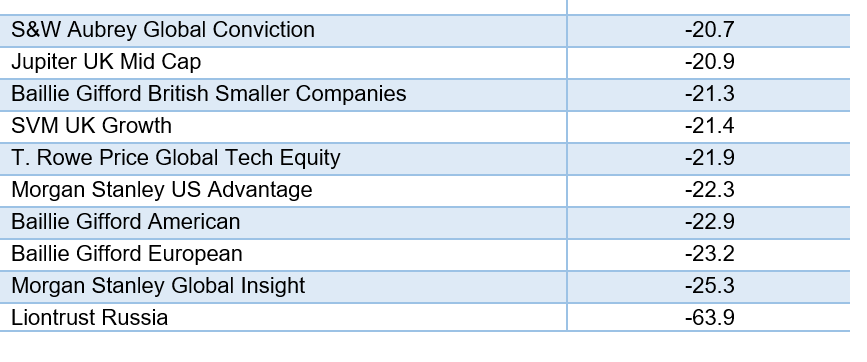

High-flying funds from Baillie Gifford have come back to earth with a thud during a tumultuous first quarter, in which UK small cap funds also struggled to find their footing.

The Scottish fund group dominated the list of biggest losers over the three months to 31 March, according to data from Morningstar, with Baillie Gifford American, Baillie Gifford European and Baillie Gifford British Smaller Companies among the bottom 10 performers.

Morgan Stanley was the only other asset manager to have multiple funds among the biggest laggards, with its Global Insight and US Advantage funds nursing losses of 25.3% and 22.3%, respectively.

Liontrust Russia, which suspended days after Russia invaded Ukraine, suffered the steepest losses of all, losing investors close to 64% over the period.

Baillie Gifford’s funds, which tend to feature punchy weightings to tech companies and other high-growth stocks, have been hit hard this year as value stocks have come roaring back amid rising inflation and interest rates. The Edinburgh manger found itself in a similar predicament at the start of 2021, during another tech rout, but its losses in 2022 have been substantially more brutal.

Scottish Mortgage and Baillie Gifford European Growth were sitting on similar losses to its hardest hit open-ended funds, with shares in the former down 21.6% in the first quarter and the latter losing over a quarter of its value.

AJ Bell head of investment analysis Laith Khalaf (pictured) points out Scottish Mortgage shares would have ended the quarter down around 35% if not for a recent rally in the share price.

Though he added the £15bn trust’s long-term performance “is still exceptional”, thanks to a tailwind of fast-growing tech stocks, it “could face more challenging times if that goes into reverse”.

UK smaller companies funds reverse 2021 gains

UK small and mid-cap (Smid) funds and trusts also endured a bumpy ride in the first quarter.

Alongside Baillie Gifford’s British Smaller Companies fund, Richard Watts’ Jupiter UK Mid Cap fund and Colin McLean and Margaret Lawson’s SVM UK Growth fund, which has a mid-cap bias, each lost over 20%.

The Blackrock Throgmorton trust, which primarily invests in the Smid space, and Unicorn AIM VCT slumped by a similar amount.

“Inevitably after a period of such strong performance there will have been some profit taking and, combined with a weaker economic outlook and a rotation away from growth, that has left smaller companies funds deep in the red in the first quarter of the year,” Khalaf said.

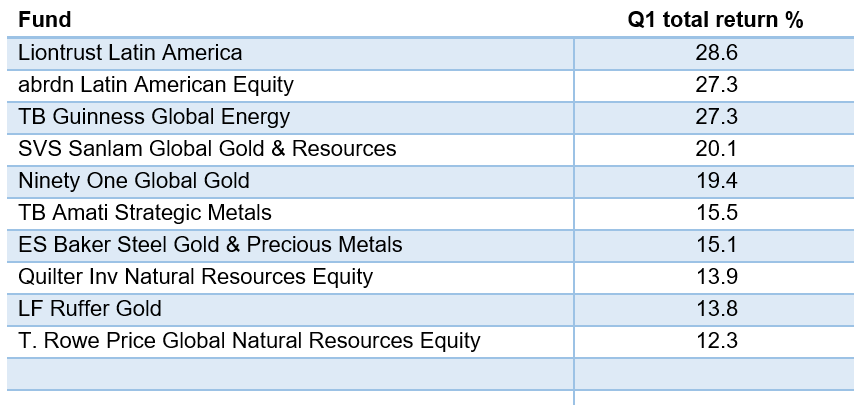

LatAM and commodities funds shine

Though it was a dismal quarter for many, Latin America-focused funds shone, buoyed by rising oil and commodity prices, as well as strong performance from financials with interest rate rises in Mexico and Brazil.

Liontrust Latin America was the biggest winner, up 28.6%, followed by Abrdn Latin America, which rose 27.3%.

For similar reasons, the rest of the top 10 performers were dedicated energy or precious metal funds, including Guinness Global Energy and Ruffer Gold.