Baillie Gifford has been hit by redemptions for the third month in a row as performance across its tech-heavy funds grinds to a halt.

Investors pulled £1.2bn from the Edinburgh manager in February, its worst monthly net outflow on record, according to data from Morningstar. It is the first time BG has suffered three consecutive months of redemptions since 2015.

Baillie Gifford’s Diversified Growth fund was responsible for a third of the total redemptions, losing £393m last month. But Morningstar said outflows were widespread, with only eight out of 34 funds recording net inflows in February.

The shift in investor sentiment comes amid a turbulent period of performance for the Edinburgh manager, which has seen its funds battered by the January tech sell-off and, more recently, volatility stemming from the Ukraine crisis.

Thirty of its funds are now loss-making on a one-year view, with the Global Discovery, American and China funds all down over 40%, according to FE Fundinfo.

Five worst performing Baillie Gifford funds over one-year

| Fund | 1yr (%) |

| Baillie Gifford Global Discovery | -43.2 |

| Baillie Gifford American | -41.0 |

| Baillie Gifford China | -40.1 |

| Baillie Gifford Health Innovation | -33.5 |

| Baillie Gifford Long Term Global Growth Investment | -30.9 |

Source: FE Fundinfo

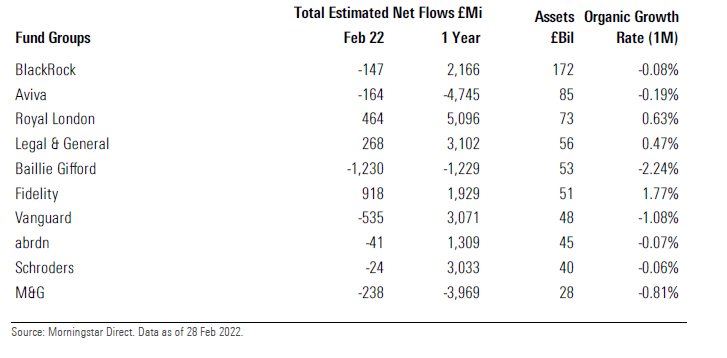

Following the redemptions and performance hit, assets across the group have tumbled to £53bn.

See also: Can Baillie Gifford endure a long-term value rally?

Investors pile out of Vanguard FTSE All Share Tracker

Vanguard also had a dismal time in February, recording a “rare net outflow”. The $7.2trn passives giant racked up £535m worth of redemptions, its worst month ever for UK domiciled funds.

Its FTSE All Share Tracker was the main culprit behind the unprecedented level of redemptions, accounting for £614m, but Morningstar noted its US equivalent and UK Long Duration Gilt Index saw “reasonably large outflows”.

Its rival Blackrock also ended the month with lower assets but recorded a much smaller redemption of £147m.

Behind Baillie Gifford and Vanguard, M&G was the next worst fund group in terms of fund flows, leaking £238m in February. Over the last 12 months investors have yanked close to £4bn from its funds, more than any other asset manager apart from Aviva Investors (-£4.7bn).

Nick Train’s UK fund continues leaking cash

Despite an improving performance picture, UK equity funds continued haemorrhaging cash last month.

UK large cap funds were particularly punished, with £1.2bn walking out the door, while a further £422m exited UK equity income funds and £404m left UK small cap funds.

Nick Train’s Lindsell Train UK Equity fund was the single biggest loser across the entire category, losing £172m.

Like Baillie Gifford, Train’s funds have struggled to outperform amid the rotation away from growth stocks toward cyclical names. Lindsell Train UK equity has lost 2.8% over the last year, worse than the average IA UK All Companies fund (+0.6%).