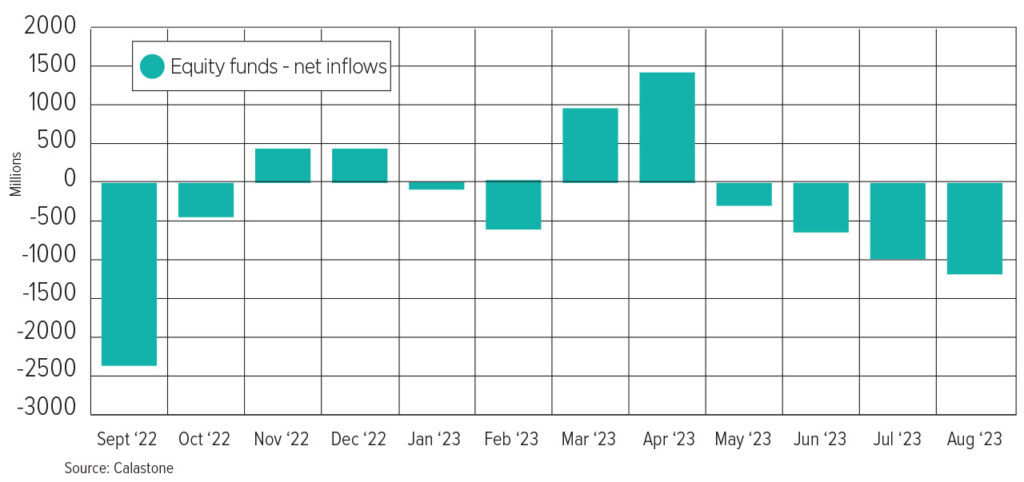

Equities funds shed £1.19bn collectively in August, according to the latest Calastone Fund Flow Index report.

Investors continued in risk-off mode as rates on offer in the money markets continued to look like a better risk versus reward prospect than equities for many.

UK equities funds once again struggled to retain money, with redemptions hitting £811m, for the month. This was the highest outflow since February, and one of the seven worst months on record. It also represented the 27th consecutive month in which investors have withdrawn capital from the asset class.

US equity funds were not immune to the prevailing trend, seeing their worst ever month with outflows of £620m, taking total net selling to £3.05bn in the last 12 months. ESG funds were also notable laggards in August, seeing record outflows of £953m.

See also: Weekly outlook: Australian and Canadian central banks set to make interest rate decisions

Income funds had their fifth worst month on record with outflows of £632m, while European, Asia-Pacific, country and sector funds all saw outflows.

Global equities absorbed much of the money leaving other assets, with a net £1.18bn coming in as part of an intensifying trend in favour of funds with a global mandate. Emerging markets equities funds were also up for the month, with £180m coming in.

Equity funds, net inflow/outflow

Another major beneficiary of this asset allocation shift was once again money market funds, which booked net flows of £637m for the month.

Calastone said August’s ‘bond market turbulence’ caused the first net outflows for fixed income since June 2022, with a net £330m leaving. A significant proportion of this came from index-linked funds.

Edward Glyn, head of global markets at Calastone, commented: “Fear was a big motivator in August. Discouraging economic data in the UK showed core inflation has proven resistant to rate hikes, while the US economy has shown signs of accelerating in recent weeks – expectations of yet more rate hikes are bad news for asset prices.

See also: Lipper ETF flows: European equities and financials see largest outflows

“Bond yields pushed higher as a result, dragging stock markets and bond prices lower,” Glyn continued. “This had investors running for the safety of cash and money-market funds. With savings interest rates and yields on safe-haven money market funds at their highest level since 2007, it doesn’t take much to cause a rout.

“Tepid economic data in the second half of the month boosted hopes that central banks may begin to lower interest rates sooner rather than later after all, and that has driven the market rally. But it’s not been enough to tempt fund investors back into to riskier assets. A clearer prognosis from central banks this month would help investors set their direction for the next few months.”

–

PA EVENT: Fixed Income, September 14th | RSVP HERE

Hosted at Pan Pacific Hotel

Join us for an in-depth exploration of the fixed-income market, where industry experts will delve into the current landscape, emerging opportunities, and strategies for optimizing fixed-income portfolios.

Sponsors include Alliance Bernstein, J Safra Sarasin, Premier Miton, RBC Bluebay, Vontobel and 1 more to be announced.