Some of Baillie Gifford’s most popular and top performing funds have endured a brutal kick in the teeth during the recent tech rout, sparked by rising US Treasury yields and fears of higher inflation, leaving some questioning whether the Edinburgh fund group can cope with a sustained value rotation.

James Anderson’s (pictured) Scottish Mortgage trust and the Baillie Gifford US Growth Trust, run by Gary Robinson and Kirsty Gibson, were down 30% on Monday morning compared with their mid-February highs, as were shares in Douglas Brodie’s Edinburgh Worldwide Investment Trust.

See also: Scottish Mortgage two-day slump continues after Tesla sees shares pummelled

However, they have since clawed back some of those losses as the aggressive sell-off showed signs of easing up on Tuesday. Scottish Mortgage shares are trading at a 4% discount at 1,124p, compared to an 11% discount on Monday, thanks in large part to board-initiated share buybacks. Meanwhile, Baillie Gifford US Growth Trust shares have pepped up to 322p, a 4% premium to its NAV.

But the violent price swings over the past weeks have made some investors wonder if Baillie Gifford’s long-winning streak could finally be coming to an end.

“Over the last 12 months, I’ve seen so many comments about how value investing is dead and why you should just put all of your money in Baillie Gifford or Fundsmith or Lindsell Train,” says AJ Bell head of active portfolios Ryan Hughes.

“The last few weeks are a timely reminder that things change, market leadership shifts and investor behaviour can move very quickly.”

Two thirds of Baillie Gifford’s funds are sitting on losses year-to-date

Known for its long-term growth house style, Baillie Gifford’s funds have delivered stonking performance over the last decade as its top tech holdings in Amazon, Netflix, Google parent Alphabet and, more recently, Tesla have driven growth in US markets.

See also: Active advocate Baillie Gifford trounces Vanguard and Blackrock for UK fund flows

And its tech-heavy top performers did even better in 2020 as the Covid crisis rapidly accelerated the trend of businesses moving online, benefitting many of the existing e-commerce, cloud computing and digital healthcare names in Baillie Gifford’s funds.

Out of Baillie Gifford’s 46 Oeics and investment trusts 13, or just over a quarter, returned over 50% last year, according to data from FE Fundinfo. The top four funds, including Baillie Gifford US Growth Trust and Scottish Mortgage returned well over 100%, with the former returning a whopping 133.5%, six and a half times higher than the IT North America’s 20.6% average.

Only two of its funds, the Keystone Investment Trust and Baillie Gifford UK Equity fund were loss making in 2020, with the former down 0.82% and the latter sliding 4.1%.

See also: Charles Plowden regrets Zoom miss as Baillie Gifford colleagues rake in millions

But as the value rotation has ramped up, fuelled by the rollout of global vaccine programmes, Baillie Gifford’s biggest winners have swiftly become its biggest losers, with Baillie Gifford US Growth Trust, Baillie Gifford American and Scottish Mortgage all sitting on losses year-to-date.

Top 10 Baillie Gifford funds in 2020 vs 2021 ytd

| 2020 | 2021 ytd | |

| Baillie Gifford US Growth Trust | 133.5% | -5.5% |

| Baillie Gifford Pacific Horizon | 128.6% | 0% |

| Baillie Gifford American | 121.8% | -6.3% |

| Scottish Mortgage | 110.5% | -8% |

| Baillie Gifford Long Term Global Growth | 95.6% | -7.6% |

| Baillie Gifford Edinburgh Worldwide IT | 87.7% | -10.7% |

| Baillie Gifford Positive Change | 80.1% | -13.3% |

| Baillie Gifford Global Discovery | 76.8% | -8.4% |

| Baillie Gifford Global Stewardship | 71% | -2.4% |

| Baillie Gifford European Growth Trust | 64.8% | -5.9% |

Source: FE Fundinfo

Only eleven of its funds have generated positive returns year-to-date, while two thirds are loss-making. Excluding the Schiehallion fund, which is up an impressive 26.1%, the rest of its ‘high risers’ are up a meagre 1-3%.

Schroder Global Recovery overtaking Scottish Mortgage could drive flows into value funds

Hughes says the change in market leadership from growth to value has been underway since last September when it became clear the dispersion in valuation between the two styles “had gone too far”. But more recently, as the US 10-year Treasury yield has surged above 1.5%, this has fully moved into the tech space with investors starting to question the “sky high valuations” of some companies.

