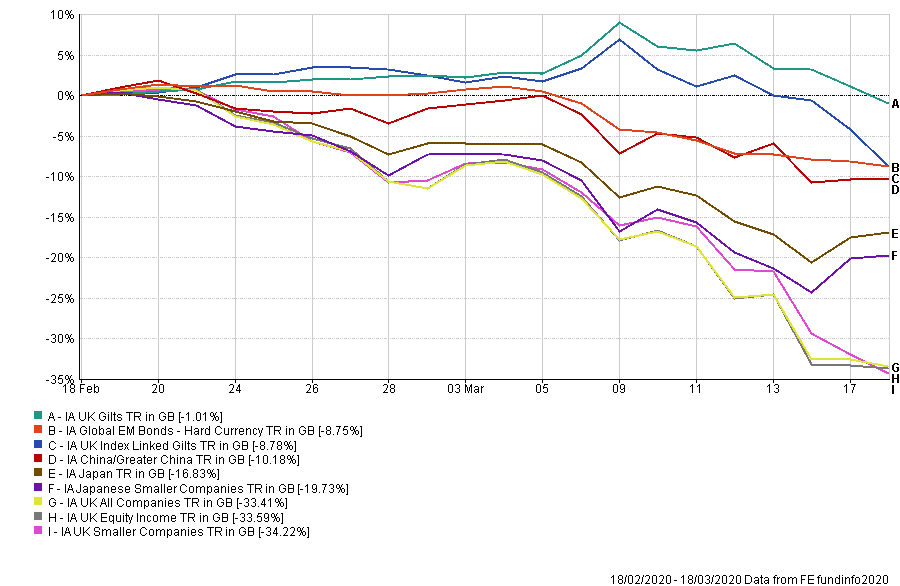

As the chart above shows, while almost every IA sector has fallen over the past month, UK gilts have maintained a fairly steady position, falling only by 1.01% since 18 February, with much of this coming only over the past few days. Compare this to UK Smaller Companies which have fallen by 34% during the same time frame. To qualify for this sector, funds must invest at least 95% of their assets in sterling-denominated (or hedged back to Sterling) triple AAA rated, government backed securities, with at least 80% invested in UK government securities (gilts). Although the recent fall in sterling is another issue altogether, it seems for the time being this approach is holding steady.

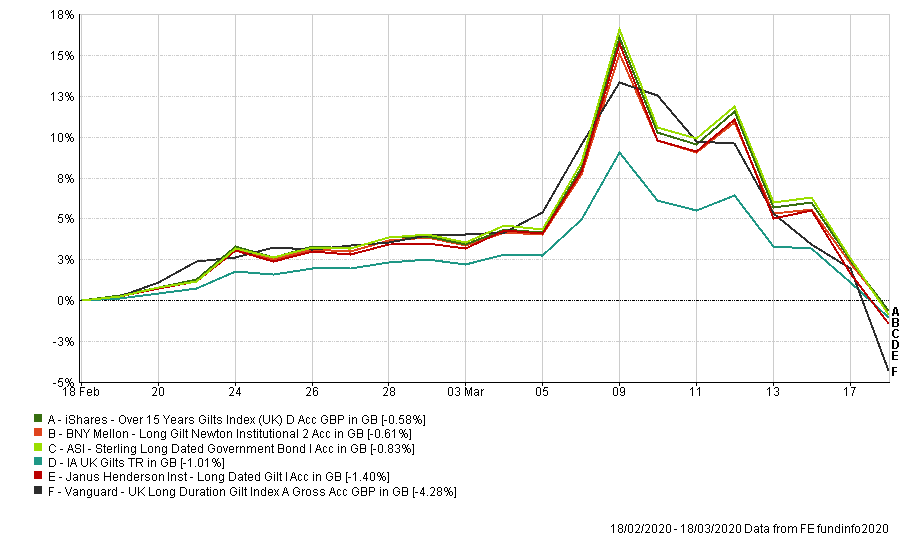

At fund level (as the chart below shows) the best performers in the sector have also held-up for the most part. While the fall from a return-high of 16.57% on 9 March for the ASI Sterling Long Dated Government Bond to -0.58% on 17 March, looks alarming other funds in other sectors have seen significantly sharper falls over the same period. The fact that during the early weeks of the crisis, the majority of gilts increased in value, demonstrates their appeal to investors.

At the present time, one particular fund of interest is the Allianz Gilt Yield fund. The fund’s consistency has long been recognised by our analysts, enjoying a 5-Crown rating (the highest possible). It aims to maximise total return, consistent with preservation of capital and prudent investment management, primarily through investment in British government securities. It is actively managed by Mike Riddell and Kacper Brzezniak, who have been co-managing the fund since 2015 and 2017 respectively.

Over the next few weeks and months we will see how quickly the markets rebound. Some sectors will certainly take longer than others. Gilts suffered in the 2008 recession, as did many other assets, but did not fall comparatively for as long or as hard. That said, as investment professionals, we do not make calls on the future. Indeed, given the current climate, it would be a foolhardy professional who did. Instead, all we can do is to monitor and look for a diversified shortlist of funds that remain resilient. In such worrying times, UK Gilts will remain a cornerstone for any diversified portfolio. Unless there is an increase in inflation expectations or an actual rise in inflation, then overall gilts will remain an investor’s best diversifying instrument, alongside existing equity allocations. We will soon find out whether they are worth their weight.

Charles Younes is research manager at FE Investments