In previous editions of this column we have tended to concentrate on either individual or groups of funds which mainly focus in certain types of assets or sectors. We have not looked more broadly at investment portfolios and their construction, where diversification is as, if not more, important than generating outright returns.

During September FE Investments carried out its latest rebalance of its ‘Mosaic’ portfolio range. Launched in 2018, these are a range of 15 risk-targeted portfolios which offer investors a wide selection of holdings in almost every asset class. These 15 portfolios are arranged on 1-5 scale on investor risk appetite along with three holding periods of short, middle and long. As with all of FE Investments’ portfolios, they are constructed not to make market calls, but to manage risk and maximise diversification.

It is fair to say that 2020 has been a year like no other and it has provided a stringent test of the robustness of this methodology. The economic fallout from the Covid-19 pandemic (along with the corresponding lockdowns), the forthcoming US presidential election, the looming prospect of a ‘no-deal’ Brexit, overrunning liquidity issues in property markets and the collapse in oil prices have all made rebalancing portfolios a tricky act to get right.

At the June review of the Mosaic portfolios, the markets were in the process of bouncing back from the Covid-19 sell-off in March. Since then, equity markets have continued their recovery, with US equities delivering particularly strong returns, while gilt values have fallen. Despite recent strong performance from most risk assets the future remains very uncertain. As the portfolios have demonstrated that they can outperform both in a sell-off and recovery we see no need to deviate from our current strategy.

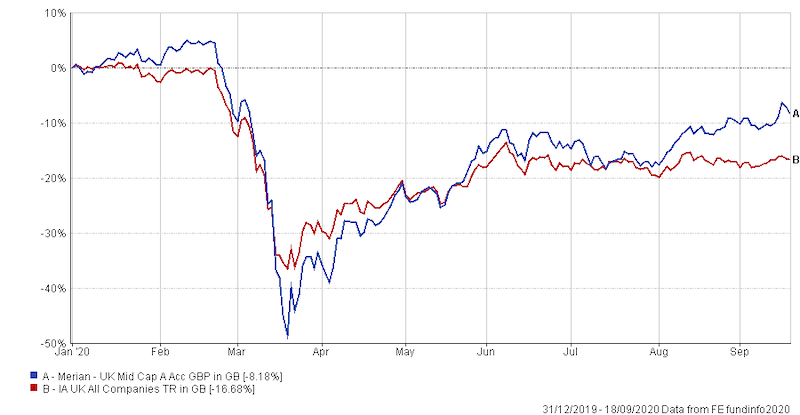

Consequently, the main focus in this latest cycle has been one of small rather than wholesale changes. Where changes have been made, we have tended to tilt more to growth funds, particularly the case in US and UK equity markets and gone slightly overweight in small to mid-caps. Again, this has been done, not as a market call, but one where we found diversification benefits. One of the few changes we have made was introducing the Merian UK Mid Cap fund. Merian has a flexible approach to stock picking, which is its main driver, but the manager can also tilt their portfolio based on the assessment of the environment. As the chart below shows has recovered strongly in recent months above its IA UK All Company sector benchmark.

Merian UK Mid Cap fund performance in the year to date

Within the US equity markets meanwhile, we made no changes to our fund selection, but have instead preferred to rebalance our weightings to optimise diversification. Given the uncertainty in the markets, we have also adopted some contrarian positions, maintaining our exposure to finance and health through Dodge & Cox US Stocks fund, which will allow investors to catch the upside if a vaccine is found, or if the economy in the US rotates. Additionally, we have increased our exposure to US tech stocks through taking a greater holding in Baillie Gifford’s American fund, which as the chart below shows has rallied strongly in recent months.

Baillie Gifford American fund performance in the year to date

The Baillie Gifford fund however offers a good reminder of the dangers of not going too overweight in portfolio balancing. It can be very tempting to allocate greater ratios of assets into a fund when it is soaring, but as the sudden tech sell off in September shows in the chart, it is important to stick to your convictions when markets become choppy.

By the time we are due to rebalance the Mosaic portfolios again in early 2021, we hope that the decisions we have taken today will not only allow investors to be protected against what is likely to be a very volatile end to the year, but also capitalise on any recovery in the world’s economy. Portfolio balancing and construction is vital for investors of every risk profile looking to hedge their bets on sectors or assets, while allowing the flexibility should the environment change.

Charles Younes is a research manager at FE Investments