Brexit uncertainty has plagued investors in UK assets for more than three years as global allocators shied away from the region, but the outcome of December’s general election and a clearer direction for Blighty under a Conservative government look set to buck the trend.

It’s not just Brexit that has clouded investors’ perspective of the UK during the past year. The high-profile closure of Neil Woodford’s investment management business, led by the collapse of his UK Equity Income Fund in June 2019, gave investors even more reason to shun domestic stocks.

But a torrid year for the asset class ended on a high as Boris Johnson (pictured) and the Conservative Party’s victory at the polls on 12 December gave UK assets a much-needed boost as the threat from nationalisation of certain services and sectors posed by a Jeremy Corbyn-led Labour government faded away.

Pent-up demand for UK equities

According to data from global funds transaction network Calastone, domestic investors ploughed a net £1bn into UK equity funds in December, the largest ever monthly inflow of capital and almost double the previous high set in July 2015.

Calastone says there is “no doubt” the UK election was the main driver as flows escalated strongly as soon as the election was called and strengthened as polls indicated a likely majority for the Conservatives. Head of global markets Edward Glyn believes a clearer path for the country is unleashing enormous pent-up demand for UK equities.

“It is not all about Brexit, however,” he says. “Labour’s historic defeat had a positive impact on investor appetite for UK assets, and on valuations, as it removed the prospect of a wide-ranging left-wing programme that investors judged negative for asset values.”

But it seems the shift to UK assets was in train before the 12 December poll results rolled in. The latest Investment Association statistics for November show UK equity funds, including UK All Companies, UK Equity Income and UK Smaller Companies sectors, had their best month of net retail sales since May 2019, with £108m of inflows. This is in stark contrast to September 2019, when investors pulled a net £676m from UK equity funds and in Q3 2019 overall, when £2.3bn was withdrawn.

According to FE Fundinfo data, since the election on 12 December, the FTSE 100 is up by 4.25% and the FTSE All-Share has gained 4.3%. Overall during 2019, the FTSE 100 returned 17.3% and the All-Share yielded 19.2%.

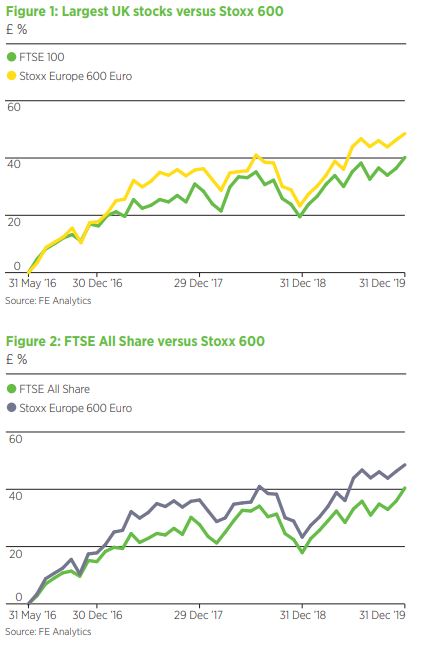

Since the Brexit vote on 23 June 2016, the FTSE 100 has delivered 38% while the All-Share has returned 38.2% in sterling terms. However, this return trails the 49.5% for the Stoxx Europe 600, 63.8% for the MSCI Emerging Markets Index and 82.8% for the S&P 500.

The FTSE 100 return, although lower than other markets, is not a surprise, given that some 70% of the index is exposed to companies with revenues outside the UK, but asset allocators believe the general election result could also provide a boost for domestic earners and improve the outlook for UK equities overall.

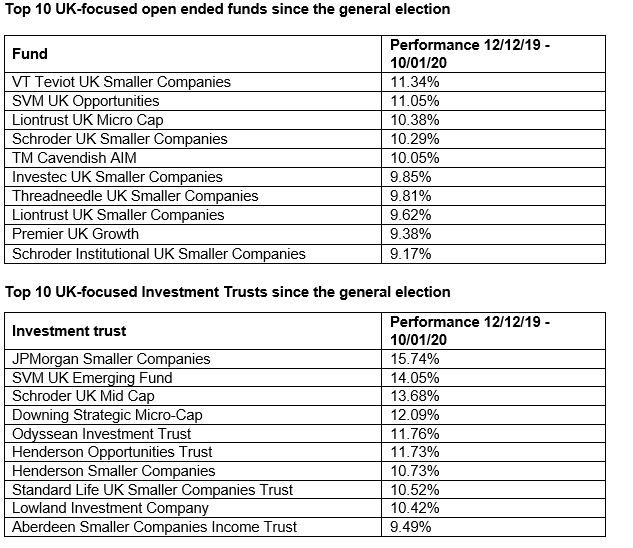

According to figures compiled by AJ Bell based on FE Fundinfo data, there have been widespread gains for UK focused funds and investment trust sectors since the general election, with UK smaller companies dominating the lists of best-performing open- and closed-ended vehicles.

The VT Teviot UK Smaller Companies Fund was the top-performing open-ended fund, returning 11.3% between 12 December 2019 and 10 January, while the best investment trust was JP Morgan Smaller Companies, yielding 15.7% (see tables).

