The launch of a US value fund from Brown Advisory has been described as “timely” amid the start of a possible market rotation towards cyclical sectors on the back of the positive Covid-19 vaccine trials.

The BA Beutel Goodman US Value Ucits fund will be seeded with up to $25m of client assets managed out of Brown Advisory’s London office. The sub-advised fund will be based on the Beutel Goodman US Equity Strategy, which has over 3% in annualised excess performance compared to the Russell 1000 Value (net) Index.

The strategy typically holds 25 to 35 stocks, seeking out companies trading at a discount to their intrinsic value, which Beutel Goodman considers to be the present value of their sustainable free cash flow.

‘The test will be whether or not they can attract assets’

Willis Owen head of personal investing Adrian Lowcock said it was “very interesting” to see a value fund launch after the sector has been so unloved, although he thought it was still too early to say whether the value rebound over the last couple of weeks was a trend.

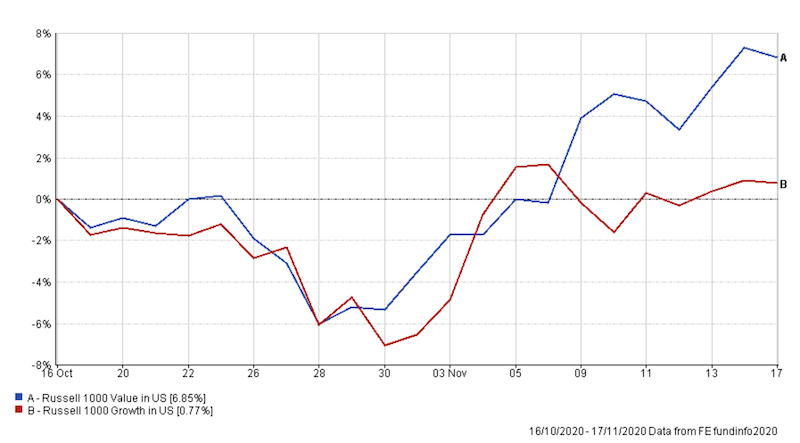

Over the last month, which included Joe Biden’s win of the US presidential election and positive Covid vaccine trial results from Pfizer/BioNTech and Moderna, the Russell 1000 Value index has returned 6.85%, while the Russell 1000 Growth index has returned 0.77%.

Russell 1000 Value vs Russell 1000 Growth

“The test will be whether or not they can attract assets and generate enough interest to support the fund,” Lowcock said. “Fund launches themselves are not a reliable indicator that a style or asset class is going to perform, so whilst this could be an early mover in value investing I think the focus for investors should be more fundamental.”

Tilney managing director Jason Holland described the BA Beutel Goodman US Value fund as a “very timely launch”.

“The performance gap between growth and value has become so extreme, you have to wonder how much longer this can continue and the emergence of credible Covid-19 vaccine candidates over the last fortnight has started to prompt a rotation into cyclical sectors where value stocks are found in abundance, turning the trends since the start of the year on its head,” Hollands said.

“If this shift continues, we could be on the cusp of very strong run for value-strategies, although this window may have a limited time frame as markets rebalance. That’s the thing about value investing, when it works, it tends to be in short, sharp bursts.”

UK investors have limited options in US value space

Brown Advisory head of international business Logie Fitzwilliams (pictured) said the $100bn asset manager is seeing increasing demand from its UK and European clients for US value.

“Given the limited number of high-quality US equity value strategies currently available to the UK market, we are now pleased to be able to bring the expertise of Beutel Goodman to our clients here.”

Lowcock said there are attractive opportunities in US value despite the market being associated with growth stocks.

“Whilst the US market currently has a bias towards growth stocks it is a very large and broad market with plenty of opportunities in a wide range of sectors and despite the headlines there are plenty of companies at low valuations.”

Beutel, Goodman & Company is a Canadian investment manager with $28.6bn in assets under management.