Blackrock has unveiled an income fund for its MyMap range which is closing in on £700m worth of assets after two years.

The MyMap 4 Select Income targets both capital growth and income, using interest payments received from investing in bonds and dividends from equities to help generate the latter.

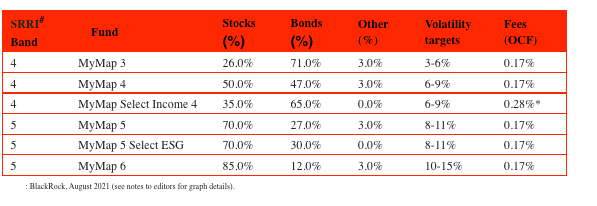

It is the sixth fund in Blackrock’s multi-asset range, which use iShares ETFs and index funds to invest in bonds, equities, alternatives and cash across different risk profiles. All the funds are actively managed and rebalanced on a quarterly basis.

Though MyMap is just a little over two years old, assets have already surpassed $791m (£679m) as of 10 September. Vanguard’s five-strong Lifestrategy range, its closest competitor, had around £30bn in assets by July after a decade in the UK market.

The MyMap 4 Select Income fund holds around 35% in stocks and 65% in bonds and has a volatility target of 6-9% over a rolling five-year period.

It has an OCF of 0.28% making it pricier than the existing portfolios in the range which cost 0.17%.

Blackrock head of banks and digital channels in the UK Joe Parkin said in the 18 months since the coronavirus pandemic hit, savers have been taking steps to improve their financial health, resulting in an estimated £1.5trn sitting in individual bank accounts.

“Investing can play a key role in meeting financial goals allowing people to access not only higher returns than a savings account, but also to mitigate the growing risks that inflation presents to cash deposits.”

See also: FCA unveils £11m campaign to address idle cash holdings and high-risk investments

The existing five MyMap funds have delivered an average return of 13% year-to-date and 26% since launch, according to data from Blackrock.

The MyMap 5 Select ESG fund, which just celebrated its one-year anniversary, has returned 20% since launch.

See also: Blackrock rival to Lifestrategy prompts split views on static allocation