Investors are continuing to allocate less cash toward UK equities, with Brexit and the Covid crisis further eroding their home-bias, a report from the Investment Association has shown.

Despite the devastating effects of the coronavirus pandemic in the first quarter of 2020, the UK funds industry had one of its best years on record, according to the trade body’s latest Investment Management Survey.

Retail fund sales swelled to £30.8bn in 2020 making it the second highest year on record for net sales after 2017. This catapulted UK investor funds under management (FUM) to a blockbuster £1.4trn by the end of December, a 9% increase from £1.3trn in 2019.

While there was a swell of demand for global equities, responsible funds and index trackers, investors continued moving money out of UK equities, which suffered £2.8bn worth of redemptions.

Assets held in UK equities have been on the decline for the past decade. In 2020 UK equities accounted for just 14% in FUM, a steep decrease from 2005 when they accounted for 39% of total assets.

But events like Brexit and the Covid pandemic have exacerbated this trend, the IA noted.

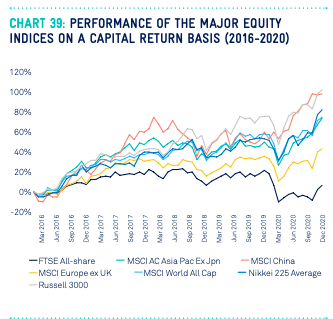

Retail investors have pulled £16.5bn from UK equities since the Brexit vote. Over that timeframe the FTSE All Share has trailed major global indices, even the MSCI Europe ex UK index.

Investors hungry for globally diversified funds

While retail investors have continued shunning home-grown stocks, their appetite for globally diversified funds has grown, the IA report noted.

Global equity funds have racked up £37.3bn of net retail sales over the past decade, higher than any equity sector. In 2020 net inflows into the IA Global sector hit £6.1bn, which was three times higher than North America, the next highest selling equity region.

This also explains the strong investor preference for global bond funds, the trade body said, which accounted for nearly a third of total fixed income sales in 2020 at £4.5bn.

Green agenda on the rise

Elsewhere, the IA said the trend toward greener investments was one of the “standout developments” in 2020.

Net retail sales into responsible investment funds reached £11.7bn last year, accounting for 38% of total net retail sales. FUM grew by a whopping 60% to £55bn over the period, though this still represents a small percentage of total FUM (3.9%).

“The green agenda continues to rise in prominence and investment managers have committed to support the transition to net zero emissions,” the IA said. “49% of total assets managed by IA member firms apply ESG integration, up from 37% in 2019. The proportion of assets subject to sustainability focused criteria almost doubled in 2020 to 2.6% of total assets.”