Blackrock has added two more ESG funds to its low-cost multi-asset indexing range, MyMap.

MyMap 3 Select ESG broadly mirrors the allocation of the existing cautious portfolio, MyMap 3, while MyMap 7 Select ESG has no corollary and is 100% invested in stocks for investors with a higher risk-profile.

Both funds will target a reduction in their portfolio’s carbon emissions intensity by 30% relative to an equivalent asset mix, which is measured each calendar quarter, as well as an ongoing reduction in their carbon emission intensity over five-year periods on a rolling basis.

They are required to invest at least 80% of their corporate assets into ESG exposures. Where applicable, funds must also ensure a minimum of 80% of their government bond exposure is held in assets with an ESG sovereign rating of BB or higher as defined by MSCI.

The launches take the number of ESG funds in the $9.6trn (£7.81trn) fund group’s low-cost multi-asset range to three, following on from the roll out of MyMap 5 Select ESG in June 2020.

The existing fund will now target the same reductions in carbon emissions intensity and ESG investment requirements to strengthen its ESG outcome and ensure all three funds share the same investment approach.

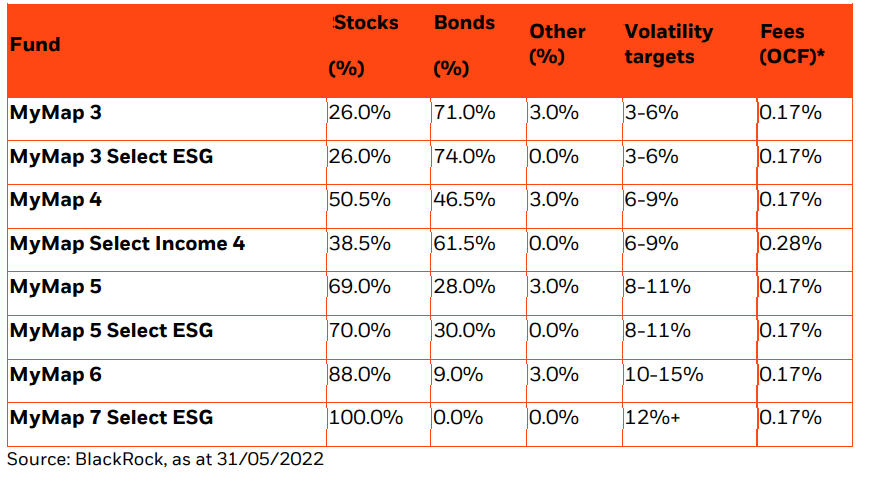

Blackrock’s MyMap range uses iShares ETFs and index funds to invest in bonds, equities, alternatives and cash across different risk profiles. All the funds are actively managed and rebalanced on a quarterly basis.

Hailed as a major challenger to Vanguard’s Lifestrategy range when it launched in 2019, MyMap currently has £710m in assets under management. The funds have an ongoing charges figure of 0.17%, excluding the MyMap Select Income fund which charges 0.28%.

Heather Christie, head of UK advisers and platforms at Blackrock, said: “Since we launched the MyMap range three years ago, global markets have been pushed to the limit, with the stresses of the global Covid-19 pandemic and the outbreak of war in Ukraine leading to significant market volatility and uncertainty for investors.

“As interest rates continue to rise and with inflation hitting a 40-year high, it’s now more important than ever for people to consider investing to mitigate the eroding impact that inflation can have on their hard-earned savings. For investors moving out of cash, multi asset funds like MyMap are becoming increasingly popular as they offer simple and cost-effective approaches to investment.

“Adding new ESG-focused funds into the MyMap range continues our commitment to providing choice and means people can benefit from being invested in a low-cost range of funds whilst expressing their investment objectives in a sustainable way.”

See also: Larry Fink: Russia war on Ukraine spells end of globalisation