By Sid Lall, manager of the Marlborough Multi Cap Income fund

Many of the UK’s strongest smaller companies are successfully navigating higher interest rates and economic turbulence, growing into even more attractive businesses as a result of the challenges they have overcome.

We believe this is creating a rare long-term opportunity because smaller companies remain, for now, out of favour, and the improving fortunes of these businesses are not being properly reflected in valuations.

Well-managed, well-capitalised small and mid-cap companies are trading robustly, meeting – and often exceeding – earnings forecasts. They are also paying attractive and, in many cases, growing dividends. Healthy balance sheets enable strong management to position companies to take market share and continue profit growth despite the macroeconomic headwinds.

The sell-off in smaller companies has created a disconnect between company fundamentals and valuations. We are seeing quality companies, with healthy earnings growth, on single-digit price/earnings (P/E) multiples. Indeed, some are now cheaper still in terms of P/E multiple, not because share prices are falling, but because earnings per share have increased. It seems odd a company that nearly doubled revenues and almost quadrupled profits over five years should trade on a multiple lower than before the pandemic.

See also: Premier Miton’s Rayner: Oil price rise complicating inflation battle

The opportunity has been compounded because UK equities in general are out of favour with global investors. Our analysis indicates UK companies are on an average discount of around 17% relative to comparable businesses in other developed markets, and this increases further down the market cap spectrum.

We do not believe the current level of smaller company valuations will last forever. We are already seeing increased merger and acquisition activity, and, more importantly, positive earnings and cashflow news. This is driving unusually sharp share price increases for some smaller companies.

Housebuilder Vistry rebounds

Housebuilder Vistry’s share price is up around 40% so far this year. The company is in a sector that was negatively impacted by rising interest rates, as the prospect of higher mortgage costs and squeezed incomes led to initial forecasts that UK house prices would fall 10-20%.

Even more significant for UK housebuilders is the impact of operational leverage, which means a low single-digit fall in revenue growth translates into a much larger decline in net profit. Add to this the woes of input cost inflation and an additional 4% of tax on profits, and the impact was close to a perfect storm. Stocks that had traded on a P/E multiple of around 15 times were suddenly on around eight or nine times. Since last summer, some construction companies have seen peak-to-trough share price falls of over 60%.

With all these bear points, it would have been easy to write off Vistry at the start of the year. Even more so after it announced last month [September] that a share buyback would replace the half-year dividend.

See also: Is an equity-bond market correlation ‘the new normal’?

However, that would have been an expensive mistake. At the same time as the dividend announcement, the company unveiled a new strategic focus on building affordable housing in partnership with local authorities and housing associations. The company is targeting a return on capital employed of 40% and revenue growth of 5-8% a year. The share price surged on the news, pushing gains so far this year to over 40%.

Higher rates boost for Wincanton

While higher interest rates have posed significant challenges for construction companies like Vistry, for other businesses they have had a positive impact. Logistics firm Wincanton recently announced its pension scheme had swung back into surplus after a boost from higher bond yields. The company’s shares surged 15%. This followed a 10% increase to the final dividend paid in August.

In a very different sector, Bloomsbury Publishing is a prime example of a well-managed company successfully navigating higher interest rates. Bloomsbury is a global business, with two thirds of sales outside the UK. The company has a stable of prize-winning authors, and its academic and professional division and Bloomsbury Digital Resources offering are both performing strongly. The company continues to go from strength to strength. It has issued a succession of earnings upgrades and increased this year’s final dividend by 10%.

Attractive and growing dividends

We believe first-class smaller companies like these are being overlooked simply because of the perception UK smaller companies will struggle in a climate of higher inflation, rising interest rates and economic uncertainty.

While economic uncertainties remain, we are seeing some encouraging signals from data releases and policymakers’ responses. We certainly appear to be closer to the peak of the interest rate hiking cycle, given the pauses in the UK and US.

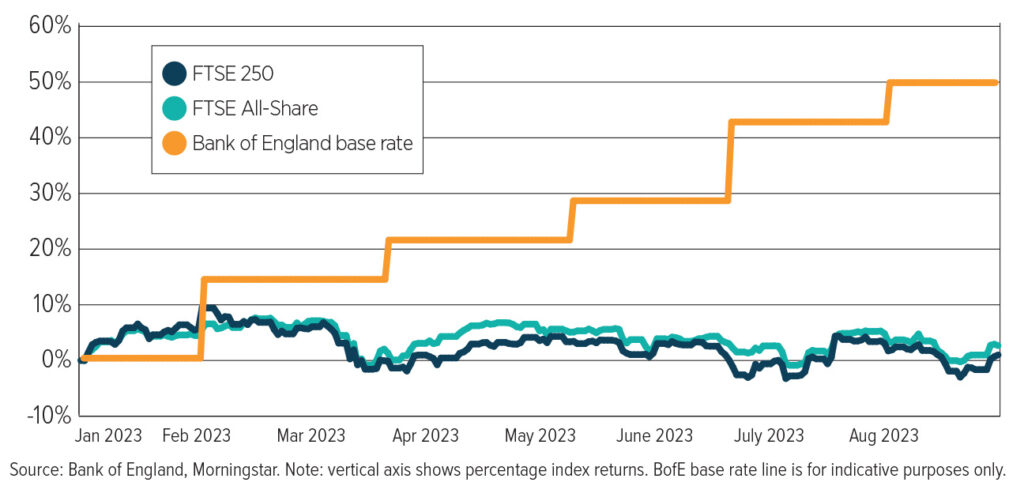

It is noteworthy that, as the chart below shows, this year’s increases have had little impact on either the FTSE All-Share or the FTSE 250, indicating the market had already priced in this year’s higher rates. Meanwhile, inflation seems to be easing and companies tell us input costs are falling. In addition, revised ONS GDP growth figures suggest the UK is not the global laggard previously indicated.

UK interest rate increases this year have had little impact on the FTSE All-Share and FTSE 250

As the macroeconomic picture continues to brighten, we expect many investors to take a fresh look at the disconnect between the valuations of the UK’s smaller companies – and the earnings upgrades, robust growth potential and attractive, growing dividends the strongest of them offer. At current valuations we believe these agile, dynamic businesses represent an exceptional long-term opportunity.