By now, almost everyone is aware of the devastating impact climate change is having on our environment. It is quite clear that climate change poses one of the, if not the most, significant risks to the long-term profitability and sustainability of companies.

But less talked about is the vital role fixed income investors have to play in accelerating the shift to a net zero world by 2050, writes Fidelity International portfolio manager Kris Atkinson (pictured).

As it currently stands, the bond market, which trades around $1trn (£825m) each day, has enormous but unrealised potential in supporting the transformation to a carbon neutral world. However, there is substantial scope for this to change.

According to a report by McKinsey, capital spending on physical assets for energy and land-use systems to transition to net-zero is estimated to require up to an additional $3.5trn each year from 2021 to 2050.

The bond market has a central role in plugging that funding gap and it also has some specific characteristics that give it an edge in influencing how corporations do business and offer investors a unique way of addressing the climate problem.

But not just that. It is often thought that equity markets play the foremost role in urging issuers to become more sustainable. However, fixed income investors are in some ways better positioned than equity markets to exert pressure and promote positive change.

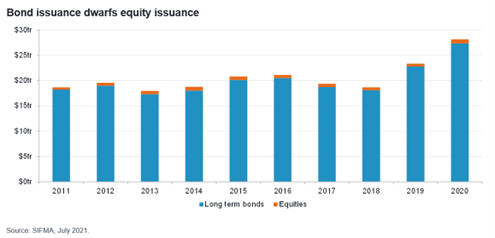

For one, the bond market is bigger than the equity market. The Securities Industry and Financial Markets Association (Sifma) estimated that, at the end of 2020, global bond markets were worth $123.5trn compared to the equity market’s $105.8trn.

Also, companies tap bond markets for new issues far more regularly and in greater size than equity markets, which facilitates a close relationship between fixed income investors and corporate executives.

Bond markets comprise public and private businesses. In addition, governments, local authorities, and supranational institutions issue debt, not shares. This is important given non-listed entities are responsible for significantly more carbon emissions than public companies.

Finally, fixed income markets allow investors to deploy capital in more targeted ways and offer the ability to invest in securities to finance specific projects (such as green bonds) or align with client interests via sustainability linked bonds.

How to incorporate climate risks

The transition to a low carbon world needs to encompass the entire economy – all sectors, asset classes and geographies. It can be tempting to invest in a climate strategy via building a systematic data screen or a low carbon passive index that filters for issuers with the lowest carbon footprints.

This is a relatively simple way of sustainable investing and suits many investors. However, this passive-led approach has its limitations.

For example, it can invest in low carbon emitters or companies with a set of superior ESG metrics, but it is not very good for supporting decarbonisation efforts or mitigating the disintermediation risk of decarbonisation solutions or balancing risk and return considerations.

It does not evaluate the direction of a company either and instead uses historical data with which to deliver outcomes that will occur in the future.

This approach can also compromise on diversification by excluding certain types of companies or industries.

For example, one Paris-aligned benchmark excludes companies that generate over half their revenues from electric power generation via fossil fuel sources. As emissions tend to be concentrated in specific sectors, ensuring that these are captured is essential to make a meaningful difference.

If we ignore the decarbonisation challenge for whole groups of companies and industries, non-climate focused investors will continue to fund them, and real-world emissions will not be reduced.

A truly transformative decarbonising investment strategy should be built on rewarding capital to companies that demonstrate climate best practices today or are on the path towards it.

Australian mining company Fortescue Metals is an example of a company that would be overlooked in an exclusionary approach but offers a credible plan towards transition and has an attractive investment profile.

Fortescue is the fourth largest seaborne iron ore producer and aims to be carbon neutral by 2030. It allocates 10% of net profits to a dedicated green energy and industry subsidiary, has strong credit quality and its net leverage is zero.

Active climate investing is time consuming and research intensive, but that is compensated by the potential to make a greater sustainability impact and generate long term alpha.

Companies that are driving the decarbonisation agenda, or are leaders in their field, should be rewarded with more capital resources. Companies that are in high emission sectors, or are laggards, should be engaged with – after all, stewards of capital have a duty to push issuers to be ambitious and set targets to combat climate change.

Investors who integrate a net-zero emissions strategy, backed by a forward-looking framework and positive engagement, will not only create value for stakeholders but also enhance the sustainable returns in their portfolios.

Global capital markets will not thrive when climate change-derived losses force defaults.

The bond market has a privileged position with which to drive change, and investors are quickly waking up to the potential of this sleeping giant.

This article was written for Portfolio Adviser by Kris Atkinson, portfolio manager at Fidelity International.