Baillie Gifford funds had a torrid time in March as high growth companies and tech stocks continued to sell-off while unloved UK equity funds continued to enjoy a comeback.

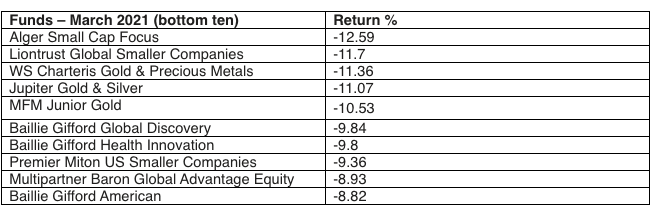

The Edinburgh manager dominated last month’s worst performers with three funds featuring among the top 10 laggards.

The worst of the trio was Douglas Brodie’s £2.2bn Global Discovery fund, which lost 9.8% during the month. Not far behind were the £74m Health Innovation fund (-9.8%) and the £6.4bn Baillie Gifford American fund (-8.8%).

However, the biggest losses last month were served up by the Alger Small Cap Focus fund, which fell 12.6%, and the Liontrust Global Smaller Companies fund which was down 11.7%.

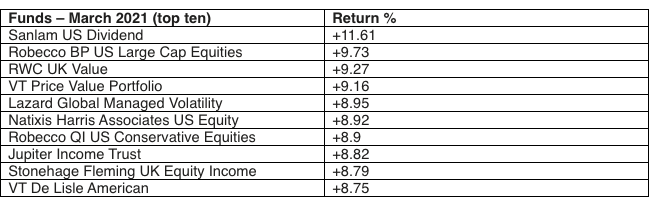

Source: Fairview Investing using FE Fundinfo; performance figures 28/02/21 to 31/03/21

Baillie Gifford American and Global Discovery losses widen

Of Baillie Gifford’s 34 open-ended funds, 26 were loss-making in March with its China fund and Long Term Global Growth fund, formerly led by James Anderson, also losing around 8%.

Baillie Gifford’s fall from grace last month is a huge reversal from its stonking performance during the outbreak of the coronavirus pandemic. Tom Slater (pictured) and Gary Robinson’s American fund shot up by a massive 121.8% in 2020, while Brodie’s Global Discovery was up 78.6%. Both are now sitting on losses over three months with American down 6.8% and Global Discovery down 7.6%.

“It is slightly ironic, or maybe fortuitous timing, that in the month Baillie Gifford’s James Anderson announced his planned retirement that their funds had such a tough time,” Fairview Investing consultant Ben Yearsley said.

“At the same time, the top of the performance tables was dominated by out of favour value and cyclically focused funds. An obvious reminder to have balance in portfolios and that one style doesn’t dominate in perpetuity.”

See also: Can Baillie Gifford endure a long-term value rally?

Jupiter’s Whitmore enjoys a comeback

Though it was a bad month for Baillie Gifford and other high growth strategies, UK equity funds had another positive month.

UK Equity Income was the second best IA sector in March, with the average fund up 4.8%, just behind the Global Equity Income sector’s 5.1% lead. Rounding out the top three was the IA UK Smaller Companies sector which rose 4.3%.

Despite this, only three UK funds made it into the top 10 best performers – the RWC UK Value Sicav, run by Nick Purves and Ian Lance, Ben Whitmore’s Jupiter Income trust and the Stonehage Fleming UK Equity Income fund.

Whitmore’s £1.4bn fund was flagged, alongside his £2bn UK Special Situations fund, by Jupiter’s fund board for failing to deliver value consistently for shareholders thanks to his value style being out of favour.

On a three year view the fund is up just 2.4% against the IA UK Equity Income’s 9.1% gains but following the rotation from growth to value his fund is now first quartile over six months, up 31.8% versus peers’ 23.5%. “Maybe there is life in Jupiter post the Merian acquisition after all,” Yearsley said.

Top US equity funds not the usual suspects

Even though growth strategies struggled, last month’s strongest performers were mainly comprised of US equity funds.

But Yearsley noted they weren’t the usual suspects from Baillie Gifford but had more of a value flavour, including top performer Sanlam US Dividend (11.6%) and US small cap value specialist De Lisle American which finished tenth on the list (8.8%).

Robeco US Large Cap Equities (9.7%), Natixis Harris Associates US Equity (8.9%) and Robecco QI US Conservative Equities (8.9%) also featured in the top 10.