The BMO Global Smaller Companies Trust has decided not to adopt the Columbia Threadneedle moniker for its rebrand.

The vast majority of BMO Gam’s funds are to adopt the ‘CT’ prefix on 4 July to bring them in line with the Columbia Threadneedle branding following its acquisition of the former’s Emea business.

There was a question mark over whether its investment trusts would follow suit, with name changes being left up to their respective boards.

In the trust’s annual results published today, chair Anja Balfour said, after due consideration, the board had decided to rename the strategy the Global Smaller Companies Trust.

The updated name emphasises the trust’s mandate more clearly and “removes the potential for confusion with smaller company products managed by Columbia Threadneedle”, Balfour explained.

Share price slumps after strong 2021 performance

After an incredibly strong year in which its share price surged 54%, the trust suffered a reversal in performance as markets conditions deteriorated amid supply chain challenges, surging inflation and the conflict in Ukraine.

Its shares fell 6.4% in the year to 30 April 2022, while net asset value fell 0.2% from 174.9p to 172.8p.

However, the trust still beat its benchmark, a 30/70 split of the Numis UK Smaller Companies excluding investment companies and MSCI All Countries World ex UK Small Cap, which fell 3.2% during the period.

Balfour said manager Peter Ewins’ “conservative approach to stock selection” of prioritising profitable business franchises helped mitigate losses, as speculative and loss-making growth stocks endured a “savage de-rating” following expectations for interest rates to climb higher.

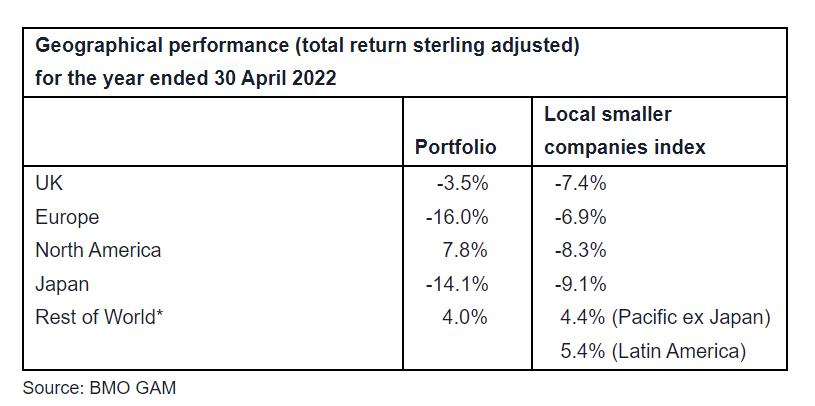

This was particularly evident in Ewins’ North America smaller companies stock selection, which generated a positive total return of 7.8% compared to an 8.3% loss for the local smaller companies index.

His UK holdings also fared better in part thanks to elevated takeover activity, with 17 being the target of bid approaches or mergers during the period.

However, the trust’s exposure to European names on higher valuations came back to bite it in the second half of the year, when its Japanese collectives portfolio also had a rough time as a fall in the yen undermined returns in sterling terms.

Discount widens

By the end of its financial year, shares were trading on a 9.6% discount to NAV, up from 3.6%, despite the trust initiating share buybacks to close the gap.

Global Smaller Companies has a consistently applied share buyback policy, separating it from “some peers which have allowed their discounts to widen without taking any action”, Balfour said.

“With investors becoming more cautious about the global economic outlook, discounts on most smaller company investment trusts have widened considerably.

“While a more favourable market backdrop may be needed, the board continues to aim for the discount to be below 5%. In the meantime, further shares have been bought in during the early part of the new financial year with the aim of minimising the absolute level and volatility of the discount.”

Although softer economic growth forecasts and anticipated rate rises remain headwinds for share prices, Balfour said it is possible “the extent of monetary policy adjustment may be more limited than presently expected if economies continue to slow and inflationary pressures moderate”.

“Corporate earnings are coming under some pressure now given recent events, however valuations in the markets are beginning to appear more attractive for some of the more beaten down smaller-cap growth stocks. The investment management team is hopeful that it can take advantage of this in the coming months.”