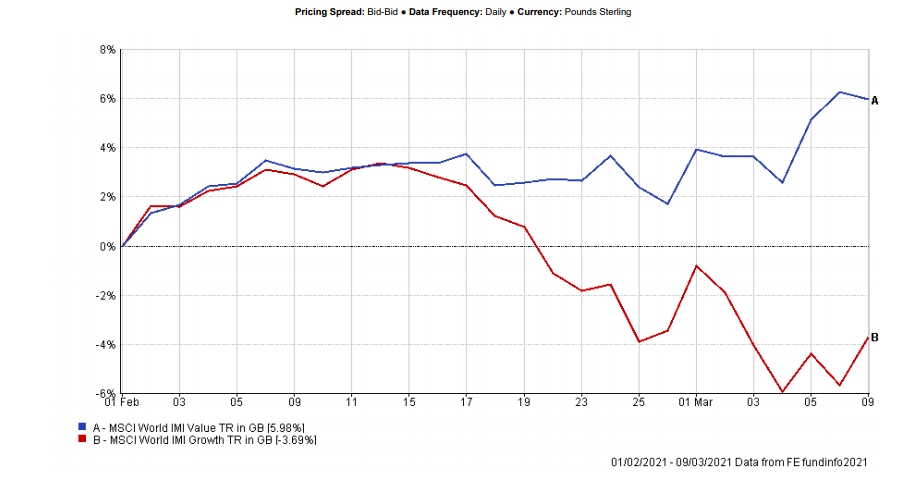

Since the beginning of February the MSCI World Value index is up 6% while the MSCI World Growth index has fallen 3.7%.

Shares in Tesla, which represents around 5% of Scottish Mortgage and Baillie Gifford American, have lost around a quarter of their value since February, dropping from $840 to their current price of $668. Meanwhile Amazon, another top holding of both funds, is down 10%.

Hughes says the fact a well-known “deep value” fund like Schroder Global Recovery is now outperforming Scottish Mortgage on a six-month basis “will put a lot of value focused funds into the spotlight”. “That could easily be followed by investors’ money”.

“The likes of Baillie Gifford have been huge winners of the market favouring growth companies, however with many investors significantly underweight value, there may well be some continued rotation out of funds such as those managed by Baillie Gifford and into value focused players as investors look to reposition and chase short-term performance,” Hughes says.

See also: Baillie Gifford American managers join James Anderson in slashing Tesla holding

Scottish Mortgage sell-off ‘not a disaster’

Chelsea Financial Services managing director Darius McDermott believes investors will stick by Baillie Gifford because of the extraordinary returns generated in recent years.

“A lot of Baillie Gifford products were up at 80%, 90% and 100% last year, including Scottish Mortgage,” McDermott says. “I think investors would very much be prepared to accept the price that they pay for high growth will have periods of time where it underperforms,” he says.

In the case of Scottish Mortgage, the recent sell-off has knocked shares back to where they were trading around November. “That’s not a disaster,” says McDermott.

7IM senior portfolio manager Peter Sleep thinks that while “a lot of professional investors” will chase performance and switch out of growth equities into other areas of the market, he adds that “Baillie Gifford articulate their strategy well and I think a lot will stay”.

7IM intends to keep its holding in Scottish Mortgage, which it balances alongside the Schroder Global Recovery fund.

Baillie Gifford has survived a long-term value rally before

Sleep says Baillie Gifford has already proved it can sustain itself when value is in favour, having survived the six-year value rally between 2001 and 2007, right before the financial crisis, and the short-lived rally in 2016.

Because the Edinburgh manager is structured as a partnership, it can endure earnings shortfalls better than listed managers, Sleep says.

This is also the reason why its business model can be uniquely reliant on growth equities. Listed fund managers have the added pressure of share price performance and as such would want a mix of styles, like value, growth and core, and asset classes to ensure they can weather all kinds of market environments.

“You have to give Baillie Gifford credit,” Sleep says. “They specialise in an area (large cap equities) where ETFs are strong, and they seem to be winning.”

Not all Baillie Gifford funds have punchy tech plays

FE Investments senior analyst Tanvi Kandlur notes that not all of Baillie Gifford’s funds have hefty positions in tech stocks. While its US and global fund ranges have larger weightings in this area, its Japan funds tend to be “slightly cyclically-focused,” Kandlur says, which is “purely down to the opportunity set in those respective markets”.

The flagship Baillie Gifford Global Alpha Growth fund is another example of a fund that can hold allocation to cyclical growth stocks, says Square Mile investment research analyst Daniel Pereira.

“This helps keeps this particular fund more competitive when its overall growth stylistic characteristics works against it,” he explains.

At the same time “Baillie Gifford makes no secret of its belief in technology companies,” Kandlur continues, with its funds exposed to companies across a range of sectors, including property and financial services, that are using technologies to disrupt their respective industries.

“Naturally then, any long-term rotational shift would be a concern,” she says, “but Baillie Gifford are adept at spotting opportunities for growth and would no doubt reposition their assets to capture the upside of high growth technology companies, should a downturn be sustained, while still staying true to their growth philosophy.”

Baillie Gifford could keep investors onside with competitive fees

Kandlur agrees professional investors, who typically look at performance over a three-year period, will not be swayed by any short-term fall in technology stocks.

“2020 by any metric was an exceptional year and for the most part Baillie Gifford funds performed admirably as their holdings were among the biggest ‘winners’ throughout the pandemic,” she says.

“Most investors accept – or hope – the events of 2020 will not be repeated, so should be prepared for the fact that some funds may not deliver these same exceptional returns.”

The fact Baillie Gifford’s funds are “for the most part very competitive” is something else Kandlur thinks will keep investors onside.

“Low fees help to attract and maintain clients which allows for greater flexibility when it comes to what investors are prepared for regarding returns,” Kandlur says. “Baillie Gifford’s fee structure is unlikely to change, so it becomes less about forgiving periods of underperformance and more a choice of competitively priced funds.”

Baillie Gifford declined to comment.