A higher interest rate environment, attractive valuations and comfortably passing the Bank of England’s latest stress tests mean large incumbent UK banks are looking increasingly attractive, according to some fund managers.

Others, however, warn that greater-still regulatory scrutiny, the rise of alternative payment methods and modest growth prospects will continue to weigh on the typically-unloved sector.

Banks have been in the news for myriad reasons over the last month. This week, the ‘big five lenders’ either have or will release their quarterly results. Lloyds kicked off proceedings today (26 July), with pre-tax profits rising to £3.9bn over six months to the end of June, and the company subsequently setting aside £660m for bad loans. This fell below consensus forecasts however, with the stock’s share price slipping by more than 2% on the news.

NatWest has had rather a more difficult time just two days ahead of its results, with group CEO Dame Alison Rose resigning after publicly discussing the financial affairs of controversial former politician Nigel Farage’s account with Coutts – which is part of the NatWest group. Stocks subsequently tumbled by 2.5%.

Barclays is due to report tomorrow (27 July), followed by Standard Chartered on Friday (28 July), and HSBC on 1 August.

There was much more positive news for the big UK banks less than three weeks ago, following the Bank of England’s annual stress test (a rigorous regime implemented in the aftermath of the global financial crisis) confirming that major UK banks are “resilient to a severe stress scenario that incorporated persistently higher advanced-economy inflation, increasing global interest rates, deep and simultaneous recessions in the UK and global economies with materially higher unemployment, and sharp falls in asset prices”.

But just days before this, UK banks came under fire from the Financial Conduct Authority for failure to pass on higher savings rates to customers, despite interest rates rising from 0.1% to 5% since December 2021.

According to research from AJ Bell, some £250bn of cash is currently sat in bank accounts earning zero interest – five times the amount than there was in 2008, despite interest rates being at the same level.

Cynically this could be good news over the short term for banks, given they are presumably pocketing the profits, but creates long-term ethical concerns at the most basic level, and could lead to increased scrutiny and customers deciding to take their money elsewhere.

Tim Levene, CEO of publicly-listed fintech fund Augmentum, told Portfolio Adviser that recent messaging from the FCA and the Treasury makes it “very clear they expect incumbent banks to be doing more to pass on higher interest rates to savers”.

“New powers under Consumer Duty – which comes into effect this month – will give the regulator greater power to take action when they believe “good outcomes” are not being delivered to customers,” he warned. “With this change in regulation we expect increased scrutiny and action against those players who are not passing on rate increases.”

Nick Brind, manager of the Polar Capital Global Financials Trust, said the impact of Consumer Duty regulations is still unknown. While he expects increased pressure on incumbent banks to improve their communication with customers in terms of highlighting any higher interest-rate accounts they could switch into, he would be “very surprised if that stretches to forcing banks to increase the level of interest rate they should pay on savings accounts”.

Brind said: “I don’t think this will change people’s views materially as it will reinforce the view of those that believe the incumbent banks do not provide a good value service and, in part, explains why challenger banks have seen such a huge growth in customer numbers.”

Rise of the challengers

According to research from Statista, the popularity of challenger banks has indeed increased worldwide over recent years. Europe has the highest number of challengers on a regional basis at 105, followed by North America and South America, at 73 and 57 respectively. Last year alone, 56 new challenger banks launched globally while, in the US, Statista’s research department projects an average annual growth rate 53.4% across the sector until 2030 – thereby reaching a market value of more than $2trn that year.

Levene, who has long been an investor in challenger banks and holds the likes of Zopa, Tide and Moneses in his portfolio, expects the shift in consumer behaviour towards challengers and neobanks – which operate on an online-only basis – to continue “given the agility of challenger banks to quickly adapt to changing macro conditions and consumer needs”.

“One of the first advantages brought by neobanks was the ability to quickly open an account remotely, making it far easier for consumers to switch bank accounts,” he explained. “In the current environment savvy customers are taking advantage of easy switching and account opening to ensure they receive the best possible rates.

“This is a real opportunity for challenger banks, especially those that are now mature and have a board, competitive offerings, to retain these newly won customers.”

However, Brind pointed out that most of the challenger banks remaining less well known is an issue.

“The incumbent banks, fairly or unfairly, are seen to offer greater security due to their size and importance to the UK economy – notwithstanding FSCS protections on deposits – so lots of people and the challengers have struggled to get people to move the main current account.”

Ambrose Faulks, co-manager of the Artemis UK Select fund, went further and said it is a “fair debate as to what actually constitutes a challenger bank”.

