Few investors will have been sorry to see the back of 2022 – a year that began with hopes of a return to some form of normality in the wake of the pandemic, but quickly became dominated by the uncertainty and multifaceted economic implications of war. With the energy crisis compounding inflationary pressures from Covid supply-chain bottlenecks, central banks slammed on the brakes, setting a course for global recession in 2023.

Are there any reasons to hope conditions will improve in the 12 months ahead? Many of the challenges we faced last year persist. Geopolitics looks set to remain a dominant market driver, with the deglobalisation, onshoring and near-shoring trends that began as a reaction to the pandemic becoming more widespread. Tensions between the US and China over Taiwan continue to play out in trade policy, with clean energy joining technology as a key battlefield.

Meanwhile, the war continues to disrupt food and energy supplies. As base effects kick in and higher interest rates bite in earnest, however, inflation should start to come under control – indeed, there are already signs we are past the peak, and central banks have begun to slow their rate hiking cycles accordingly.

Whether policymakers will manage to take their foot off the brake without provoking a deeper than intended recession remains to be seen. Nevertheless, more contained inflation and higher, stabilising rates mean the outlook does appear brighter for one group of clients, at least: those in search of income.

In the decade-plus period since the financial crisis, investors have grown very used to income being hard to find. Interest rates stuck fast at near-zero levels have meant only the wealthiest have been able to meet their needs with ‘natural income’ – that is, income from interest payments and dividends.

Significant variability

Total return approaches – in which drawdowns are funded with a share of portfolio growth, as well as natural income – have helped to fill the gap, but most clients have had to deplete capital to meet their expenses in decumulation. An analysis of income-focused funds with a risk profile of 5 in Dynamic Planner shows funds have maintained income payments above 3% over the past five years. Yet there has been significant variability in the sustainability of the underlying capital, with implications for the longevity of the income stream.

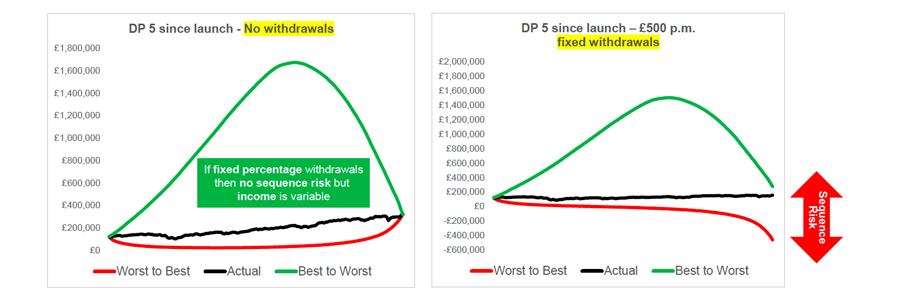

With a total return approach, clients taking a fixed monthly withdrawal are vulnerable to sequence of return risk – the risk arising from the order in which investment returns occur. MSCI Dynamic Planner 5, for example, has delivered an annualised total return of 6.65% since the launch of the benchmark index.

Without drawdowns, as the first of the following charts illustrates, there is no impact on performance if we reorder the returns achieved from worst to best, or best to worst. If investors withdraw a fixed amount each month, however, poor performance at the beginning of the investment period has a marked impact on returns and capital is rapidly depleted.

Source: Dynamic Planner

Sequence of returns risk can be mitigated if clients, rather than taking a fixed cash amount, draw down a percentage of their portfolio each month. This is not realistic for most people in retirement, however, as they need to know exactly how much money is available to them on a monthly basis to cover set expenses – as well as often needing additional lump sums to meet unexpected costs.

Welcome news

Capital preservation and longevity of income are particularly important, given clients tend to focus on the active phase of retirement and do not factor in their needs later on. A 2022 survey by Networth found 25% of retirees aged 75 and above underestimated how long they would be retired and did not feel financially secure as a result.

It will therefore be welcome news for both clients and those managing their money that natural income should be easier to come by in 2023. After the sharp sell-off of the summer, the environment for fixed income looks more favourable than it has in a long time. Core government bond yields are close to pre-financial crisis levels, meaning investors can obtain a decent chunk of income without moving down the credit ladder.

High-quality corporate bonds can also play a role. Although earnings expectations may need to come down if a deeper recession bites, companies in the investment grade space look relatively well positioned for the tough times ahead, with little sign of excessive borrowing. Issuers further down the credit spectrum may struggle more, and those holding high yield to bolster income could find it hard to transition portfolios, with fewer buyers for these bonds.

Equities are likely to endure continued volatility given the persistent uncertainty, but markets have already priced in the moderate recession anticipated by central banks. Those paying dependable dividends could prove to be relatively resilient even in a more challenging scenario.

At long last, then, there are some better options for income seekers as we enter a new year. Still, with the road ahead unclear and potentially bumpy, diversification and a risk-based approach remain vital.

Ben Goss is CEO of Dynamic Planner