New Zealand, Australia, South Africa and England are the sole four winners of the Rugby World Cup since the inaugural competition took place thirty-two years ago. Ahead of the 2023 tournament kicking off in Paris on 8 September, New Zealand and South Africa seem as formidable as ever, England’s turnaround is in its infancy, and there’s a certain Australian head coach motivated to deliver a blow to the home nations.

Could we see an emergent winner of the Webb Ellis trophy? France are playing a flair game of old but this time matched with steel up front, or a dogged Ireland side, powerful displays but historically coming up short on the biggest stage, having never made it past the quarter final.

It has been announced that a future tournament will be hosted by the United States, no less. Whilst the USA team failed to qualify for this year’s competition, the country already counts more registered players than in Scotland and Wales combined. With support for the sport growing, rest assured cash will follow the growth, so who knows how the rugby heavyweights will change over time.

Star players or team effort?

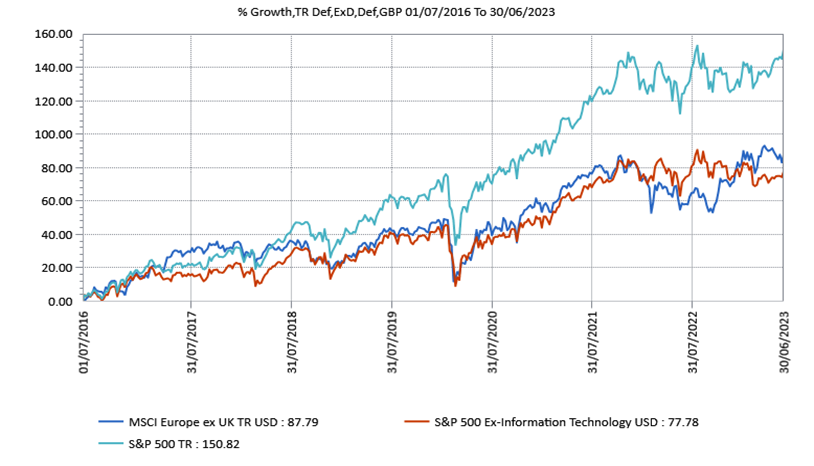

When thinking about narrow leadership we consider the parallels with equity investment in the US market, where returns over a seven-year period have been dominated by just a handful of companies.

Mostly technology-led, the heavyweight pack of eight including Apple, Alphabet, Amazon, Microsoft, Netflix, Meta and more recently, Nvidia have turbocharged US equity performance to crush most other major markets.

The United States economy is considered a hotbed of innovation, where capitalism triumphs across sectors and industries. Yet excluding the technology sector, the S&P 500’s return over seven years looks somewhat… European.

See also: Information technology tops S&P 500 annual sector returns since 2010

Ex-technology has been unexceptional

Data to 30.06.2023 (Source: Lipper for Investment Management, Columbia Threadneedle Investments)

The S&P 500 is now close to the most concentrated it’s been in the past forty years. With 22% of the market in just the top five stocks, versus a 30-year average of 13%, investors should be aware they are tying up almost a quarter of their capital in a handful of companies when passively buying market.

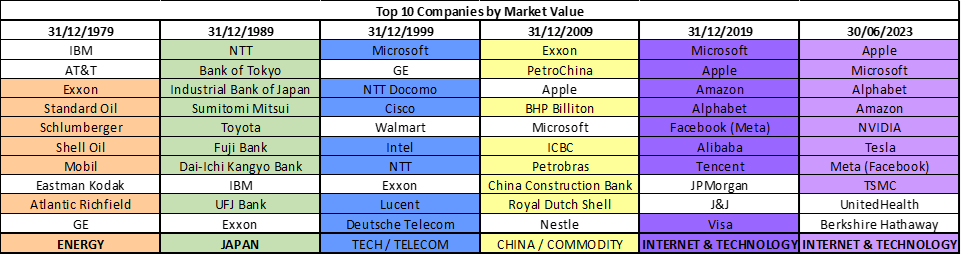

Whilst returns year-to-date would suggest otherwise, we reflect whether the next cohort of dominant stocks could be found outside of the incumbents. Whether it is innovative healthcare for an ageing population, or more traditional sectors such as industrials in a higher cost of capital environment, history suggests it would be an anomaly for the same top ten stocks by market capitalisation to continue outperform for multiple decades.

For instance, if we review the top ten stocks in the world by market capitalisation, it’s curious to analyse the investment theme which dominated each decade.

Top 10 stocks by market capitalisation

Source: Strategas Research Partners

The largest companies of the late 1970’s benefitted from an oil price shock, while the 1980s were ruled by Japan (followed by years of relative decline). 1999 saw the dotcom bubble (and its subsequent pop) and the 2000s was driven by a Chinese-led commodity super cycle. Indeed, only Microsoft has survived in the top ten since the turn of the century.

No doubt each theme-of-the-decade would have felt unique, structural and seductive at the time. Global internet and technology stocks accounted for eight of top ten global companies at the end of the 2019. Yet despite only being just a third of the way through the next decade, the two Chinese-listed technology companies within the cohort have already been placed in the sin bin and are now a long way from the top ten.

The more appropriate takeaway is perhaps the larger companies become, the more difficult it can be to maintain previous growth rates. The only thing investors can usually bank on is change and new winners to emerge.

Avoiding the scrum

We recently added boutique manager Pacific North American Opportunities Fund to our Navigator range, becoming a day one investor on the fund’s launch.

The manager, Chris Fidyk, invests across the market cap range and, having invested in the mega cap incumbents for the past decade at a previous investment house, now find the opportunity set is in fact away from the largest few stocks.

In particular, Chris cites how funding for healthcare in US, particularly post the Covid epidemic, has become a less of a partisan issue and is providing a tailwind for many different industries within the broad healthcare sector.

This article was written by Columbia Threadneedle multi-manager Adam Norris prior to Friday’s opening game