“Most are unlisted and so we wouldn’t consider them. Ironically, these might be some of the more interesting ones,” he explained. “Of the listed – for example, One Savings Bank – we have always been worried about the high proportion of lending, specifically in One Savings Bank’s case, to the buy-to-let sector. This is an area that the incumbent banks have been happy to cede share.

“On the liability side, we have always been concerned about their ability to finance themselves. Fundamentally, they don’t have what we see as the holy grail: a large pool of current accounts.

“Therefore, they have had to use more expensive term deposit financing, or pay up for deposits in areas like ISAs, where there isn’t the natural customer relationship that incumbent banks have.”

Indeed, One Savings Bank issued a profit warning earlier in the month, admitting they had made incorrect assumptions about customer behaviour during a rate rising environment.

See also: How ‘sticky’ will inflation really be?

That is not to say all smaller banks are struggling, at least from a share price perspective, with the £203m market-cap Metro Bank up 40.5% over the last year and the £175m Arbuthnot Banking Group up 28.9% over the same time frame, according to data from Simply Wall Street. Virgin Money, while much larger in size than the aforementioned banks at £2.4bn, is up 24.4% over the last 12 months.

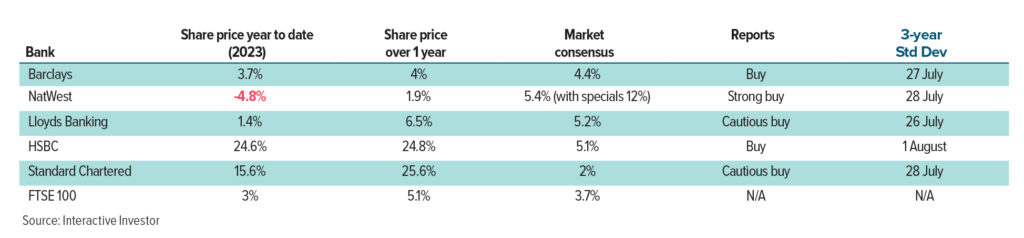

In contrast, Lloyds, Barclays and NatWest – while still in the black – have achieved respective total returns of 6.5%, 4% and 1.9%, according to data from interactive investor.

Share price performance of the ‘big five’ banks

No longer dinosaurs

Ian Lance, co-manager of the Temple Bar Investment Trust, still believes it is worth sticking with the larger incumbent UK banks for long-term, reliable growth.

Contrary to popular opinion that the big banks aren’t ‘moving with the times’, he pointed out that all of the big names are now adapting fintech approaches to the way they interact with customers.

“This not only neatly heads off the risk of technological obsolescence – with the well-funded banks able to put substantial resources into such effort – but makes these processes more pleasant and efficient for customers, likely increasing consumer experience and retention, and lowering costs to deliver products,” he said.

He used the example of holding NatWest which, last year, had 10.1 million active digital users – 8.9 million of which were on the mobile app. This marked more than a 100% increase since 2016. The manager also said that almost 50% of customers are successfully having any issues resolved through AI virtual assistance, thereby streamlining the business.

“The same story is true across the wider banking sector where retail banking customers and investors have come to expect their banks to keep up the pace of improved technological capabilities,” Lance said. “In such an environment, it is puzzling to accuse these businesses of ignoring, or being incapable of responding to, technological innovation.”

Artemis’s Faulks concurred, having increased his exposure to banks in the past year, with Barclays, NatWest Group and Standard Chartered all in his list of top 10 holdings.

While banks have underperformed since the global financial crisis, he said rising interest rates have improved profit margins – even if they are under pressure to pay savers more.

“The incumbent banks today are well capitalised, with over three times more capital than before the global financial crisis. It has taken them over a decade to achieve this,” he said.

“In all our central scenarios they still look to have excess capital, low requirements to retain that for loan growth, and therefore we would expect the vast majority of their cash generation to come back to shareholders via dividends and buybacks.”

However, Redwheel’s head of global equity income Nick Clay believes the sector is far from safe, given that capital-intensive businesses such as banks can often suffer from market disinterest due to “seemingly modest growth prospects”.

“Their ability to compound at a rate modestly exceeding their cost of capital can often go unappreciated,” he reasoned.

“Over the years, our fundamental research has taught us a crucial lesson: even slight changes in operating conditions faced by capital-intensive businesses can rapidly undermine dividend payments.

“Financial leverage, political interference, and the impact of technology, social media, and globalisation complicate the understanding and anticipation of these operational changes.”

And, while Faulks is bullish on banks and believes they “look very cheap today”, he warned: “We have to recognise that they are past the ‘sweet spot’ for interest rates.”