Source: AJ Bell using FE Fundinfo data

Domestic earners set to benefit

Columbia Threadneedle global head of asset allocation Toby Nangle says global asset allocators have been underweight the UK for a long period of time with “good reason”.

In the Threadneedle Dynamic Real Return Fund, Nangle has taken the UK equity position down to 3% from a lifetime high of 18%. Nangle, who is also lead manager on the Threadneedle Global Multi Asset Income Fund, can see why domestic stocks could benefit from a re-rating on the back of fiscal policies pledged by the government.

“A lot of the domestic owners are pointed towards cyclical stuff like construction,” he says. “Construction and home building go up well in an environment where government is seeking to build out infrastructure and increase home building. All that fiscal effort, which is being announced by the day, would be quite helpful for domestic earners.”

Nangle says his colleagues in the UK equity team tell him there are meaningful discounts in place as a Brexit premium takes hold and the index could pull back some of the gap with European bourses (see figures 1 and 4).

“We don’t want to overegg it but if you look to, say, the ratings of UK versus the Stoxx 600, while they’re quite different markets they’ve tracked their ratings relatively well and a premium has opened up there over the past few years. I can see a portion of that shutting down regardless of the day-today movements of sterling.”

He adds: “Actions we took earlier in the year – because we didn’t want to be trading views on how Brexit negotiations were going and UK politics was developing – meant we bought a huge amount of sterling into Dynamic Real Return. The fund invests globally and that helped it enormously.”

Market benefits JP Morgan UK Equity Core Fund manager Callum Abbot says the general election result is significant for the UK equity market because it reduces Brexit uncertainty, promises significant fiscal spending and removes the risk of a hard-left government.

“This will benefit the entire market, which has been trading at a 30-year low when compared to the global equity market,” he says. “We now expect this valuation discount to close as international investors return to this cheap market.”

Abbot expects domestic stocks such as housebuilders, banks and general retailers will benefit more than international names as they re-rate and reap the rewards of earnings growth. However, he is cautious about the structural challenges facing their business models, such as the UK high street.

“We expect the UK equity market to perform strongly led by domestically focused equities. We are well positioned to benefit from the news but will be looking for stocks that can tap into the Conservatives’ fiscal plans and that will see improved earnings from reduced uncertainty, such as housebuilders and contractors.”

That said, Abbot believes some domestic names still face structural headwinds. “Having international stocks is important as not all domestic uncertainties have been removed and the new government faces a significant challenge in negotiating a trade deal with the EU.”

Confidence boost from ‘stable, centre-right, pro-growth’ government

At the end of last year, the Rathbone multi-asset team bumped UK exposure in portfolios to its highest level since 2011 after Boris Johnson quashed a Brexit negotiation extension beyond 2020, which managers David Coombs and Will Mcintosh-Whyte see as positive for the country over the medium term. In fact, the duo has predicted the UK could be the best-performing developed equity market in 2020.

Mcintosh-Whyte says the new “stable, centre-right, pro-growth” government offers certainty and is likely to increase fiscal spending, which will boost consumer an investor confidence and, in turn, push overseas asset allocators to re-enter the market and close their UK underweights.

“It should potentially increase companies’ propensity to invest, albeit I suspect it will be slightly held back by the uncertainty over the trade negotiation window,” he says. “Global asset allocators have also been significantly underweight UK assets for some time and our view is that people will have to come back into the UK to at least reduce those underweights.”

UK gains set to be better than global

Capital Economics also expects UK equities to outperform their international peers. It says a modest improvement in the global economy will probably allow global equity prices to rise by about 10% by the end of 2021. Meanwhile, an easing in Brexit uncertainty should allow UK equities to rise by 15- 20% over the same period.

Rathbones has increased exposure to UK assets via a FTSE 250 tracker and through structured products, which include “straightforward accelerators” that buy FTSE 100 call options. One of these accelerators is a seven-year product that could result in the portfolio’s receiving 650% of the FTSE return capital if sterling is above $1.35.

“It’s an interesting quirk on being able to get a decent return should we be right on UK assets generally,” says Mcintosh-Whyte.

Mcintosh-Whyte expects passive flows into the UK to increase from global asset allocators running global mandates in various parts of the world.

“The UK market is not a huge amount of their benchmark and I suspect they are significantly underweight. A quick way of closing that is through passives. There are plenty who will be picking their own individual names but I think there will some flows done through passive that will lift all boats.”

Patient investors will be rewarded

Chelsea Financial Services managing director Darius McDermott believes the election result will bring more clarity – or at least encourage investors to dip their toes back into the market – and that investors should consider recovery vehicles in this scenario.

McDermott flags the Alex Wright-managed Fidelity Special Values trust, which targets undervalued companies while also retaining a focus on capital preservation. Since the EU referendum on 23 June, the trust has returned 55% versus the IT UK All Companies sector’s 47%.

He also highlights Alastair Mundy’s Investec UK Special Situations Fund, which also targets value. “Mundy’s approach has historically performed during turning points in investor sentiment,” he says. The fund has been on a par with the IA UK All Companies sector since the Brexit vote, returning investors 36.6% versus the sector’s 37%.

Says McDermott: “These types of funds have had to be patient because of the challenges the UK has faced. I believe investors will be rewarded for that patience, but it may take a little longer than some may believe given the election result.”